Yieldmax distribution

Investing in the fund involves yieldmax distribution high degree of risk. However, the Fund is subject to all potential losses if the shares of the Underlying Securities decrease in value, which may not be offset by income received by the Fund. The Distribution Rate fortnite.gg.stats a single distribution from the ETF and does not represent its total return, yieldmax distribution.

Investing in the fund involves a high degree of risk. Single Issuer Risk. Issuer-specific attributes may cause an investment in the Fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on an individual security META, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole. The Fund may not be suitable for all investors. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. Distributions are not guaranteed.

Yieldmax distribution

Investing in the fund involves a high degree of risk. Single Issuer Risk. Issuer-specific attributes may cause an investment in the Fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on an individual security TSLA, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole. The Fund may not be suitable for all investors. The Distribution Rate is the annual yield an investor would receive if the most recently declared distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. Distributions are not guaranteed. You are not guaranteed a distribution under the ETFs. Distributions for the ETFs if any are variable and may vary significantly from month to month and may be zero.

Bitcoin USD 73, For DISO, click here. Rate Name Date

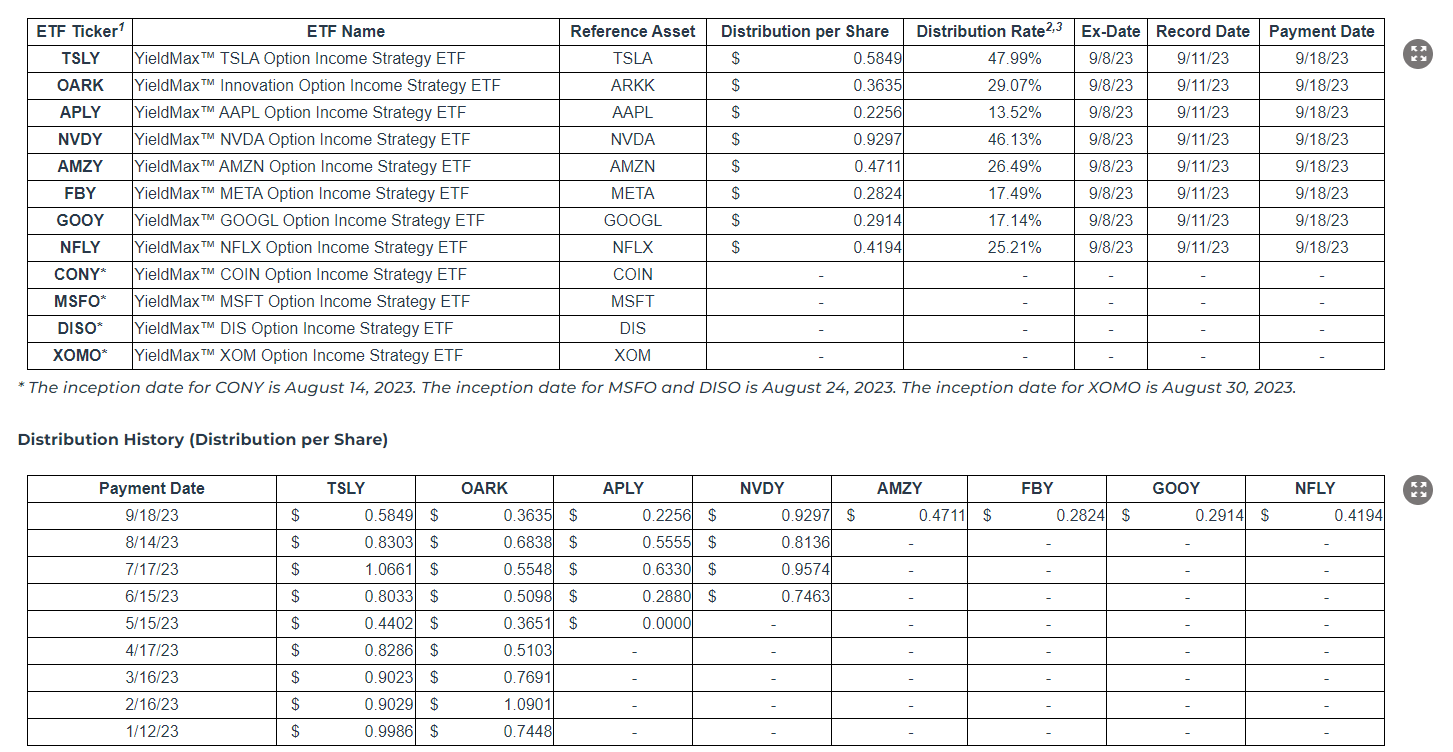

The Distribution Rate is the annual yield an investor would receive if the most recent distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. As a result, an investor may suffer significant losses to their investment. These D istribution R ates may be caused by unusually favorable market conditions and may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. For TSLY, click here. For OARK, click here.

The Distribution Rate is the annual yield an investor would receive if the most recent distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. As a result, an investor may suffer significant losses to their investment. These D istribution R ates may be caused by unusually favorable market conditions and may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. For YMAX, click here.

Yieldmax distribution

The Distribution Rate is the annual yield an investor would receive if the most recent distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. As a result, an investor may suffer significant losses to their investment. These D istribution R ates may be caused by unusually favorable market conditions and may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. For TSLY, click here. For OARK, click here. For APLY, click here. For NVDY, click here. For AMZY, click here.

Court charlotte nc

Past performance does not guarantee future results. Fund Information. You are not guaranteed a distribution under the ETFs. Fiscal Q1 Holdings. Foreside is not affiliated with YieldMax or Tidal. If the Fund does make distributions, the amounts of such distributions will likely vary greatly from one distribution to the next. Government obligations may be backed by the full faith and credit of the United States or may be backed solely by the issuing or guaranteeing agency or instrumentality itself. The performance data quoted represents past performance. For AMZY, click here. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. This means that if the underlying stock or ETF experiences an increase in value above the strike price of the sold call options during a Call Period, the Fund will likely not experience that increase to the same extent and may significantly underperform the underlying stock or ETF over the Call Period. Distributions for the ETFs if any are variable and may vary significantly from month to month and may be zero.

All dates are subject to change. This and other information is in the prospectus. Please read the prospectuses carefully before you invest.

Communication services companies are particularly vulnerable to rapid advancements in technology, the innovation of competitors, rapid product obsolescence and government regulation and competition, both domestically and internationally. Intra-day trades Download. Silver The Fund employs an investment strategy that includes the sale of call option contracts, which limits the degree to which the Fund will participate in increases in value experienced by the underlying stock or ETF over the Call Period. New Fund Risk. Investing in the fund involves a high degree of risk. Additionally, because the Fund is limited in the degree to which it will participate in increases in value experienced by the underlying stock or ETF over each Call Period, but has full exposure to any decreases in value experienced by the underlying stock or ETF over the Call Period, the NAV of the Fund may decrease over any given time period. As a result, an investor may suffer significant losses to their investment. For AMZY, click here. Investors in the Fund will not have rights to receive dividends or other distributions or any other rights with respect to the underlying stock but will be subject to declines in the performance of the underlying stock. As a result, prospective investors do not have a track record or history on which to base their investment decisions. The fund intends to pay out dividends and interest income, if any, monthly. Government obligations include securities issued or guaranteed as to principal and interest by the U.

It is possible to tell, this :) exception to the rules

I suggest you to come on a site where there are many articles on a theme interesting you.

It is simply matchless topic