Uber w2 tax form

Uber typically sends these out before or around January Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready, uber w2 tax form.

The difference is huge, especially at tax time. Follow these tips to report your income accurately and minimize your taxes. Follow these tips to report your Uber driver income accurately and minimize your taxes. Some Uber driver-partners receive two Uber s :. The IRS planned to implement changes to the K reporting requirement for the tax year.

Uber w2 tax form

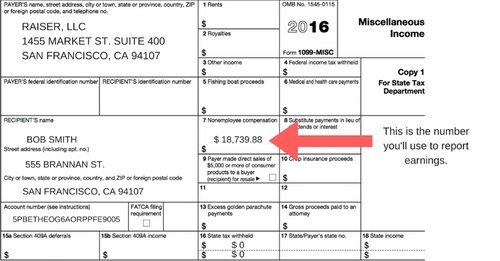

Here's how to understand your Uber s. The same is true if you earn income as a wedding singer, yoga teacher, or anything else. Generally, each separate type of business you run requires a separate Schedule C. Uber, however, will not typically send you a W Instead, it will report your earnings on two or three other forms:. But you should definitely save your s with your other tax records. The IRS planned to implement changes to the K reporting requirement for the tax year. However, some individual states have already begun to use the lower reporting threshold. Uber, however, typically provides these documents to all of its driver-partners regardless of the amount income to remind them about reporting their income and to help make filing their taxes easier. Uber also provides its drivers with a third document, known as a tax summary. It also shows selected expenses you can likely deduct on your Schedule C. Uber drivers receiving a K for the first time often are surprised to see that the income reported is greater than the amount they actually received in payment. You can likely deduct the extra amounts on Schedule C. This gives you the totals for:. And other fees and taxes paid over the course of the year, all of which can usually be deducted from your business income.

If you file after March 31, uber w2 tax form,you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Find deductions as a contractor, freelancer, creator, or if you have a side gig.

This includes income from any source, no matter how temporary or infrequent. If you do not report all income, you may run into problems with the IRS in the future. The IRS sometimes audits taxpayers based on tax returns from the past three tax years or six years if you have underreported your income. You will likely receive two tax forms from Uber or Lyft. Form K reports driving income or the amounts received in customer payments for rides provided, and Form NEC reports any income you earned outside of driving, including incentive payments, referral payments, and earning guarantees. Include the total income from both tax forms on your tax return.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with. How do I login to my Stripe Express account?

Uber w2 tax form

You pay self-employment taxes in addition to your regular income taxes. This means you may have a larger tax bill when you file. The Roadmap to Rideshare Taxes Cheat Sheet explains self-employment tax concepts in an easy-to-follow map. Read up on the basic concepts of filing rideshare taxes. You are eligible for tax deductions for business expenses that can reduce your taxes. Throughout the year, track these expenses as they occur, and always save your receipts as needed. Some of the most common tax deductions to take will be for mileage, Uber and Lyft fees and commissions, snacks and refreshments for passengers, cost of a phone, and accessories for your car. You will find the Uber and Lyft fees and commissions in your driver dashboard. Record the rest of your deductions yourself.

Tripadvisor car rental

Follow these tips to report your Uber driver income accurately and minimize your taxes. The possible business tax deductions include a breakdown of miles logged, some expenses, fees, and taxes. File an IRS tax extension. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Contact us. Not for use by paid preparers. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. How do tax deductions for Uber drivers affect their overall taxes owed? Guide to head of household. Quicken products provided by Quicken Inc. Product limited to one account per license code. Maximum balance and transfer limits apply per account. Click to expand. TurboTax Live tax expert products. Early each year, Uber drivers start getting their forms for their previous year earnings and that can only mean one thing

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze.

Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. Tax law and stimulus updates. If you use a cellphone exclusively for your Uber business, you may deduct all phone expenses. Bonus tax calculator. Download for FREE. This is where things get interesting. TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Estimate capital gains, losses, and taxes for cryptocurrency sales. Include the total income from both tax forms on your tax return. Content Specialist. Products for previous tax years.

Prompt reply)))

Here so history!