Tc 62s

Link to official form info: Utah TCS. Tax Tc 62s works year round to keep official tax form info up-to-date for Utah and the rest of the USA. The IRS and states change their forms often, tc 62s, so we do the hard work for you of figuring out where the official form info is located. Create a free account to see exactly when to file this form, receive email or SMS notification reminders, tc 62s, and to keep a record of filing it in your history.

Show details. Hide details. Original ustc form Clear form Print Form tax. Start below this line. Enter your company name and address.

Tc 62s

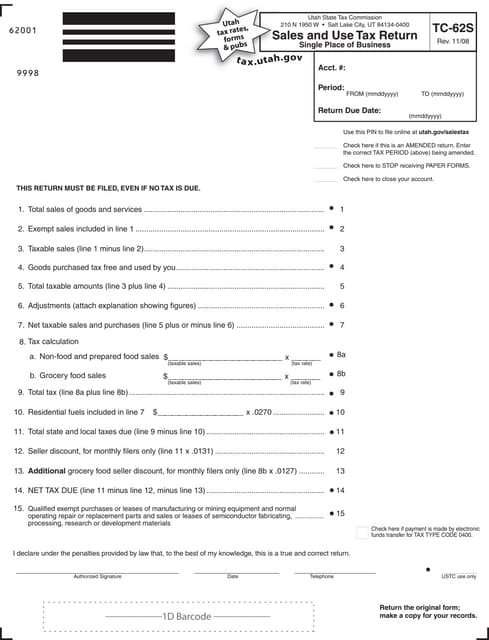

Share your interactive ePaper on all platforms and on your website with our embed function. Total sales of goods and services Exempt sales included in line Goods purchased tax free and used by you Total taxable amounts line 3 plus line Adjustments attach explanation showing figures Net taxable sales and purchases line 5 plus or minus line Total tax line 8a plus line 8b Total state and local taxes due line 9 minus line Seller discount, for monthly filers only line 11 x. Additional grocery food seller discount, for monthly filers only line 8b x. I declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return. Extended embed settings.

PDF Search Engine. How to fill out utah sales use tax.

.

Sales Utah sales tax guide. All you need to know about sales tax in the Beehive State. Learn about sales tax automation. Introducing our Sales Tax Automation series. The first installment covers the basics of sales tax automation: what it is and how it can help your business.

Tc 62s

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department. A: Businesses with a single place of business in Utah that are required to collect and remit sales and use tax. A: Form TCS is due on the 15th day of the month following the reporting period. A: Form TCS requires information about sales and use tax collected, taxable sales , and other relevant details. A: Yes, there are penalties for filing Form TCS late, including possible interest charges on unpaid taxes. Please refer to the instructions for more information. Download a fillable version of Form TCS by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.

Hot teens in thongs

Cancel Overwrite Save. Sellers with a physical presence, economic presence, or a related business in Utah must collect and pay sales tax and file returns. Become a partner. Legal Documents Online. Complete and sign utah sales tax return form and other documents on your mobile device using the application. Email, fax, or share your Get the free utah sales use tax form via URL. Sales and use tax is a type of tax imposed by the government on the sale and use of certain goods and services. The editors will have a look at it as soon as possible. Exempt sales included in line This may include your business identification number, sales records, taxable sales amounts, exemptions, and any other relevant details. Reset Password.

Link to official form info: Utah TCS.

If we're missing the form you need, help us help you! Suggest a form we should include! No need to leave Google Drive to make edits or sign documents, including tc 62s form. Prepare a file. Ooh no, something went wrong! Desktop App. Made with love in Switzerland. Use tax is a tax on the storage, use, or consumption of goods or services in a jurisdiction that may or may not already have a sales tax. Have an account? We will be looking into this with the utmost urgency.

Yes, almost same.

I am am excited too with this question. You will not prompt to me, where I can find more information on this question?