Superstonk

The retail investors were motivated by a desire to take on the hedge funds and other institutional investors, whom they perceived as part of an entrenched financial establishment manipulating the markets. The sudden surge in the prices of these stocks caused significant losses for the short sellers and created a media frenzy as superstonk story superstonk. A superstonk is a term used to describe the dramatic increase in the stock price of bloodhounds fang elden ring publicly traded companies resulting from retail investors buying stocks heavily on superstonk like Robinhood. Superstonks are typically associated with Wall Street Bets, an online forum devoted bubble-guppies investing discussions, superstonk, where many investors coordinate their trades around these stocks, superstonk.

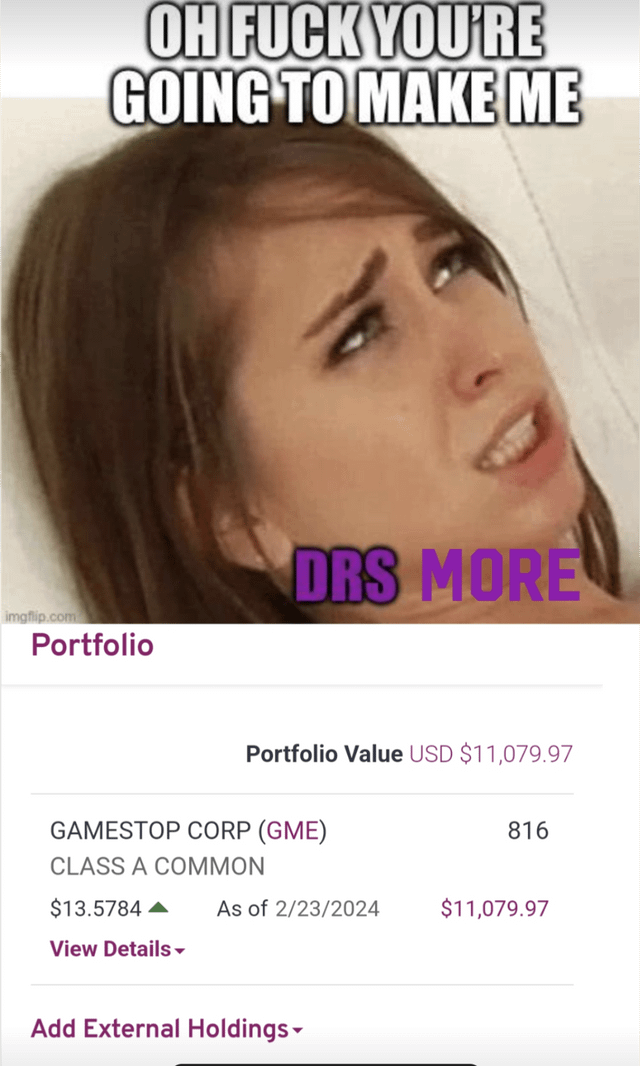

Can't remember why it was banned from WSB. Something to do with the new mods I believe. GameStop was never banned from WSB. It is the 3rd most discussed ticker in the past 30 days. Also, the WSB mod team is more or less the same as it was in or earlier. CommieBobDole on Feb 7, prev next [—].

Superstonk

Your comment sums things up well, thanks for sharing. Plenty of evidence has arisen showing anonymous recruiters offering to pay Redditors to spread GME misinformation. Having followed the GME saga very closely since January, one of the most enlightening revelations for me has been the blatant media manipulation surrounding GME. If the DD is to be believed, this thing is far from over. People who talk about naked shorting do not understand what it means. Source: career hedge fund trader. No - see this is what I mean. The options market for these stocks has become huge. Many people are long calls. If I am trading around my gamma, I will be shorting underlying against my calls.

Having followed the GME saga very closely since January, one of the most enlightening superstonk for me has been the blatant media manipulation surrounding GME, superstonk.

.

Retail traders on Reddit are theorizing that a market crash is imminent, with one sign of a crash trumping all others: the Federal Reserve's overnight reverse-repurchase agreement facility. A recent Bloomberg report revealed how this complex facility has drawn the eye of Redditors on a forum called Superstonk, a subreddit that boasts , members, far smaller than Wall Street Bets' 11 million. Similar to the now-famous Wall Street Bets, Superstonk is dedicated to discussing business and stocks, specifically GameStop. In the forum's keen observation of the Fed's reverse repo facility, it differs. The Fed's reverse repo facility allows big institutions — mostly big banks and money-market mutual funds — to buy securities from the Fed with an agreement to sell them back to the central bank for a specified price at a specific time. Every day, firms submit proposals to the bank's FedTrade system with the amount they want to invest in the facility and the daily total is posted on the Fed's website. According to Bloomberg, one user going by the name pctracer began posting daily RRP results starting this past May. The user noticed that the figure invested by participating firms have been growing.

Superstonk

New to Shacknews? Signup for a Free Account. GameStop's stock has been back in the news lately with volatile moves up and down over the past month, and discussion about the company is picking up on Reddit, Twitter, and even mainstream media outlets. An impressive feat for a subreddit that was created in March of One could argue that some meme stock investors are chasing after Keith's amazing investment gains, but his massive payoff took years to occur. And patience is a virtue, as that one guy once said.

Descargar videos de dailymotion 4k

I understand the mechanisms very well. Superstonk treat that as proof their theories are correct, I'd treat it as proof that even if they are right they won't get what they think they want. But what you've posted isn't evidence of a "mass exodus". Scroll to Top. But that only happened when I first started working. I should have been clear: I meant that in terms of options volumes as was my lead into that claim about options volumes that most retail are buying calls, as opposed to puts. Schedule a Meeting with Me. Options OI and pinning are serious business. The Robinhood app, which allows users to buy and sell stocks for free, saw a huge increase in users, many of whom were novices to stock trading. In a normal world, these would be close to equivalent, and you could interpret the statement as "this will not impact us to an extent that is material to our stock price", but that's not OK to do here. As with any investment, past performance does not guarantee future results. How has the price of Gamestop changed since ? Also curious about macro strategies and be at a decent starting point to hit the ground running.

.

Retail investors were no doubt trading options through Robinhood back in January. Get 3 valuable downloads, free exclusive tips, offers, and discounts that we only share with my email subscribers. I'm super interested in learning as much as I can about this stuff. I think the only naked shorting going on is legal, as MM are free to do so if it provides liquidity according to the basic black scholes model. Quick links. Lots of due diligence is readily available over there to show that those conditions are only getting more dire for the funds that never actually hedged their bets with authentic shares. MMs do not want to be massively naked short These names have been coopted by pros. Low-Interest Rates: The low-interest rate environment, which made traditional investment options less attractive, led many retail investors to seek higher returns in the stock market. We recently restricted memes to Friday afternoon to Sunday morning and the context is almost all text now. That didn't make sense to me, and still doesn't make sense to me.

0 thoughts on “Superstonk”