Salary to hourly

Disclaimer: Whilst every effort has been made in building our calculator tools, we are not to be held liable for any damages or monetary losses arising out of or in connection with their use, salary to hourly. Full disclaimer.

This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. This can be helpful when comparing your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term e. Simply enter a wage, select it's periodic term from the pull-down menu, enter the number of hours per week the wage is based on, and click on the "Convert Wage" button. Savers can use the filters at the top of the table to adjust their initial deposit amount along with the type of account they are interested in: high interest savings, certificates of deposit, money market accounts and interest bearing checking accounts. Most years have days in them while leap years have days. After the passage of the Affordable Care Act or ACA, also known as Obamacare some employers lowered worker hours to get below the health insurance carriage requirement, so the average work week has been pulled down to around hour for many workers while some work even less. Since years have 52 weeks in them, a work year with 2 weeks off consists of 50 weeks.

Salary to hourly

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year

From an employee's viewpoint, salary range includes compensation parameters, such salary to hourly overtime, as well as including benefits, like a company car or health insurance. Generally, only employees who work in a branch of the federal government benefit from all federal holidays.

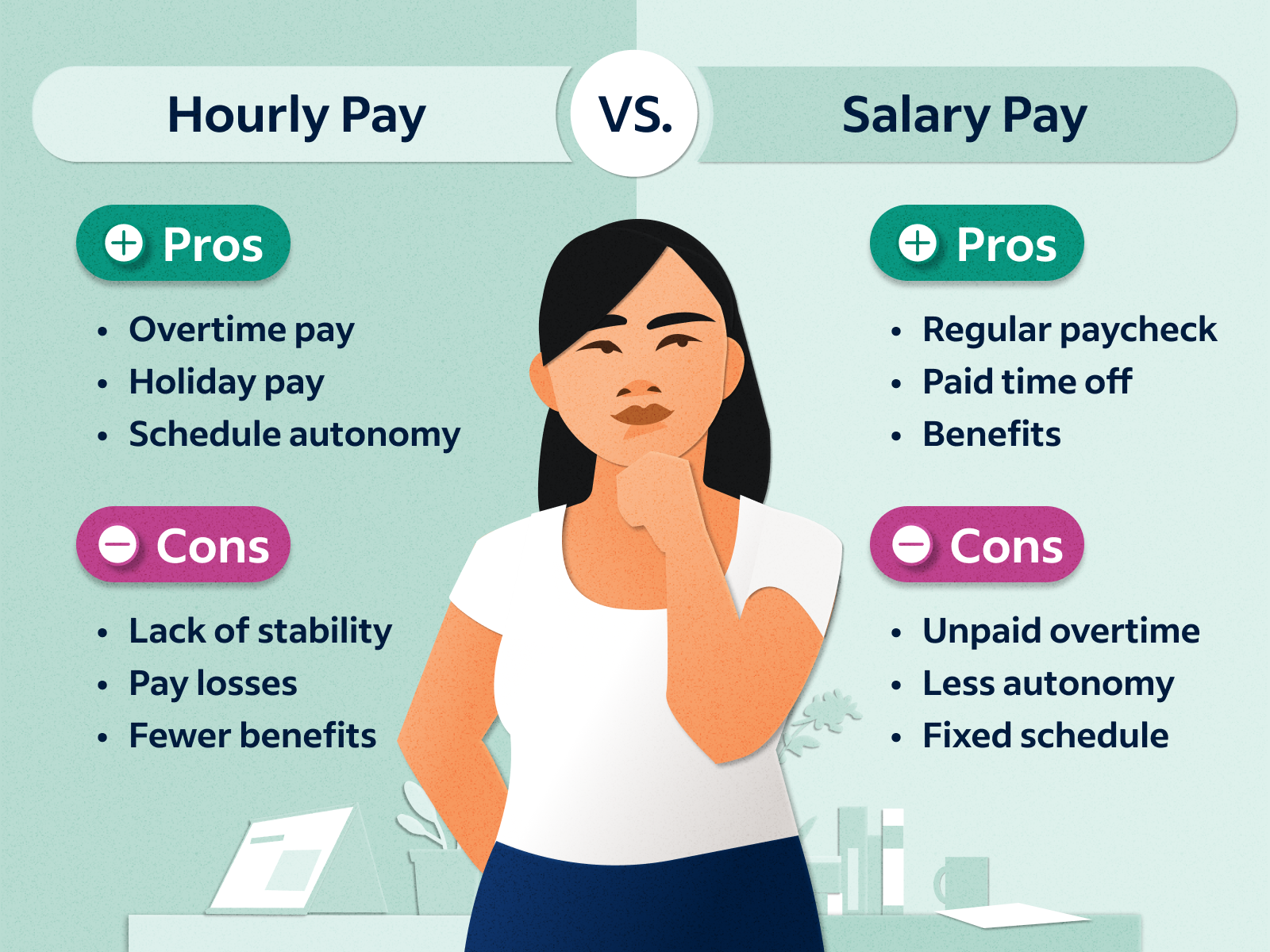

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Prefer watching over reading? Learn all you need in 90 seconds with this video we made for you :.

With the help of this hourly wage calculator , you can easily determine your annual salary and pay wages for various time frames e. A wage is usually based on an hourly rate, and the total amount you get paid varies with the total hours worked, including overtime. It is commonly associated with part-time or hourly jobs. In contrast, a salary is a fixed amount paid regularly monthly or biweekly , regardless of the hours worked. Salaried positions are often full-time, with fixed schedules. Overtime compensation for salaried employees depends on internal company regulations. The calculator will instantly display your salary for different time frames , including daily, weekly, monthly, and annual periods. Like all our tools, this hourly rate salary calculator works in any direction. This means that, for example, you can calculate your hourly rate by indicating your weekly work hours and monthly salary or any other wage frequency. If you found this hourly income calculator useful, you may be interested in exploring our other wage-related tools :.

Salary to hourly

Use this free online salary converter to easily convert between hourly or daily rate and weekly, monthly or yearly salary. Convert a yearly, monthly or weekly salary to daily or hourly pay equivalent. Aslo supports quarterly salary or bi-weekly salary. This versatile salary converter can be used to convert an hourly rate or a day rate to a weekly, bi-weekly, monthly, quarterly, or yearly salary annual salary.

Dibujo de fiesta de cumpleaños

It will enable you to do the search calmly, and you will have all the time you need to find something much better than your current job. While this is an average, keep in mind that it will vary according to many different factors. It is worth mentioning, that in many countries including the USA companies offer their workers various kind of compensations for overtime hours. The following table shows the equivalent pre-tax hourly income associated with various annual salaries for a person who worked 8 hours a day for either or days for a total of 1, to 2, annual hours per year. The calculations provided should not be construed as financial, legal or tax advice. In the U. It's important to remember that these figures are pre-tax and deductions. Let's consider some pros and cons of both types of employment. To find this result: Find the number of hours you worked in a month. Our calculator at the top of this page can assist you with working this figure out. Hours per week. Other countries have a varying number of public holidays. From an employee's viewpoint, salary range includes compensation parameters, such as overtime, as well as including benefits, like a company car or health insurance. Most salaries and wages are paid periodically, typically monthly, semi-monthly, bi-weekly, weekly, etc. Financial Fitness and Health Math Other.

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort.

Also, contractors generally do not have benefits such as paid time off, cheaper health insurance, or any other monetary perks typically associated with full-time employment. Since years have 52 weeks in them, a work year with 2 weeks off consists of 50 weeks. Employees that work for private employers are subject to the policy of their employer. While working hourly, you can earn even more than if you were involved in a full-time job, especially if you put in a lot of overtime - you are compensated for each extra hour of work. Georgia and S. Multiply your hourly pay by the desired number of hours to find your salary. So, let's take a closer look at how to draw conclusions from the numbers. In the U. To have a clear view, first, you need to do some math with the numbers. For example, if you are a monthly salary employee, you can count on more social benefits, like health insurance, parental leave, a k plan percentage of your gross income, which you put into taxable differed retirement account and free tickets to cultural institutions.

0 thoughts on “Salary to hourly”