Octa cloud gst

Over the time it has been ranked as high as in the world, while octa cloud gst of its traffic comes from India, where it reached as high as 35 position. Octagst has the lowest Google pagerank and bad results in terms of Yandex topical citation index.

Confused in complicated laws? Click here to know more. GST has created a lot of burden on Chartered accountants as well as business organizations as it includes lot of compliances. The other tax liabilities such as VAT, service tax etc. Now there is only one indirect tax regime that need compliances.

Octa cloud gst

Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. These GST software applications are simple and straightforward to directly connect with the accounting system, and information can be effectively exported to submit supplementary returns or potentially create MIS reports. Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. It is an indirect tax regime that has substantially substituted a few other indirect taxes in India, including excise duty, VAT, and services tax. A good and strong GST-compliant accounting system is a perfect match for your commercial applications. Deeply anxious that you may have submitted factually incorrect tax returns and also that the tax department may summon you? Nearly every single corporate field has considered the consequences of GST, and many professions are also directly influenced by the new indirect tax framework. Chartered Accountant is one of the sectors that would be significantly affected by the advent of GST. It tackles any underlying issues that emerge as a consequence of GST filing inaccuracies and deduction claims that assure massive profits. In addition, because all financial transactions are documented on the software, GST filing is largely automated. With more and more GST apps accessible to the public, it may be tough to carefully select reliable and consistent software. The programme behaves as a platform, enabling an end-to-end GST administration workable solution for all of your business transactions. In addition, it encompasses a series of support services, such as a reconciling system, invoicing, vendor compliance, a verification engine, and many others. The programme supports strong information security monitoring by encrypting data both at the origin and in transit.

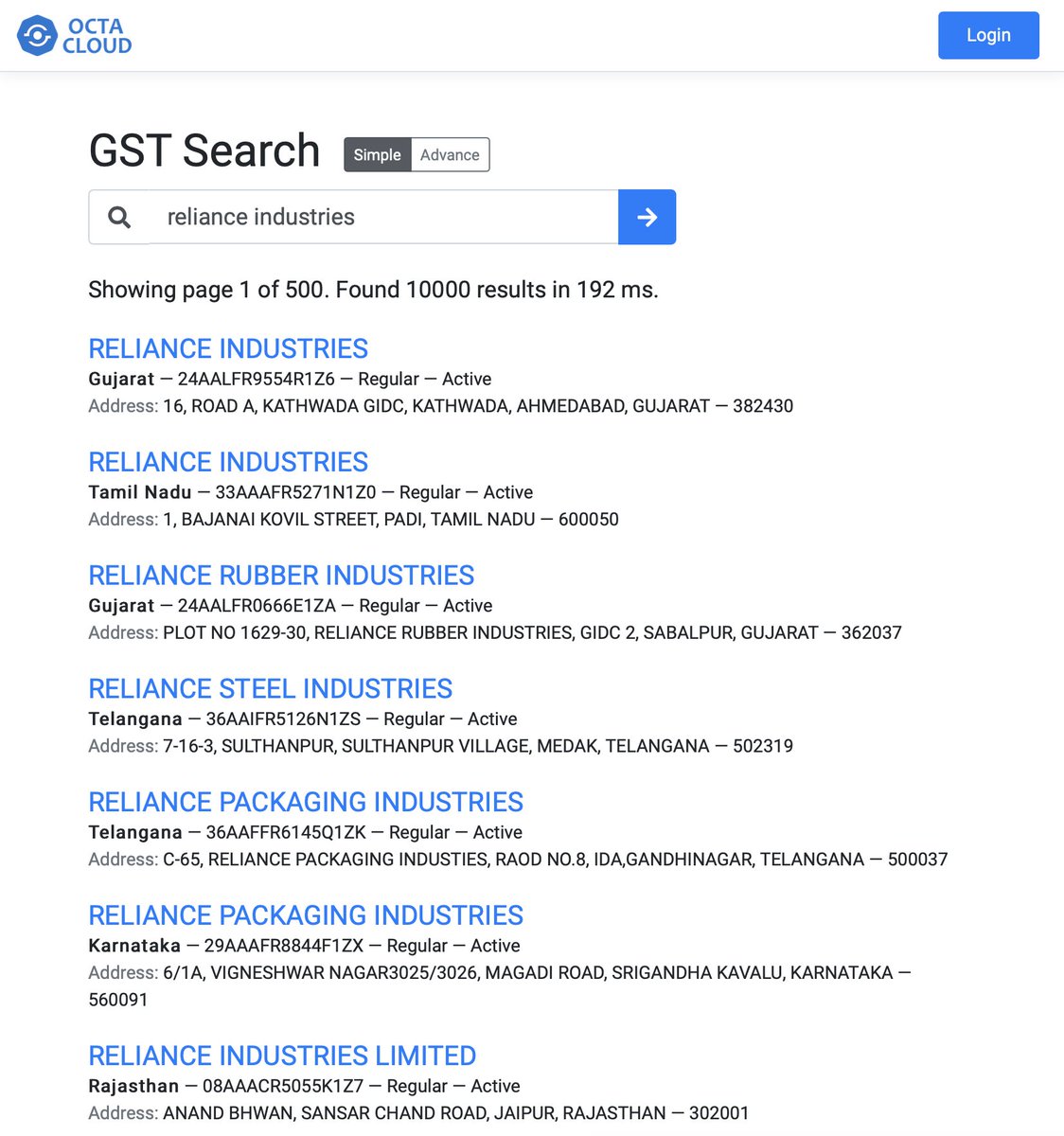

This tool comes handy at that time. It is a cloud based software that will help in completing all GST related compliances. Octa GST is an offline return filling and reconciling application that is simple and clear, and easy to implement for all kinds of businesses and tax experts, octa cloud gst.

Confused in complicated laws? Click here to know more. There are number of tools and softwares for Chartered accountants and tax professionals to ease their work. Other than GST and Income tax softwares there are also some tools which can help them to save time and efforts to a great extent. Here is a list and details of such tools. Managing tasks, allocating them to team members is a hectic task to be done each day. This application let you manage your GST and Income tax task with ease.

Cloud-based invoicing and GST returns solution for businesses. Most viewed in You are being shown a subset of the data for this profile. Copy Url. Octa company profile.

Octa cloud gst

No manual data entry required. Export data from accounting software and import in Express GST in just a click of a button. Calculate accurate ITC with invoice reconciliation and vendor management. Generate tax reports, financial reports, top vendor reports, top clients report, and many more in multiple formats in just a click of a button. Identification of mismatches or excel like functioning with Linking or Delinking of matched invoices. View Multiple Reports of different sections in one go for easy comparison. Drag , Maximize and Minimize reports as per your needs to view Comparisons side by side. With many changes to how businesses account for their purchases, sales and calculation of input tax credits, Express GST makes it easy and fast for your business to transition to being fully GST compliant. Read more!

Electric computer duster

Table of Contents. If you are confused between Octa Gst or SahiGST, you can also check if the software has customizable modules for your industry. Nameservers ns Read Article ». It provides mismatch notification, automatic data validation and updates regarding tax liabilities that helps in avoiding errors while filing returns. Here is a list and details of such tools. Rick Apps List. What's hot 14 QuickBooks Salesforce Connector. According to Siteadvisor and Google safe browsing analytics, Octagst. The programme behaves as a platform, enabling an end-to-end GST administration workable solution for all of your business transactions.

Reconciling purchase invoices and tracking ITC claim is difficult. We make it simpler with industry leading smart invoice matching and automated ITC tracking of each purchase invoice.

Confused about complicated laws? Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. Worldwide Audience Compare it to They want to cut down conformity duration, which will culminate in a cost reduction of approximately half. Table of Contents. The USP of this application is the practical features and reasonable pricing. It depends upon your business requirement. Advance Data Import Module for Odoo. All industries. Ewelina Resume Ewelina Pawelko. The programme behaves as a platform, enabling an end-to-end GST administration workable solution for all of your business transactions. Click here to know more.

0 thoughts on “Octa cloud gst”