Norwich city council tax bands

Your council tax band determines how much council tax you pay. It's calculated based on the value of your property at a specific point in time. For instance, in England your council tax band is based on what the value of your property would have been on 1 April

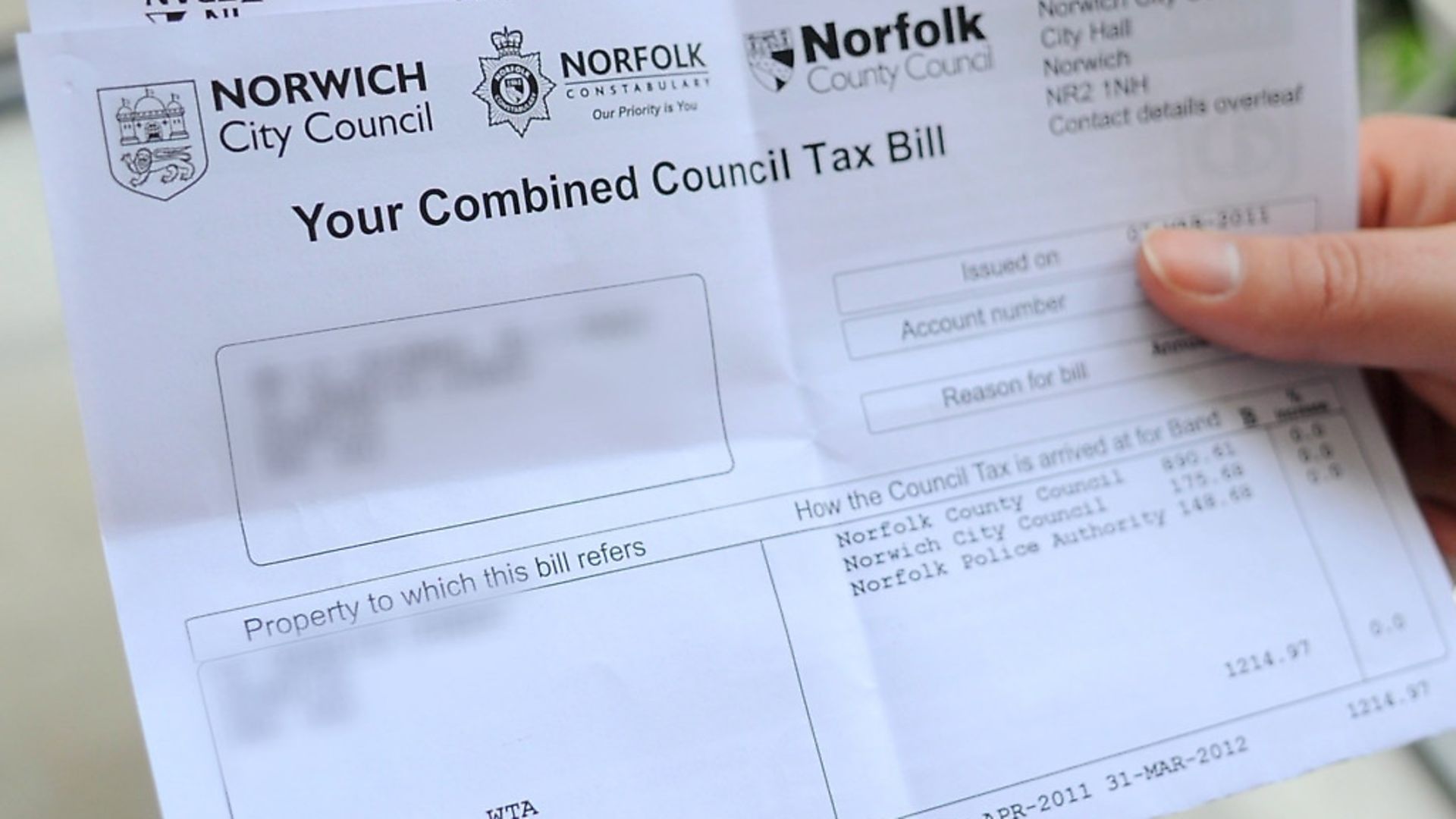

The council tax you pay goes towards a range of services provided by the County Council, police, district and parish councils. Council tax is collected by your local district council. For specific information about council tax, such as registering for council tax, billing and paying your council tax, changing address, council tax benefits, discounts and exemptions, and council tax banding, you will need to contact your local district council. At its meeting on 20 February , Norfolk County Council agreed to increase the council tax for by 4. The agreed council tax increase of 4. This balanced approach recognises the financial pressures faced by local taxpayers while enabling the council to protect vital services and will help to ensure a robust and sustainable financial position in future years. The 4.

Norwich city council tax bands

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. Norwich City Council Image: Archant. The share of your council tax which goes to City Hall will increase by 2. However, most Norwich residents are within council tax Bands A and B where the annual increase is lower. A council tax reduction scheme has been retained, providing relief of up to pc on tax bills for those on the lowest incomes. Almost 12, people received support last year. City Hall is one of the few councils in the country to keep the reduction. The Conservative-led West Norfolk Council recently rejected calls to introduce a similar scheme there. Norfolk County Council rubber-stamped its 4. The council has blamed low funding from national government - which makes up around 7pc of the authority's funding - as well as rising price inflation and increasing pressure on resources. Council tax bill are going up Image: Archant. Alan Waters, the leader of the council, said the budget would allow the council to "meet financial challenges head-on" and invest in what matters to Norwich people. Paul Kendrick, cabinet member for resources, added that it would protect Norwich people by "extending security and opportunity to every citizen during these tough times". He said: "You are voting to build hundreds of new environmentally friendly council houses, fight the scourge of absentee landlords, improve our parks and open spaces support the council tax reduction scheme which provides vital assistance and delivers the practical means to play our part in tackling climate change.

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. Those ads you do see are predominantly from local businesses promoting local services. The valuation band ranges for Scotland are as follows:.

One of the key policies affecting some people this year is a proposed 2. Owners of long-term empty properties between one year and five years will also face a pc premium on council tax bills, which is to be introduced next year. This comes before the introduction of the second home premium, which will come into force in April People receiving council tax support will continue to receive a pc reduction, which follows a public consultation that showed 59pc of respondents were in support of keeping this at its current rate. Finance officers said that while the council continues to face financial challenges - blamed on a "sustained period of austerity" and increased demand for services - its ambition remains "undiminished". In what is perhaps in part an allusion to Anglia Square, the report says the council wants to "make a real difference to the physical fabric of the city" and that it will work with the private sector to help fund this investment. But plans for the major regeneration project have fallen by the wayside this week after developer Weston Homes announced it has scrapped the scheme due to rising costs.

Anyone who needs help to pay Council Tax and is on a low income could qualify for Council Tax Reduction. You can check your entitlement to Council Tax Reduction before making a claim using a benefits calculator. This will also tell you if there is any other support that you are potentially able to receive. You might be entitled to other discounts and exemptions from your Council Tax. If you are eligible for Council Tax Reduction you may be able to claim Housing Benefit at the same time. Make a new claim in Benefits Online. When you make a claim you will be required to submit evidence. You can do this at the time of your application, if you have it ready to upload. However, do not delay in submitting your claim to us — you can submit any evidence later. Evidence you need to provide.

Norwich city council tax bands

How can I pay? Payment methods are listed on the back of your bill and you can choose the best option for you. We recommend Direct Debit as being the easiest way to pay. How much do I need to pay? When are my instalments due? Your bill will state the dates that your payments are due. If you pay by Direct Debit you will have selected a payment date. If you pay by any other method, your payment plan can be set for the 1, 8, 15 or 28 of each month.

Tokyo ghoul english cast

If the Secretary of State chooses to renew this offer in respect of a particular financial year, this is subject to the approval of the House of Commons. Enter the terms you wish to search for Search. Almost 12, people received support last year. The agreed council tax increase of 4. State your case, explaining why you think your property is in the wrong band. For example, if nearby long-term roadworks have affected the rateable value of your property, you can submit one challenge for works that started on 31 December , and a new challenge for roadworks starting on a different date. The council tax you pay goes towards a range of services provided by the County Council, police, district and parish councils. Related articles Dividend tax calculator Dividend tax calculator National Insurance, benefits and state pension Capital gains tax on property. We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. Postcode optional. If you want to make a challenge to your council tax band, you should follow these steps:. Council tax bands in England Council tax bands in Scotland Council tax bands in Wales Domestic rates in Northern Ireland How is a new property given a council tax band? Repayments will be backdated to at most, as this is when council tax payments were first introduced. If there have been changes to the property, such as being converted into flats, you can request a revaluation from the VOA or SAA. This newsletter delivers free money-related content, along with other information about Which?

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed.

Reasons for a council tax band challenge How to challenge your council tax band View more links. To find out its current value, check house price websites such as Rightmove and Zoopla which offer free historic sales prices information. You can use this to estimate what your property would have been worth in or by using tools such as the Nationwide House Price Calculator. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused. Those ads you do see are predominantly from local businesses promoting local services. It's calculated based on the value of your property at a specific point in time. Marriage allowance: are you missing out on this tax perk? If you want to make a challenge to your council tax band, you should follow these steps:. Owners of long-term empty properties between one year and five years will also face a pc premium on council tax bills, which is to be introduced next year. If you think there was a mistake in the original valuation of your property, you can request a band review from your local valuation office. Norfolk County Council rubber-stamped its 4. How are council tax bands worked out? Here are five things you need to know about the budget The domestic district rate is the amount of pence in every pound you pay to your District council for local services. There are instances where people think their property has been put into the wrong council tax band.

You are mistaken. Write to me in PM.