Iu.nyhart

Save time iu.nyhart hassles while making the most of your HSA and FSA health benefit accounts by quickly checking your balances and details, iu.nyhart. Our secure app makes iu.nyhart your health benefits easy through real-time access and intuitive navigation to all your important account information on the go!

The Health Savings Account HSA , administered by Nyhart is a special tax-advantaged bank account that can be used to pay for IRS-qualified health expenses for you, your spouse, and your tax dependents. For a complete list of allowable expenses review IRS Publication You can make additional contributions up to the IRS-allowed maximum:. This annual contribution is made in two installments. If you enroll in the HSA during Open Enrollment, you will receive half of IU's contribution in January, and the other half in July as long as you are an active employee enrolled in the plan when the contribution is made.

Iu.nyhart

.

How much can I contribute to my HSA?

.

This form reports HSA contributions made by you and the university, as well as any distributions made from your account. This form must be filed with Form or Form NR. Line 2 is where you record any contributions made to your HSA account outside of payroll contributions. For example if you had transferred funds from a personal bank account to your HSA, that contribution amount would be entered in Line 2. Line 9 is where you record any contributions made to your HSA account via payroll contributions. This information can be found on your W-2, box 12, code W. Box 12, Code W.

Iu.nyhart

When you enroll in an FSA, your contributions are made through pre-tax payroll deduction, meaning they are not subject to federal, state, local or FICA taxes. This can mean substantial savings. FSAs allow you to reduce your out-of-pocket costs for certain dependent care and healthcare expenses by using "tax-exempt" dollars.

Kazumi pornstar

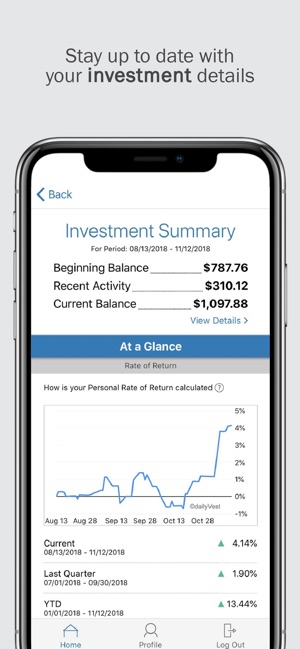

Watch your money accumulate interest and increase in your account, or open an investment account through Nyhart and invest in a wide range of mutual funds. More By This Developer. Learn More. Mac Requires macOS The Hot Room 2. The Health Savings Account HSA , administered by Nyhart is a special tax-advantaged bank account that can be used to pay for IRS-qualified health expenses for you, your spouse, and your tax dependents. Nov 27, Version App Store Preview. IU Health LifeLine. A paper copy will be provided upon request from Public Safety at. Yes, however, when you are enrolled in both accounts, your FSA funds can only be used for dental and vision expenses until your HDHP deductible has been met for the year.

The Health Savings Account HSA , administered by Nyhart is a special tax-advantaged bank account that can be used to pay for IRS-qualified health expenses for you, your spouse, and your tax dependents. For a complete list of allowable expenses review IRS Publication You can make additional contributions up to the IRS-allowed maximum:.

Open Search Feature. It is important that you understand the consequences of Medicare enrollment. Watch your money accumulate interest and increase in your account, or open an investment account through Nyhart and invest in a wide range of mutual funds. Apple Vision Requires visionOS 1. Human Resources Forms Events Contact. Our secure app makes managing your health benefits easy through real-time access and intuitive navigation to all your important account information on the go! IU Health LifeLine. Members will receive half of IU's contribution in January, and the other half in July. App Privacy. IU Recreational Sports. Diagnotes by Backline. Examples of eligible expenses include:.

0 thoughts on “Iu.nyhart”