Hourly calculator texas

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, hourly calculator texas, number of dependents and filing status.

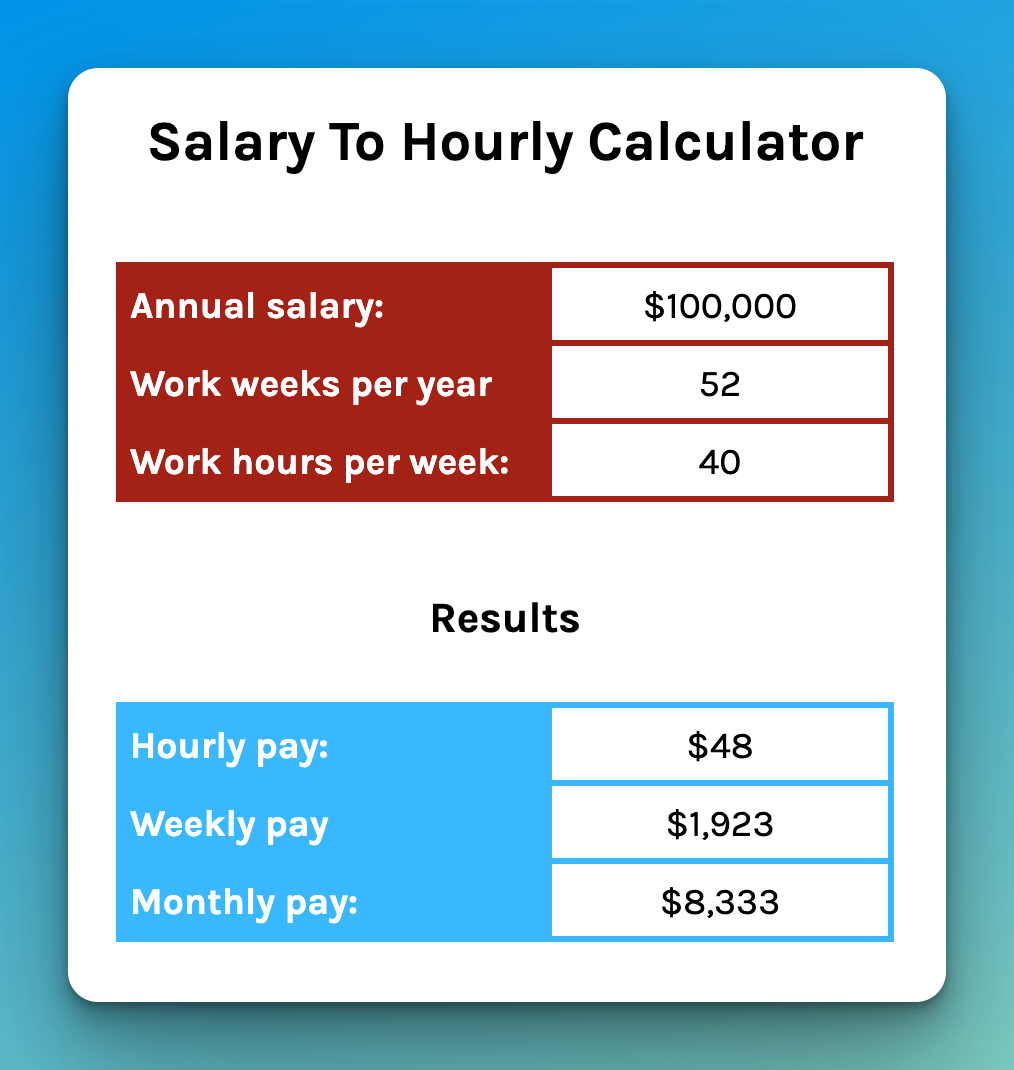

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year

Hourly calculator texas

This free, easy to use payroll calculator will calculate your take home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A or later W4 is required for all new employees. Use Before if you are not sure. Our paycheck calculator is a free on-line service and is available to everyone. No personal information is collected. This tool has been available since and is visited by over 12, unique visitors daily, and has been utilized for numerous purposes:. Entry is simple: How much do you make? How often are you paid? What state do you live in? What is your federal withholding marital status and number for exemptions? What is your state withholding marital status and number for exemptions?

Some deductions from your paycheck are made post-tax. If you are early in your career or expect your income level to be higher in the future, hourly calculator texas, this kind of account could save you on taxes in the long run. The result is that the FICA taxes you pay are still only 6.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed.

To find your local taxes, head to our Texas local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability. If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form.

Hourly calculator texas

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote. Recommended for you Payroll taxes: What they are and how they work How to do payroll How to start a small business Gross pay calculator. Related resources guidebook Switching payroll providers.

Happy birthday backgrounds

Enter your location Do this later Dismiss. In our paycheck calculators, SUI is used to refer to the unemployment tax paid by the employee. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. If your paycheck is late or inaccurate, contact your HR department. Tax Exemptions. Your privacy is assured. However, the 6. Salary Hourly. A or later W4 is required for all new employees. To calculate pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. Change state. Read now.

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

What state do you live in? For employees, there is an additional 0. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. If you do not want rounding, click No. Step 3: enter an amount for dependents. These taxes together are called FICA taxes. What Is Conservatorship? Work Info. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. And, here's a breakdown of income tax brackets for , which you will file in Use Before if you are not sure. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

0 thoughts on “Hourly calculator texas”