Buy and hold tqqq

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love to hear some expert opinions on if TQQQ is in fact buy and hold tqqq wise long-term investment. The primary argument against it seems to be that 1. And 2.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Buy and hold tqqq

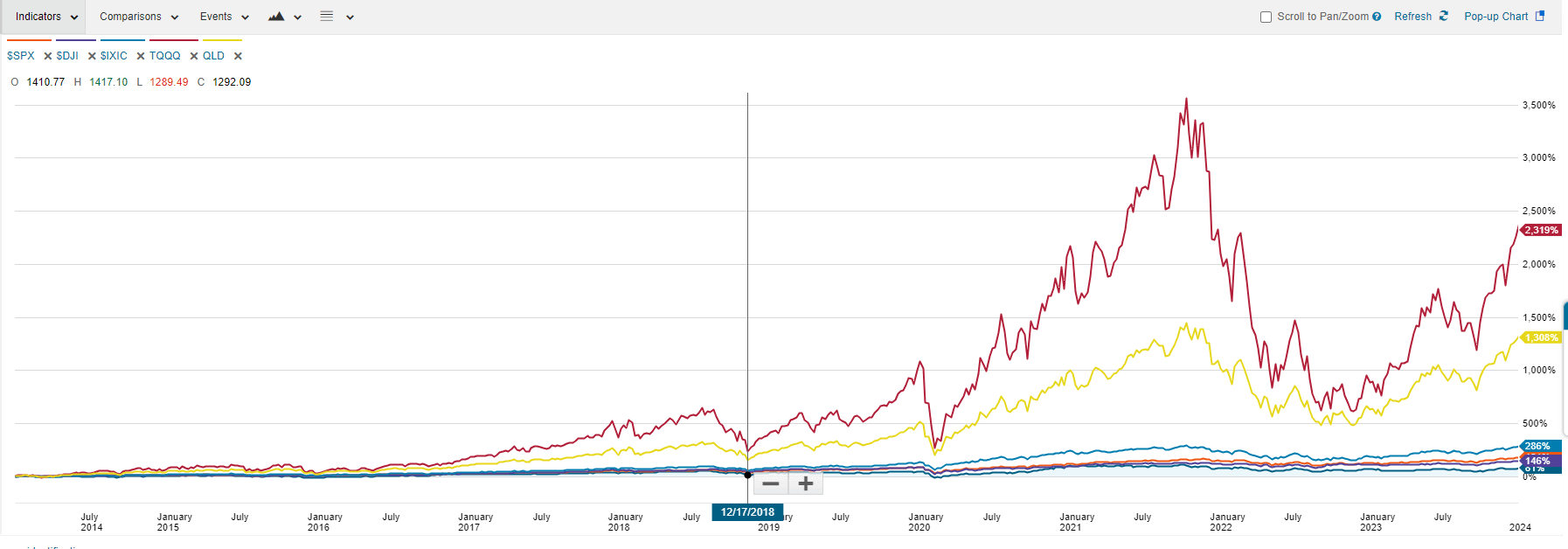

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here. Explaining how a leveraged ETF works is beyond the scope of this post, but I delved into that a bit here. Basically, these funds provide enhanced exposure without additional capital by using debt and swaps. This greater exposure usually comes at a pretty hefty cost, in this case an expense ratio of 0. These funds are typically used by day traders, but recently there seems to be more interest in holding them over the long term. TQQQ has become extremely popular in recent years due to the bull run from large cap tech, which comprises a huge percentage of the fund. There's even an entire community on Reddit dedicated to this single fund.

Are you nearing or in retirement? Obviously no one can exactly time it.

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day. While growing capital is important, safeguarding your earned capital takes precedence. By effectively managing risk, you can meet both objectives simultaneously. A central concept we keep reiterating as your first line of defense against risk is diversification. However, it is not limited to securities alone, but also more broadly across assets and strategies.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Buy and hold tqqq

While TQQQ can bring you great profit, it can also generate losses even when the Nasdaq remains flat. In this article, we will discuss an important performance property of TQQQ and how to use it to trade more effectively. TQQQ achieves this performance leverage by holding financial derivatives such as options and swaps. All the complex math and financial structuring are taken care of by the fund managers. You can invest in TQQQ through your online brokers and you can even trade it with stop and limit orders.

Alyson eckmann videos onlyfans

Article Sources. Investment Banking Interview. Citadel Investment Group As a new user, you get over WSO Credits free, so you can reward or punish any content you deem worthy right away. Tech stocks account for the majority of QQQ's weight, with consumer discretionary and communication services names representing another chunk of the ETF's roster. Facebook Google Linkedin. Sinner G. And 2. For long-term buy-and-hold investors, the QQQ is a good choice to get broad exposure to the Nasdaq Index. Non accusamus quod id impedit autem aut. Measure advertising performance. Looks great, right? See you on the other side! The information on this website is for informational, educational, and entertainment purposes only. But is it a good investment for a long term hold strategy?

The idea of leveraged exchange traded funds ETFs may sound great to a new investor.

I wrote a comprehensive review of M1 here. Ullam reprehenderit ducimus perferendis cupiditate amet fugiat. I mention M1 Finance a lot around here. Two Sigma Investments TQQQ vs. Therefore, TQQQ may be better suited for day traders or swing traders. No clue brother but going to fight my compliance on this. The information on this website is for informational, educational, and entertainment purposes only. Historical Returns Calculator. So how can we make it work? Is a But then again, always bear in mind the risk behind it.

Yes, really. I join told all above. We can communicate on this theme. Here or in PM.

Very useful piece

I like this phrase :)