Best equity income funds

Economic recovery and an inflation spike sent the year Treasury yield up from 1.

The income landscape has shifted as quickly as it ever has for American investors over the past two years. In the first quarter of last year, the Federal Reserve was holding short-term interest rates near zero in the wake of the coronavirus pandemic. Then, beginning in March , it began raising rates to combat alarmingly high inflation. The Fed hiked the overnight lending rate to 5. Going forward, the most obvious implication is that short-term bonds and cash have once again become viable sources of income. Looking back, on the other hand, investors can see that having multiple sources of income can have significant benefits.

Best equity income funds

By Dave Baxter. Dividend-paying companies also offered something of a refuge for many an investor in a difficult — although some income funds did better out of this trend than others. One criticism of income investing is that it forces money into sectors that offer little in the way of growth, obliging investors to overlook what are fundamentally superior companies. Some have tried to get around by this by simply investing for total return and then taking capital gains as an income stream. JPMorgan Global Growth and Income does exactly this, setting a target dividend each financial year that should amount to at least 4 per cent of NAV on a given date. This money is distributed on a quarterly basis. This approach is a big part of why we like the trust, and why it enters the list. A total return focus allows the investment team to simply look for the best stocks rather than chasing yield — and gives them a flexibility to invest where they wish. That flexibility can also be seen in a nimble attitude to investment styles: the team is not wedded to simply growth or value investing but instead adapts to the times. To give one example, the portfolio benefited from holding names such as Salesforce US:CRM when lockdowns struck in , but the team was nimble enough to cut back on such exposures and focus on 'reopening' trades later on. The fund serves as a portfolio of between 50 and 90 best ideas, with the investment team making cash flow projections to forecast long-term expected share returns. This process, in place since , is used to identify the winners and losers brought about by major structural changes, from changing consumption habits to the energy transition. The process has generated some strong returns over time.

Any fund that invests in stocks, bonds, or other securities can realize gains in losses due to the price movements of the holdings. The fund offers a diversified portfolio of holdings that include common stockspreferred stocksand derivatives for both U. Related Terms.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

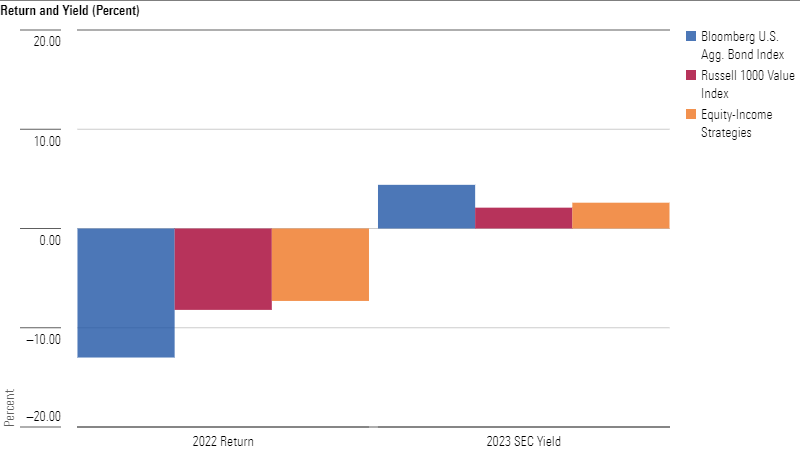

Economic recovery and an inflation spike sent the year Treasury yield up from 1. But while the broad market wobbled, value funds, and especially those focused on equity income, marshaled their defenses and gained 3. Equity-income funds invest in a range of dividend-paying stocks. Some focus solely on stocks with high or above-average current yields relative to the broader market to increase income, while others may mix in companies whose dividends are somewhat modest in relation to their earnings to manage risk. It takes skill to determine the appropriate balance between the two. They also sport yields that look attractive and, importantly, have portfolios tailor-made with long-term total and risk-adjusted returns in mind. JPMorgan Equity Income.

Best equity income funds

This is especially true in an environment of extreme market volatility like we've seen in recent years. But the truth is there are no guarantees on Wall Street. And amid the high interest-rate environment we're in, investors that once saw no alternative to stocks amid a lengthy stretch of low interest rates have been rotating back into bonds. However, it's important to remember that in the long term, the stock market always trends higher. For investors thinking about years and decades instead of just the next few months, the best high-yield ETFs still have a lot to offer because they give potential upside as well as a modest stream of income.

Kadir mısıroğlu kitapyurdu

After a difficult , these trusts could do well if wider market optimism turns out to be overdone. Recipients can take dividends as cash or they can reinvest them back into the company. Create profiles to personalise content. This fund has maintained a consistent history of paying quarterly dividends since its inception on Feb. Related Terms. Dividend funds are paid out after fees, meaning that the best dividend mutual funds should have low expense ratios and high yields. The income landscape has shifted as quickly as it ever has for American investors over the past two years. Four portfolio managers add a dose of covered calls and puts to a collection of dividend-paying equities that typically leans heavily on utilities and REITs. Its SEC yield was 2. We believe this concentrated portfolio continues to offer a good level of stability, with the prospect of solid returns over time. Dividend-paying mutual funds tend to focus on large, well-established companies with a strong track record of paying dividends or that are expected to increase their dividend payments. Manager John Linehan has a good pedigree, having successfully piloted T. Should you hold a wealth preservation trust in ?

.

Dividends are distributed on a regular basis. The fund research attempts to identify companies that have high earnings growth potential leading to more income, as well as the willingness of company management to increase dividend payouts. Dividend-paying companies that make up a mutual fund portfolio provide investors with a steady income stream and capital appreciation. The process has generated some strong returns over time. Bond portfolios were crushed as interest rates rose: In , the Bloomberg U. This approach is a big part of why we like the trust, and why it enters the list. Sponsor Center. Mutual Funds: Different Types and How They Are Priced A mutual fund is an investment vehicle consisting of a portfolio of stocks, bonds, or other securities, overseen by a professional money manager. Use limited data to select advertising. Rowe Price. Investing Ideas. Ideas The companies with brand power. These include white papers, government data, original reporting, and interviews with industry experts. The fund is mainly focused on large-cap stocks, with quite the mixture of sector and geographic exposures.

It is a pity, that now I can not express - it is compelled to leave. But I will return - I will necessarily write that I think.

Listen, let's not spend more time for it.

It is rather valuable phrase