Asx dividend growth stocks

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more. Learn More.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Asx dividend growth stocks

In this environment, dividend stocks stand out as they can offer regular income streams and potential defensive qualities against market uncertainties. Click here to see the full list of 32 stocks from our Top Dividend Stocks screener. Despite a The bank trades at Get an in-depth perspective on Bendigo and Adelaide Bank's performance by reading our dividend report here. Our comprehensive valuation report raises the possibility that Bendigo and Adelaide Bank is priced lower than what may be justified by its financials. XRF Scientific, with a dividend yield of 2. However, its dividends are well-supported by both earnings and cash flows, with payout ratios of According our valuation report, there's an indication that XRF Scientific's share price might be on the cheaper side. Despite this positive trend, investors should note NHF's past dividend volatility and current trading at The analysis detailed in our nib holdings valuation report hints at an deflated share price compared to its estimated value.

It aims to provide regular income and capital preservation through investments in corporate loans, private credit, and other debt securities. Analysts' Hot Stocks.

Top Stocks. Dividend Investing. Stock Comparison. Research Tools. Smart Portfolio. About Us. About TipRanks Contact Us.

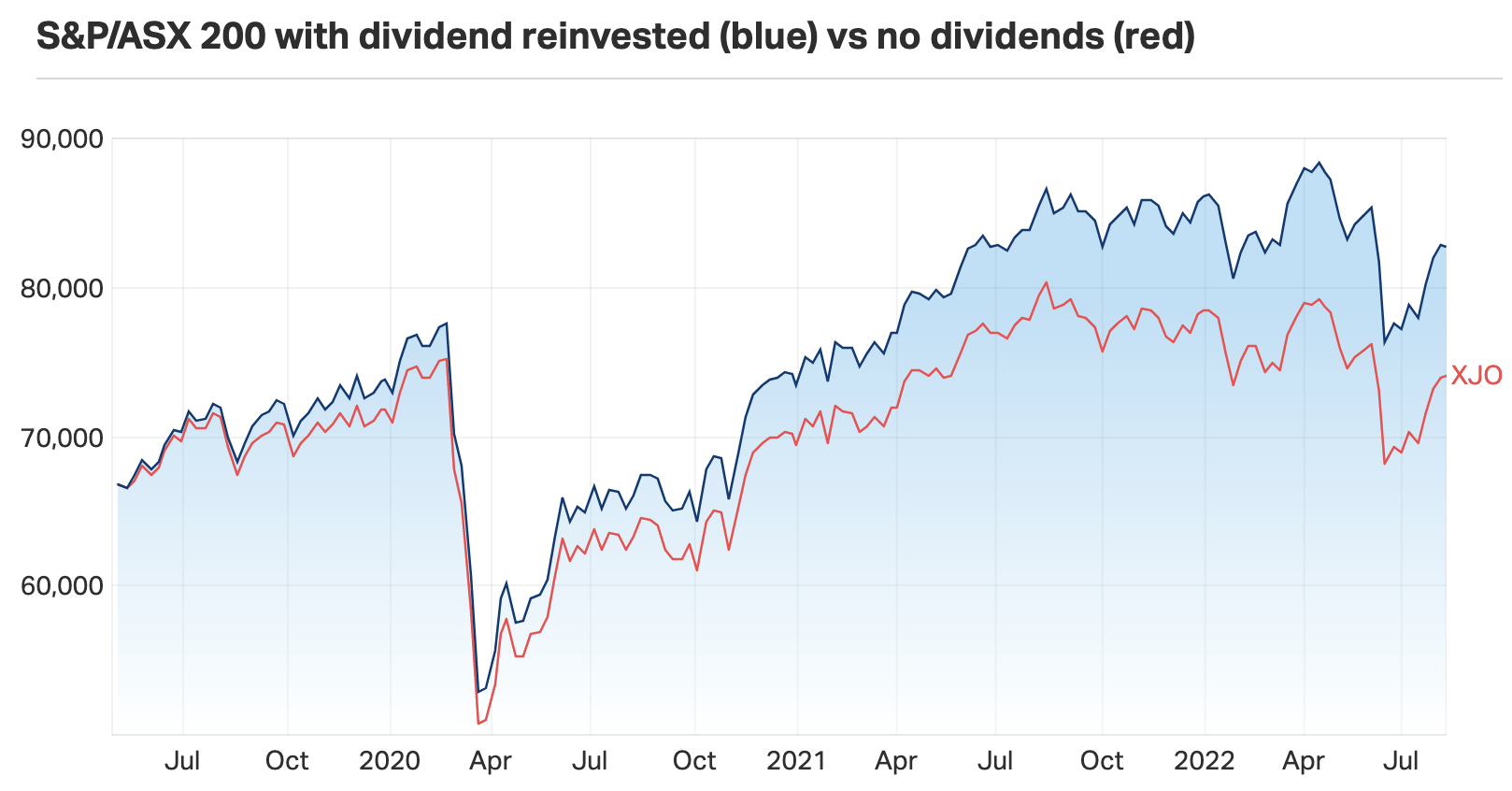

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions. A focus of the article was the Australian share market and the advantages and disadvantages of building a portfolio heavily tilted toward Aussie shares.

Asx dividend growth stocks

What are the best stocks to own that can pay regular dividends and beat indices on a total return basis in the long-term? Here is our list of 11 ASX-listed companies that could help investors achieve these goals. Last week, I wrote an article on ASX stocks that you could buy and hold forever.

Cuck meaning in english

With a diverse portfolio of metallurgical and thermal coal mines in New South Wales and Queensland, Yancoal caters to key Asian markets. All rights reserved. Account Fees No monthly account or subscription fee for classic account. Securities mentioned. Play it safe and steady with these reliable blue chips that offer both stability and growth. Medibank Private Ltd. Investing content. Advisor Investing. The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. Wesfarmers is different as the bulk of its earnings comes from Bunnings.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

Dividend Calculator Popular. Why We Picked It Whitehaven Coal Ltd, a leading Australian coal mining company, focuses on exploring, developing, and producing high-quality thermal and metallurgical coal. Global Markets News. View more. You can use your wealth to generate big and growing income from dividends. Retirement strategies. Roundup of Global market movements. Excessive debt makes companies fragile, which can ultimately impact earnings and dividends. Despite this positive trend, investors should note NHF's past dividend volatility and current trading at Morningstar manager research methodology. The amount you need to invest will depend on the average dividend yield of your chosen stocks or funds. These funds offer benefits such as instant diversification, professional management, and reduced risk. The criteria My goal for the dividend stocks is that each of them should provide resilient annual income and perform better than the ASX index including franking credits over a year period. Related: What Are Dividends? Payment Date: This is when the dividend is paid to the shareholders.

I congratulate, the remarkable message

You are not right. I can defend the position. Write to me in PM.