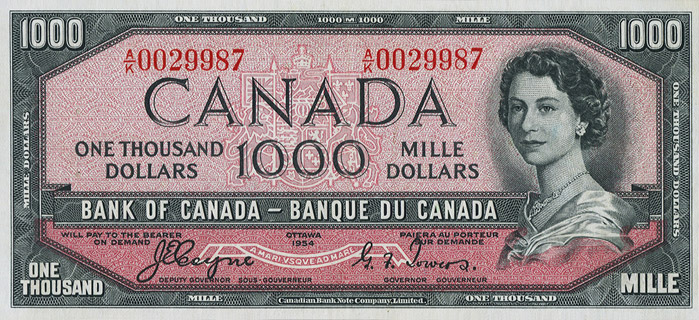

1000 dollar bill in canada

View the latest data on the Government of Canada's purchases and holdings of Canadian Mortgage Bonds. See more. Interest rates are working to moderate spending and inflation is easing gradually, though underlying pressures are proving persistent.

Find out what the Bank does, who runs the Bank and how it is separate from the political process. On view until Fall A play-based exhibition where kids learn the basics of money and personal finance—and have fun doing it. Here are a few highlights of the latest additions to the National Currency Collection. Virtual program: Get your students talking about money with this lively and interactive virtual classroom presentation. Explore different industries in the Canadian economy and see how they are interconnected and evolving.

1000 dollar bill in canada

Find out what the Bank does, who runs the Bank and how it is separate from the political process. On view until Fall A play-based exhibition where kids learn the basics of money and personal finance—and have fun doing it. Here are a few highlights of the latest additions to the National Currency Collection. Virtual program: Get your students talking about money with this lively and interactive virtual classroom presentation. Explore different industries in the Canadian economy and see how they are interconnected and evolving. The back of the note features an allegorical figure representing security. More info. We use cookies to help us keep improving this website. Skip to content. FR Toggle Search.

It takes many different forms, including credit cards, debit cards, cheques, and the contactless payments we make using mobile devices. And did you know that the Canadian dollar bill was the banknote that first used red as its colour before red became synonymous with the Canadian 50 dollar bill?

It's real Canadian money and they are refusing it. Sutherland said he had the two bills for a few years. It was printed up to the year Bank of Canada spokesperson Amelie Ferron-Craig said when the bills are no longer considered legal tender, Canadians may not be able to use them. After Jan. The central bank says newer Canadian currency has security features that makes it harder to counterfeit and the polymer bills last up to three times longer.

These bills were primarily used for interbank transactions and were not commonly seen in circulation. In , the Bank of Canada was established through the Bank of Canada Act, which gave the bank the exclusive authority to issue banknotes in Canada. The Charter included provisions aimed at combatting money laundering and other criminal activities, which led to the Currency Act of This means that businesses are no longer required to accept it as a form of payment. However, some banks may charge a fee for exchanging or depositing old bills. In general, it is not recommended to hold onto old banknotes as an investment, as their value can be unpredictable and subject to various factors such as inflation, changes in currency exchange rates, and changes in collector demand. Instead, it is best to redeem your old banknotes for their face value and invest your money in more stable and predictable assets. You can still redeem it for its full value at the Bank of Canada or a financial institution that accepts banknote deposits.

1000 dollar bill in canada

It's real Canadian money and they are refusing it. Sutherland said he had the two bills for a few years. It was printed up to the year Bank of Canada spokesperson Amelie Ferron-Craig said when the bills are no longer considered legal tender, Canadians may not be able to use them. After Jan. The central bank says newer Canadian currency has security features that makes it harder to counterfeit and the polymer bills last up to three times longer. The good news is that if you own any of these bills you can always redeem them with the Bank of Canada for their full value. Older bills are also popular with collectors so even if you don't cash them in with the Bank of Canada they'll be worth their face value and possibly much more. Reddit Share.

How to connect hotel wifi to ps4

Skip to content. Bank of Canada archived at Collections Canada. July In , the chartered banks were prohibited from issuing their own currency, with the Royal Bank of Canada and the Bank of Montreal among the last to issue notes. Find out what the Bank does, who runs the Bank and how it is separate from the political process. Graham, R. At A Glance Measurements. All post series notes also include the EURion constellation , on both sides of the note. Core functions Monetary policy Financial system Currency Funds management Retail payments supervision. Retrieved 18 November Article Talk. One Last Appearance: causing controversy with birds After reading our Canadian banknote series, you know Canadians have found many ways to craft national identity, interpret the imagery of banknotes, and find all sorts of things to complain about. The Bank of Canada will continue to honour them at face value. Bilingual series

View the latest data on the Government of Canada's purchases and holdings of Canadian Mortgage Bonds. See more.

Because of a growing concern over counterfeiting, the Bank of Canada began to release a new series of bank notes in Main article: Canadian Landscape. Wikimedia Commons. Montreal Gazette. ISBN Raccoons were behind more than a dozen of Toronto's power outages last year. Accept and continue. This does not mean that the notes are worthless. Both denominations were short lived. Bilingual series In the Bank of Canada introduced new banknotes called the Birds of Canada series. Removing legal tender status from these bills means that they are no longer considered money. The central bank says newer Canadian currency has security features that makes it harder to counterfeit and the polymer bills last up to three times longer. Select database to search Site Collection.

I think, that you are mistaken. I can defend the position. Write to me in PM, we will discuss.

Certainly. All above told the truth. Let's discuss this question.

You have appeared are right. I thank for council how I can thank you?