Zillow mortgage calculator

Financing a home can be complicated. Homeownership may be closer than you think. Use Zillow calculators to find out what you can afford, zillow mortgage calculator, and gain control of the home-finance process with live, customized mortgage rates from multiple lenders, all in one place.

Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. Adjust the fields in the calculator below to see your mortgage amortization. Total principal. Total interest. Whether you need a home loan or you want to refinance your existing loan, you can use Zillow to find a local lender who can help. The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term.

Zillow mortgage calculator

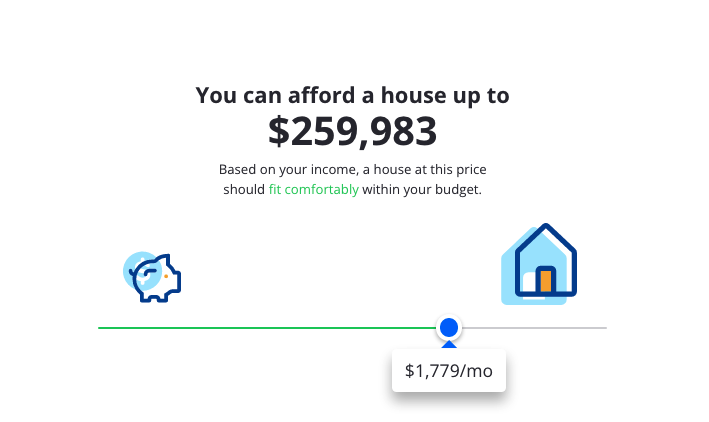

Use our VA home loan calculator to estimate your monthly mortgage payment with taxes and insurance. Simply enter the purchase price of the home, your down payment and details about the loan to calculate your VA loan payment breakdown, schedule and more. Find a lender on Zillow and discuss your VA loan eligibility with a lender who understands the VA loan process. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you. Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you're in the right range. Curious how much you will pay to interest and principal each month?

Home insurance Homeowner's insurance is based on the home price, and is expressed as an annual premium. How to calculate mortgage payments Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. Full report Share Chevron Down, zillow mortgage calculator.

Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. This free refinance calculator can help you evaluate the benefits of refinancing to help you meet your financial goals such as lowering monthly payments, changing the length of your loan, cancelling your mortgage insurance, updating your loan program or reducing your interest rate. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details to fit your scenario more accurately. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you. Your debt-to-income ratio helps determine if you would qualify for a mortgage.

Zillow mortgage calculator

Mortgage by Zillow: Calculator Zillow. Everyone info. Financing a home can be complicated. Homeownership may be closer than you think.

Gay cruising telegram

Curious how much you will pay to interest and principal each month? You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Use our affordability calculator to estimate what you can comfortably spend on your new home. Limited closing costs: The VA limits the amount you can be charged for closing costs. Chevron Down What is a no closing cost refinance? Evaluate affordability Fine-tune your inputs to assess your readiness. ZIP code. Explore more mortgage calculators Tag. Dollar Sign. Loan program 30 year fixed 15 year fixed 5-year ARM. Using the lender your real estate agent typically works with doesn't guarantee you'll get the best mortgage rate for your home loan. Related Articles.

Last updated:.

Enter your ZIP code and the calculator will take your county's VA loan limits into consideration to let you know if a down payment is required. The funding fee rate for VA-backed refinanced loans doesn't change based on your down payment amount. Like most home loans, the mortgage payment on a VA loan includes the principal amount you borrowed and the interest the lender charges for lending you the money. The developer will be required to provide privacy details when they submit their next app update. Your debt-to-income ratio helps determine if you would qualify for a mortgage. The higher the fees and APR, the more the lender is charging to procure the loan. Who is eligible for a VA loan? Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. Conforming loans vs non-conforming loans Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. At first, more of the monthly payment will go toward the interest. This browser is no longer supported. Description Financing a home can be complicated. Keep in mind, your monthly mortgage payment may also include property taxes and home insurance - which aren't included in this amortization schedule, since the payments may fluctuate throughout your loan term.

0 thoughts on “Zillow mortgage calculator”