Zable credit card

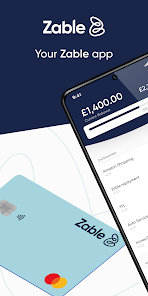

The Zable credit card is a simple, flexible and transparent credit card. Our app allows you to set your PIN, freeze your card, manage your transactions and repayments. Zable credit card you have not done so yet, you can apply for a Zable credit card on www. Release v4.

Zable Zable. Everyone info. The Zable app which allows you to manage repayments, transactions and account operations for your Zable credit card. Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. The developer provided this information and may update it over time. This app may share these data types with third parties Personal info, Financial info, and Device or other IDs.

Zable credit card

Formerly known as the Level card, this is the first credit card from personal loans giant Lendable. Lendable is known for providing credit to a broad range of credit profiles, and describes its Zable credit card as a tool to build your credit rating AKA a "credit-builder credit card". Technically, all credit cards do this, provided you use them correctly, but credit builders can be easier to get approved for and sometimes offer a few extra features to help you on your journey to a better credit score. If you've been turned down for other cards, the Zable card may still be a possibility. But the Zable card doesn't really come with any features to give extra help to build your credit, although it's at least accompanied by a decent app offering alerts, controls and real-time spending updates. If you're not sure what your credit record looks like, you can check yours for free with Finder. The main appeal of the Zable card is that it doesn't charge currency conversion fees if you use it abroad — instead converting currency at standard Mastercard rates. However, the stripped-back fees should come with a few notes of caution. Firstly, going over your credit limit is a terrible idea despite the absence of a penalty fee, because it'll get recorded in your credit file making it harder and more expensive for you to borrow money in the future. Secondly, cash withdrawals at home or abroad will incur a fee. Using a credit card to withdraw cash is always a bad idea — it's generally expensive and once again, it's a red flag on your credit file. If you do take this card with you on holiday, don't forget that if a merchant offers to bill you in either sterling or the local currency, choose the local currency.

Otherwise, zable credit card, it's the merchant's bank's currency conversion fees that will apply and not your preferential ones. Uninstall and install failed. Using a credit card to withdraw cash is always a bad idea — it's generally expensive and once again, it's a red flag on your credit file.

Our site uses cookies to function and provide a better experience. To learn more, please refer to our Cookies policy. Complete our short form to check if you are eligible. Checking your eligibility won't affect your credit rating. Spend abroad with zero transaction fees. We also don't charge any monthly or over-limit fees.

Formerly known as the Level card, this is the first credit card from personal loans giant Lendable. Lendable is known for providing credit to a broad range of credit profiles, and describes its Zable credit card as a tool to build your credit rating AKA a "credit-builder credit card". Technically, all credit cards do this, provided you use them correctly, but credit builders can be easier to get approved for and sometimes offer a few extra features to help you on your journey to a better credit score. If you've been turned down for other cards, the Zable card may still be a possibility. But the Zable card doesn't really come with any features to give extra help to build your credit, although it's at least accompanied by a decent app offering alerts, controls and real-time spending updates. If you're not sure what your credit record looks like, you can check yours for free with Finder. The main appeal of the Zable card is that it doesn't charge currency conversion fees if you use it abroad — instead converting currency at standard Mastercard rates. However, the stripped-back fees should come with a few notes of caution. Firstly, going over your credit limit is a terrible idea despite the absence of a penalty fee, because it'll get recorded in your credit file making it harder and more expensive for you to borrow money in the future. Secondly, cash withdrawals at home or abroad will incur a fee.

Zable credit card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. When you need time to pay off a sparkly gift for yourself or a special someone, the Zales credit card — also known as the Diamond Credit Card, issued by Comenity Bank — can take the pressure off your budget with several financing options and perks. Depending on your goals, though, it may not be as valuable as other credit cards that offer rewards or a sign-up offer. Some store-branded credit cards offer different versions: one you can use basically anywhere, and one you can use only within that brand.

L&e global

Build your credit rating Stay within your limit, make your payments on time and your score may improve. Data privacy and security practices may vary based on your use, region, and age. Before you apply, check that you meet the eligibility requirements and have the information and documents you'll need to make the process as straightforward as possible. Representative Example: More about Debt Camel. Zopa Bank. Very easy to use. Comments on this article are now closed as Zable has brought the card into line with other cards. Out of curiosity, why do you prefer level to Capital One? Otherwise, it's the merchant's bank's currency conversion fees that will apply and not your preferential ones.

The Zable credit card is a simple, flexible and transparent credit card. Our app allows you to set your PIN, freeze your card, manage your transactions and repayments.

Help with your debts Recommended places for debt advice. If you do not pay your Minimum Payment Amount in full by the payment due date each month we will charge interest on the unpaid part of your interest. But the Zable card doesn't really come with any features to give extra help to build your credit, although it's at least accompanied by a decent app offering alerts, controls and real-time spending updates. Matter of fact, I prefer it to Cap1 for many reasons. While we are independent, the offers that appear on this site are from companies from which finder. Reported to action fraud. If they then do pay the statement in full by the due date, they will be charged interest on these purchases. Seems like this lesson is even more beneficial considering current economic… Another reason I prefer level is because they increased my credit limit rather swiftly yet in small steps. We look at a number of important factors, like interest rates, credit limits, features to help you track your credit, plus the potential costs involved with running the card both in the short and longer term. Tesco Bank. Some people have been told that Zable is increasing their interest rate from Never again. I have now updated the article above and am closing comments on it.

What magnificent words

I join told all above. Let's discuss this question.

Good question