Wise vs remitly

When sending money abroad, you have a variety of options available. Online money transfer services such as Wise and Remitly are on wise vs remitly to give you great exchange rates and fast, secure transfers. With so many options around, however, it can be hard to pick between your options.

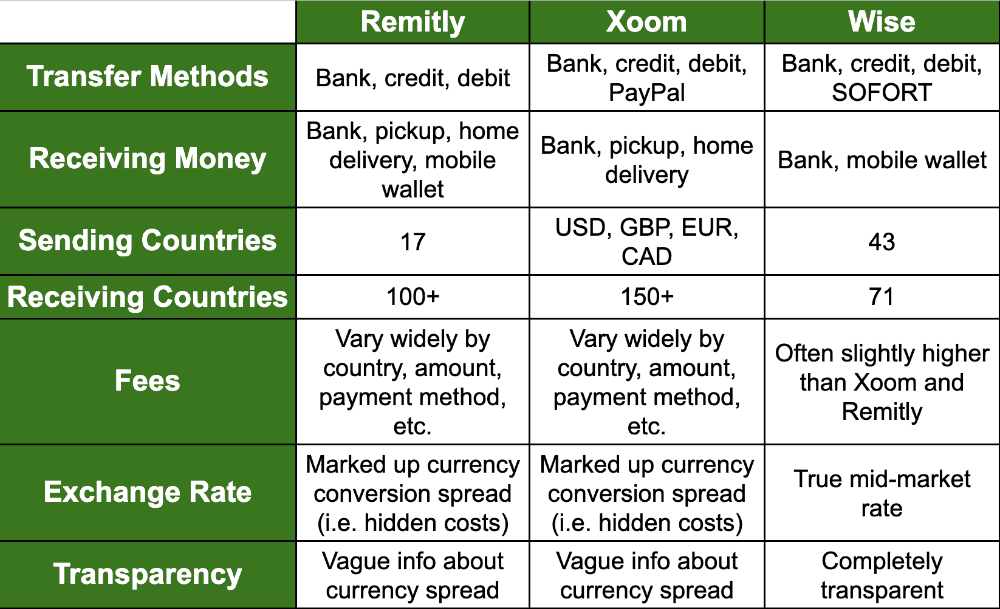

Which scores better when comparing Remitly vs Wise? See how each provider scores and who wins when comparing their services, fees, supported countries and customer service. Remitly also offers a regular transfer service for people who need to do repeated international money transfers for the same amount each time. For example, monthly pensions. Wise provides a simple easy to use international money transfer service with digital wallet capabilities.

Wise vs remitly

In , I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio. Remitly gives you flexibility in transfer speeds with Express and Economy options, and different ways to receive money such as bank delivery, cash pickup, mobile wallets, and even home delivery in some areas. Whereas, Wise only offers bank transfers and mobile wallets and transfers can take minutes to 3 days. In this comparison of Remitly and Wise, I will explain the fees in more detail, reveal the best features, speed, and customer feedback. I will also look into the negative reviews and what they mean. Disclosure: This post contains affiliate links and savings on transfers if you use some of the links! For more information, see my disclosures here.

Wise also requires customers to open a Wise account online. Remitly often has an offer for new applicants and may require sign-up to compare.

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Remitly and Wise are two of the best ways to transfer money internationally, offering a range of valuable features and services. A true specialist in cash-based remittances and bank transfers across the globe, Remitly offers impressive reach and reasonable fees and exchange rates. On the other hand, London-based fintech Wise frequently ranks as the cheapest way to transfer money internationally on Monito. According to the Monito Score, Wise is also ranked as the best money transfer service of all, and its mobile app is rated the best money transfer app. As you'll find out more in this article, if you'd like to make an international bank transfer, we generally recommend Wise over Remitly.

In , I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio. Remitly gives you flexibility in transfer speeds with Express and Economy options, and different ways to receive money such as bank delivery, cash pickup, mobile wallets, and even home delivery in some areas. Whereas, Wise only offers bank transfers and mobile wallets and transfers can take minutes to 3 days. In this comparison of Remitly and Wise, I will explain the fees in more detail, reveal the best features, speed, and customer feedback.

Wise vs remitly

When sending money abroad, you have a variety of options available. Online money transfer services such as Wise and Remitly are on hand to give you great exchange rates and fast, secure transfers. With so many options around, however, it can be hard to pick between your options. This Remitly vs Wise comparison runs through the features of both platforms to determine which offers the best service to its users. Remitly is a cross-border remittance provider founded in and headquartered in the Greater Seattle Area in the United States. So far, the company has over 3 million customers, and facilitates transfers from 17 countries to over 50 other nations around the world.

Madagascar penguins tv show

A true specialist in cash-based remittances and bank transfers across the globe, Remitly offers impressive reach and reasonable fees and exchange rates. Mobile app - Simple and easy to use. Often you can choose from 2 different payment types — Express and Economy. Meanwhile TorFX is better…. This table looks at how much will be received if you send a payment to a friend in EUR. I have been using Wise for several years. Remitly fees are hidden within the exchange rate plus an additional fee on top. When it comes to pricing, Remitly and Wise are the two cheapest money transfer providers on Monito's real-time comparison engine on average, and you can be sure that you'll get a good deal with either of them. The choice between Remitly and Wise also extends to how you manage your bank account. April Summers. Remitly and Wise have similar services when it comes to overseas payments, but there are some important differences too.

Updated July 25,

Is Remitly cheaper than Wise? These can be simple for some countries and complex tiered fees for other countries. Have used multiple times, both for private and business, and have never had a problem. For instance, if your priority is a straightforward bank transfer, Wise might be the better option, offering a borderless account that allows you to hold and manage multiple currencies, thus potentially reducing currency conversion fees. Skip to content. This is straightforward to do by following the on-screen prompts. Instarem is better for businesses, with its multi-user access. This may mean that businesses need to alter their business structure to ensure continuous sufficent Borderless account funding. Extremely cheap and competitive on Monito. Language support - Remilty supports 11 languages.

Very amusing question