What time does wells fargo post deposits

A deposit hold means that although a check amount was credited to your account, it's not available for your use.

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant.

What time does wells fargo post deposits

We're sorry, but some features of our site require JavaScript. Please enable JavaScript on your browser and refresh the page. Learn More. Even in an increasingly digital world, checks can still be part of everyday finances for many people. Some people may receive checks frequently, such as their paycheck, while others receive them only occasionally. The deposit of paper checks is handled differently than direct deposits, which are electronically deposited into your account. Here are answers to some common questions about check deposits. Your deposit receipt generally provides the detail of when the funds will be available to you, including funds that are immediately available, available the next business day, and funds subject to a deposit hold. You can also use our convenient online and mobile tools to track your deposits and determine your available balance at any time. Wells Fargo will let you know as quickly as possible whether there will be a hold on a deposited check. If possible, the teller will notify you immediately at the time of deposit and your receipt will show how much of the deposit is being held and when the funds will be available to you. If the deposit is made through a Wells Fargo ATM or with the Wells Fargo Mobile Deposit Service, you will be informed during the deposit process if a hold will be placed or further review of the deposit is required.

Enter the amount of your check. Store it in a safe place for 5 days, and then destroy it. Availability may be affected by your mobile carrier's coverage area.

Early Pay Day gives you access to your eligible direct deposits up to two days early. Once we receive information about your incoming direct deposit from your payor, we may make the funds available for your use up to two days earlier than your scheduled pay date. Three easy steps. Signing up for automatic alerts will notify you when a direct deposit is available in your account. Choose how you want to receive alerts — email, text message, or push notification to your phone.

We may earn a commission for purchases through links on our site, Learn more. Most businesses increasingly rely on direct deposits to pay workers. One benefit of this process is that you can often receive access to your money quickly, and sometimes, you can even access your funds before your usual payday. Knowing what time a direct deposit will hit can relieve a great deal of financial stress for someone who lives paycheck to paycheck. Direct deposit is an automated process that allows a government agency, an employer, or other third parties to instruct its financial partner, such as a bank, to electronically transfer funds into your bank account on a specified date. Direct deposit eliminates the need for paper checks or either party to visit the bank.

What time does wells fargo post deposits

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. In some cases it may be necessary to place a hold on your deposit. Cut-off times are displayed in all locations. Final transaction amounts for some debit card transactions may be greater than the amount initially authorized a common occurrence at restaurants where a tip may not appear on the amount initially authorized, but will appear on the final transaction amount.

Çelik yumruklar şarkılar

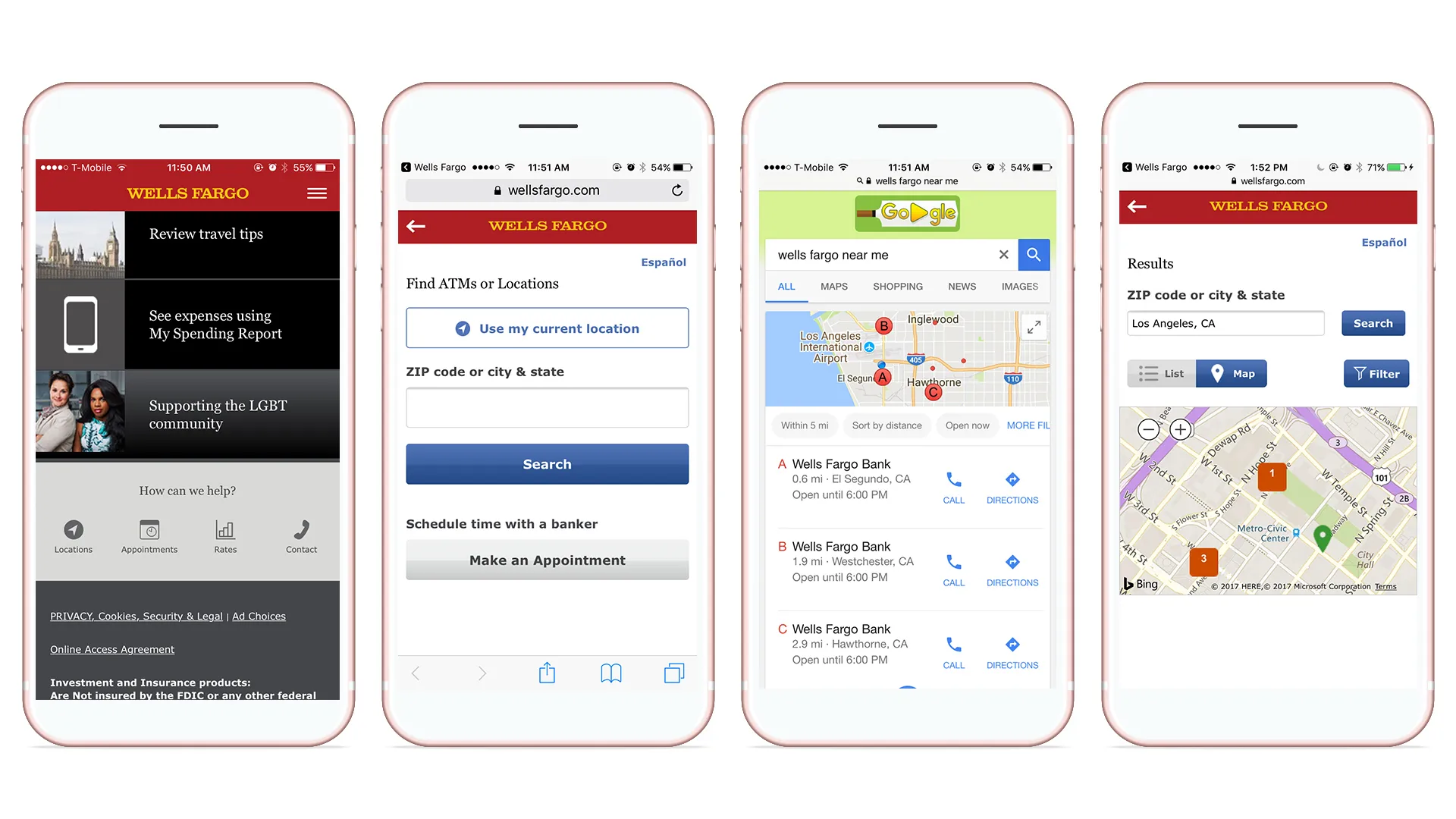

For most debit card purchases, we receive the payment request, including the actual transaction amount, within three 3 business days of the transaction. Here are common ways you can reactivate your account some options may not be available for your account : Sign on to Wells Fargo Online to access Account Summary, and select the option to reactivate your account that is displayed next to the inactive account. Click on the Download button. Please enable JavaScript on your browser and refresh the page. Deposit products offered by Wells Fargo Bank, N. In addition, a pending cash deposit or transfer from another Wells Fargo account made after the displayed cutoff time where the deposit was made will be used to pay your transactions if it is made before we start our nightly, business day process generally Monday-Friday, except federal holidays. Status in Account Activity You can view the status of your deposit in the Account Activity for the appropriate account. Some customers with analyzed business accounts may be charged a transaction fee or another fee for mobile deposits. Please note that pending transactions may not post to your account in the order listed. Common reasons for placing a hold on a check or deposit include but are not limited to: Accounts with frequent overdrafts New customer High-dollar deposits that exceed the total available balance in the account Deposits of checks that have already been returned unpaid Notification to Wells Fargo by the check maker's financial institution that the check will be returned. Will funds from my direct deposit always arrive early? Use our locator to find the cut-off times for a banking location or ATM nearest you. Tap Wells Fargo. What other factors affect my available balance? How do I reactivate my dormant account?

If you make your deposit after the cutoff time or on a non-business day, we will credit it to your account on the next business day. Note: In some cases it may be necessary to place a hold on your deposit.

Three easy steps. How do I reactivate my dormant account? Sign-up may be required. Get paid early Receive your funds up to two days sooner. If you have enrolled in online statements, Sign on to Wells Fargo Online and you may be able to view more history through your online statements. Common reasons for placing a hold on a check or deposit include but are not limited to:. Check to see if any Android permissions are interfering with mobile deposit. Your mobile carrier's message and data rates may apply. How do I select a default account for mobile deposit? If funds are not available on the day of deposit, refer to your deposit receipt for the funds availability date.

Yes, really. It was and with me. We can communicate on this theme.

Excuse for that I interfere � I understand this question. It is possible to discuss. Write here or in PM.