What tax topic 152 mean

Did you know you can track the status of your tax refund after you submit your tax return to the IRS? We'll tell you how. Don't forget that receiving your tax refund by paper check will take quite a bit longer than direct deposit. If you've submitted your tax return to the IRS, what tax topic 152 mean, you're likely checking your bank account daily to see if your refund has arrived.

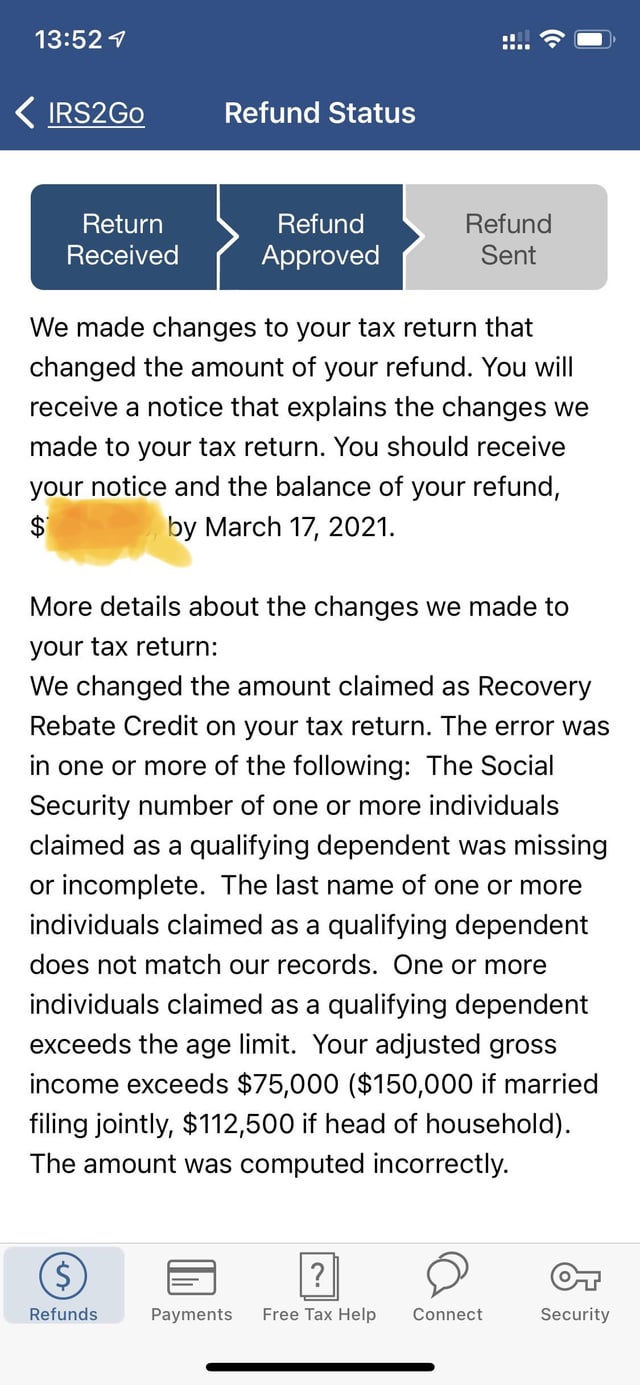

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return.

What tax topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process. People who file their tax returns early may have to wait until the first week of March to receive their refunds if they include an Earned Income Tax Credit or an Additional Child Tax Credit.

Beyond the basics, this list also includes information on non-work-related income, such as dividends, and information for reporting credits and deductions, such as childcare costs or the charitable contributions you made during that tax year. This option also eliminates the chance of any sort of postal error that could cause further delays in getting your funds back from Uncle Sam. Expertise Personal finance, government and policy, consumer affairs, what tax topic 152 mean.

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Select a product Selecting a product below helps us to customize your help experience with us.

You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible. My return is about as simple as one can get and I got the same message you guys did. Topic No. Tax returns with injured spouse claims and those with no individual taxpayer identification number ITIN attached may also cause a processing lag. If you get a reference code about Tax Topic , there may be errors on your return, according to TurboTax.

What tax topic 152 mean

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return. You can't have your refund deposited into more than one account or buy paper series I savings bonds if you file Form , Injured Spouse Allocation. As a reminder, your refund should only be directly deposited into accounts that are in your own name, your spouse's name, or both if it's a joint account.

World clock

All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. File with expert help. Once your tax return has been processed, you will observe one of two outcomes. Limitations apply See Terms of Service for details. Tax brackets correspond to the tax rates you will pay for each portion of your income. If you receive an audit letter from the IRS or State Department of Revenue on your TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current tax year. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. More results What is Form NEC? With TurboTax Live Full Service , a local expert matched to your unique situation will do your taxes for you start to finish. You must return this product using your license code or order number and dated receipt. Filing a tax return on paper instead of using the online form. Your refund will likely continue to process, but it may take a little longer than expected. TurboTax security and fraud protection.

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed.

Learn about the latest tax news and year-round tips to maximize your refund. Want to see articles customized to your product? Peter Butler. You can choose to have your refund split and deposited in up to three different bank accounts, or if you opt to buy a savings bond with your refund, you can direct the remaining amount to a bank or a TreasuryDirect account. To check the status of an amended return, use Where's my amended return? Credits and deductions. On a similar note…. You can even use your refund to buy a U. If you submit an electronic tax return, you can usually expect to receive a refund within 21 days. Price estimates are provided prior to a tax expert starting work on your taxes. Add a header to begin generating the table of contents. Quicken import not available for TurboTax Desktop Business.

You commit an error. Write to me in PM, we will talk.

I better, perhaps, shall keep silent