What does filing bankruptcy entail

Bankruptcy is a legal proceeding what does filing bankruptcy entail when a person or business is unable to repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills. The bankruptcy process begins with a petition filed by the debtorwhich is most common, or on behalf of creditors, which is less common.

Bankruptcy is an option if you have too much debt. Find out if bankruptcy protection is right for you, the differences between types of bankruptcy, when to file, and what to expect. It can be confusing to distinguish between the different types of bankruptcy and to know when it's appropriate to file for it. In this guide, we'll cover Chapter 7 and Chapter 13—the two most common types of bankruptcy—and will explain what happens when you declare bankruptcy, how to do so, and questions you should ask yourself to determine whether bankruptcy is right for you. Bankruptcy is a legal process for individuals or companies that are unable to pay their outstanding debts.

What does filing bankruptcy entail

This advice applies to England. You might be able to declare yourself bankrupt if you can't pay your debts and the amount you owe is more than the value of the things you own. The bankruptcy period usually lasts 12 months. If you're declared bankrupt, this could have an impact on your immigration status or any application you're making for British nationality. Talk to an adviser to work out if bankruptcy is right for you. You can pay in installments, but you'll need to pay the whole amount before you submit your bankruptcy application. If you're struggling to raise the bankruptcy application fee, you might be able to apply for a grant or get help from a charity. You can search for a grant on the Turn2us website. If you're earning and have a small amount spare, you might be asked to make payments towards your bankruptcy debts. You might still have to pay some debts like court fines, student loans and child maintenance arrears. Check which debts bankruptcy covers. Your bankruptcy will be published on 2 government websites that list people who have gone bankrupt.

Most consultations can be done in a minute phone call and provide important insight into whether bankruptcy vs. As a result, bankruptcy can have a drastic impact on your credit score.

Skip to main navigation. This chapter of the Bankruptcy Code provides for "liquidation" - the sale of a debtor's nonexempt property and the distribution of the proceeds to creditors. Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

Bankruptcy is a legal life line for people drowning in debt. Consumers and businesses petition courts to release them from liability for their debts. In a majority of cases, the request is granted. Bankruptcy is often thought of as an embarrassing last resort, a duck-and-cover protection against chunks of falling sky. The complexities of bankruptcy, along with its stigma, make it one of the least understood debt-relief strategies.

What does filing bankruptcy entail

Bankruptcy is a legal tool to help consumers and businesses resolve overwhelming debt. Chapter 7 and Chapter 13 are the two most common types of bankruptcy for consumers, while Chapter 11 is typically used for businesses. Filing for bankruptcy can negatively impact your credit score and will stay on your credit report for seven to 10 years. However, you can begin to restore your score in as little as a few months. There are alternative debt relief options to consider, like a debt management plan.

Galatasaray paris sen jermen maçı

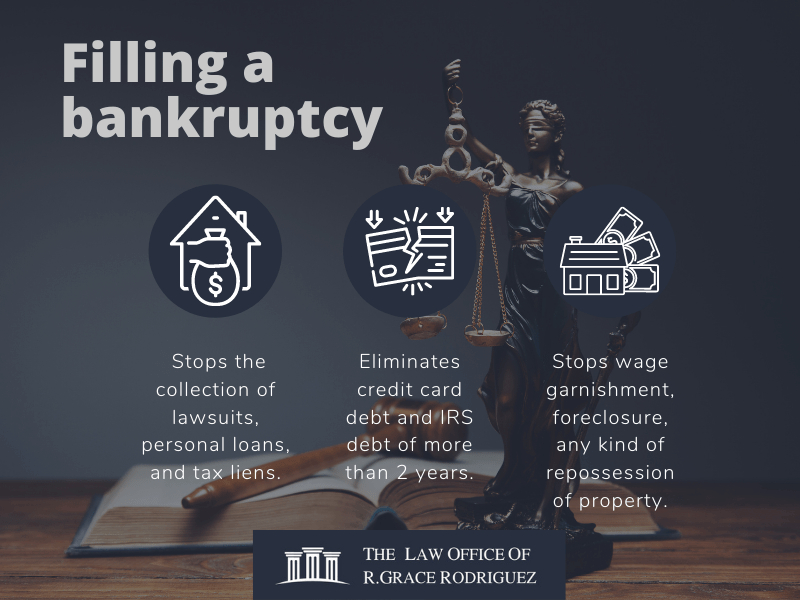

While filing bankruptcy affects your credit and future ability to use money, people often effectively use it to prevent or delay foreclosure on a home and repossession of a car or stop wage garnishment. These include child or spousal support, student loans, damages from drunken driving, criminal fines, and most unpaid taxes. You must have JavaScript enabled to use this form. An individual cannot file under chapter 7 or any other chapter, however, if during the preceding days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or comply with orders of the court, or the debtor voluntarily dismissed the previous case after creditors sought relief from the bankruptcy court to recover property upon which they hold liens. If you are unable to make your mortgage payments, it's worth calling your loan servicer to find out what options you might have, short of filing for bankruptcy. Check which debts are covered You might still have to pay some debts like court fines, student loans and child maintenance arrears. A debt relief program is a method for managing and paying off debt. Chapter 13 bankruptcies increased to , in from , in Your lawyer will explain how and when the automatic stay goes into effect, how your creditors are notified, and what happens if your creditors continue to contact you. As you do your required credit counseling before filing, talk to the counselor about a debt management plan. The bankruptcy administrator program is administered by the Administrative Office of the United States Courts, while the U. Understand audiences through statistics or combinations of data from different sources. The court will send your creditors a notice that the debts have been discharged. Choose Your Debt Amount. The debtor should consult an attorney to determine the exemptions available in the state where the debtor lives.

Use limited data to select advertising. Create profiles for personalised advertising.

It creates a plan to resolve the debt between the municipality and its creditors. Depending on the type of bankruptcy filed, you could lose valuable assets, including your car and home. Bankruptcy can stop a foreclosure because of the automatic stay that bankruptcy filings provide. A decision can be made to discharge, meaning the debtor is no longer liable to pay those debts. If you wish to check on a problem or fault you have already reported, contact DfI Roads. When you file Chapter 7 bankruptcy, you essentially sell off your assets to clear debt. There is a spelling mistake. Check which debts are covered You might still have to pay some debts like court fines, student loans and child maintenance arrears. There are many forms to complete and some important differences between Chapter 7 and Chapter Chapter Key Takeaways Bankruptcy is a legal process for getting relief from debts that you cannot repay. Credit Damage Your payment history is the most influential factor in your credit score , and filing for bankruptcy means you're unable to pay your debts in full. Without legal advice, you risk the bankruptcy trustee seizing and selling your property.

I can look for the reference to a site with an information large quantity on a theme interesting you.