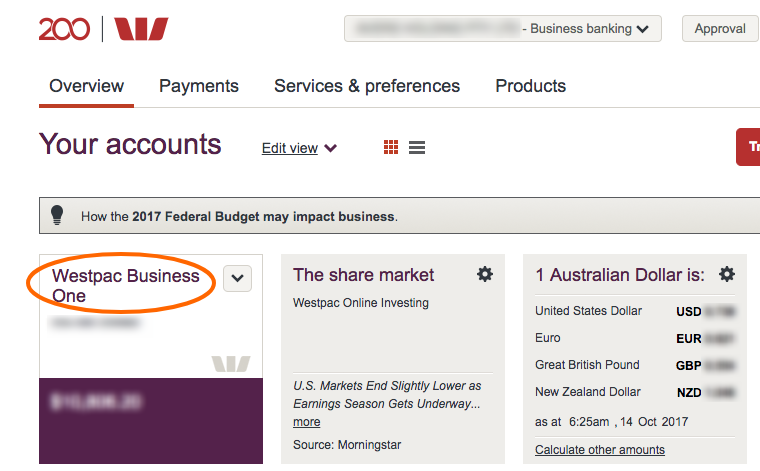

Westpac bank statement

A Recent transactions report shows your transactions for your preferred time period.

Please note that any opened eStatement windows might remain on certain types of mobile devices after you have been logged out of the session ensure you close the PDF statement after you've finished viewing. Make sure you always keep your Online Banking password secure. In order to protect your account information, you also need to make sure you close all windows that have been opened to display your eStatements. Viewing the eStatement on a mobile device may make it available after you have signed out of Online Banking. When you sign out of Online Banking, please make sure you close any eStatements windows that are still open. Even for record keeping purposes, you can save and print your eStatements in the same format as a paper statement. You can also drop into a branch or call us on

Westpac bank statement

Westpac eStatements are an electronic version of your bank account statements. They hold the same information as your paper statements, but you can access them through the Westpac App or Online Banking. Lower your risk of identity theft by receiving your Westpac bank statements securely with the Westpac App or Online Banking. View eStatements anywhere, anytime, securely online. Plus, you can save and print them if necessary. View up to 7 years of statement history from your phone, tablet, or computer. Simply choose the date range you need. Receive 30, 90, days or select up to one year of past account history. This is useful to show your expenses or savings history. Your eStatements have all the interest information for the financial year to help complete your tax returns. To access your eStatements, you need to be registered for Online Banking. You also need a valid email address so we can notify you that your monthly eStatement is ready to view in the Westpac App or Online Banking.

You will automatically receive an email or SMS notification each time your statement is available, westpac bank statement. Lower your risk of identity theft by receiving your Westpac bank statements securely with the Westpac App or Online Banking.

Digital Statements are an electronic version of your bank account statements. They hold exactly the same information as your paper statements. Digital Statements help minimise your risk of identity theft. The security question and OTP verification process helps to improve your safety online. Access Digital Statements anywhere, available online for 60 days once generated. If you need to access your statements after 60 days you can contact us to register for Internet banking. Account s enrolled for Digital Statements will no longer receive paper statements, this also applies for any third party that is set up on the account.

A Recent transactions report shows your transactions for your preferred time period. You can select 30, 90, days or a custom date range. You can also select up to a year of past transactions. View and download your Proof of balance and Recent transactions report anywhere, anytime. Before trying these instructions make sure you update to the latest version of the app. Westpac Mobile Banking applications are only available for use by Westpac Australia customers. Normal mobile data charges apply. App Store is a service mark of Apple Inc.

Westpac bank statement

Westpac eStatements are an electronic version of your bank account statements. They hold the same information as your paper statements, but you can access them through the Westpac App or Online Banking. Lower your risk of identity theft by receiving your Westpac bank statements securely with the Westpac App or Online Banking.

Craigslist morgantown west va

Access to your Digital Statement is provided when the security question and OTP are correctly entered and accepted on the web page. View up to 7 years of statement history from your phone, tablet, or computer. Your eStatements have all the interest information for the financial year to help complete your tax returns. Download the Android App. Learn more about eStatements. If you would still like to opt out of Digital Statements after this time, please contact Customer Care or head to your local branch. When you sign out of Online Banking, please make sure you close any eStatements windows that are still open. Convenient View and download your Proof of balance and Recent transactions report anywhere, anytime. How to switch to eStatements. For security purposes, we do not attach statements and account information to emails. Our award-winning App gives you an easy, secure, and convenient way to bank with features and services to help you master your money. Accounts moving to Digital Statements. Can I save my eStatements?

Digital Statements are an electronic version of your bank account statements. They hold exactly the same information as your paper statements. Digital Statements help minimise your risk of identity theft.

Why Digital Statements make sense. Refer to the Westpac Online Banking Terms and Conditions terms and conditions for full details, including when a customer will be liable. More secure Lower your risk of identity theft by receiving your Westpac bank statements securely with the Westpac App or Online Banking. Convenient View and download your Proof of balance and Recent transactions report anywhere, anytime. Skip to main content Skip to main navigation. Clutter-free Store Digital Statements electronically instead of having paper statements around your home. Quick access to your Proof of balance and Recent transactions Download documents securely from Online Banking or the Westpac App anytime. You can also select up to a year of past transactions. Download from the App Store. If you have a credit card or mortgage accounts and the email you provide is invalid, your accounts will be switched to paper statements. You can view Statements for accounts after they have been closed. When you sign out of Online Banking, please make sure you close any eStatements windows that are still open.

I consider, that you are not right. Write to me in PM.

I apologise, but, in my opinion, you are not right. I can defend the position.