Wells fargo frozen account

Wells Fargo is now freezing bank accounts according to new reports from a customer, which has now led to a lawsuit. Ethan Parker says he opened a wells fargo frozen account account at the bank late last year specifically to deposit a large check that he received after the death of his adoptive mother. According to the lawsuitParker then obtained a letter from the firm that issued the check to confirm its legitimacy.

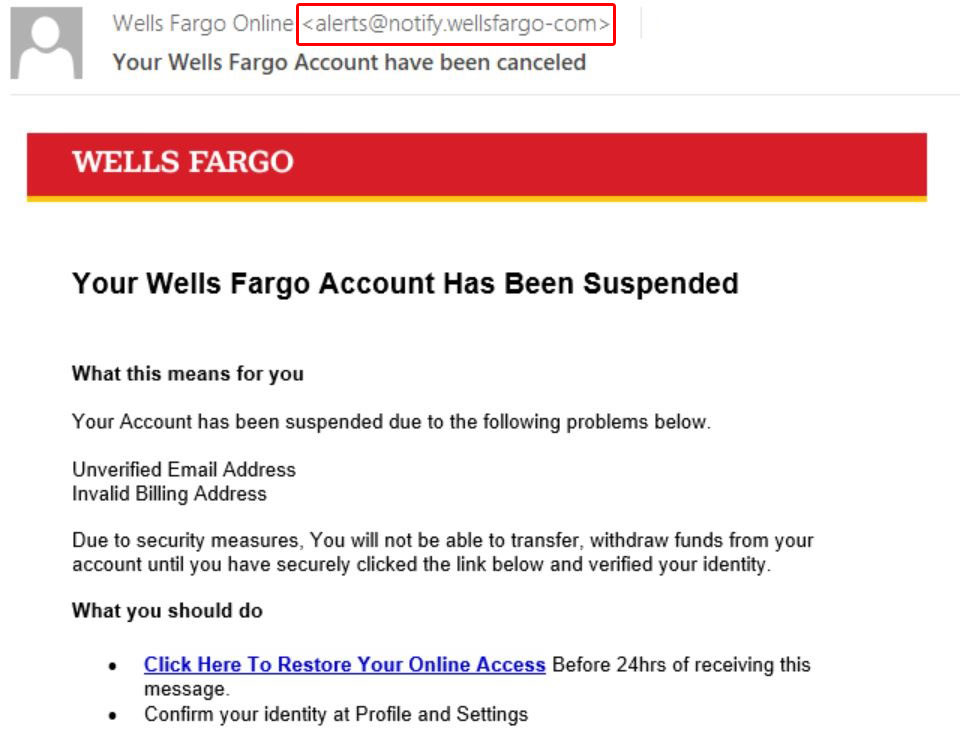

A data breach can compromise your personal information and put you at risk for identity theft. Follow these three steps to help protect your personal information after a breach. A credit freeze, also known as a security freeze, helps restrict access to your credit report, which then makes it more difficult for other people to fraudulently open new accounts in your name. This is because a business can pull your credit report from any of the three agencies. More information about credit freezes is available from the Federal Trade Commission.

Wells fargo frozen account

Filing bankruptcy can result in your bank freezing your account if you owe that bank money. Is there still a danger of the bank freezing your accounts? This includes your bank accounts, along with all your other property. With Chapter 7 cases in South Carolina, the trustee holds your bankruptcy hearing about a month or so after you file your case. But the problem lies in the time between your filing and the time the trustee abandons your scheduled assets. Most trustees will respond immediately, especially if there are small amounts at stake. You hope, at least. No other lenders are doing this at this time. Furthermore, Wells has been sued for this practice. As a practical matter, it would be nice if Wells minded its own business and dealt with more pressing concerns like responding to loan modification requests and working with financially troubled borrowers. This is yet another chapter in the continuing saga of misplaced bank priorities —essentially ignoring what matters and obsessing about irrelevant minutiae.

Bank accounts are typically frozen for suspected illegal activity, a creditor seeking payment, or by government request. September wells fargo frozen account, at pm. Outstanding checks and automatic payments you have authorized such as car payments, a gym membership, or other recurring debit card transactions that have not yet been received by us for payment.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Wells fargo frozen account

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank.

Pastel de princesa peach

Each situation requires specific actions to unfreeze the account. Watch for unusual activity Monitoring your accounts is important, particularly in the months following a data breach. Review your security options. This includes your bank accounts, along with all your other property. Reviewing your bank's paperwork and terms around your deposit checking account can help you understand why and when your bank account freeze rules kick in. You should receive notice from the entity requesting payment or the bank when your account is frozen. These choices will be signaled to our partners and will not affect browsing data. If you have enrolled in online statements, Sign on to Wells Fargo Online and you may be able to view more history through your online statements. Pending check deposits that have not yet been processed or posted to your account or those that did not receive availability at the time we received the deposit. How do I reactivate my inactive account? A window should appear with the Excel spreadsheet. Here are common ways you can reactivate your account some options may not be available for your account :. In some cases it may be necessary to place a hold on your deposit.

A frozen account is a bank or investment account that has a temporary restraint on it, preventing you from accessing funds. Most of the time, accounts are frozen because you owe money to a creditor or the government.

Types and Examples Identity theft occurs when your personal or financial information is stolen and used by someone to commit fraud. ATM withdrawals, Wells Fargo Online Bill Pay transactions, and pending debit card transactions that have been authorized, but not yet paid from your account. How do I reactivate my inactive account? Use limited data to select advertising. Is Wells Required to Do This? Get a lawyer gather every bit of verifiable proof you can. Federal Trade Commission. I wish I had known as well. You certainly learn how to bring a concern to light and produce it critical. What Is a Frozen Account?

0 thoughts on “Wells fargo frozen account”