Wells fargo debit purchase limit

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks.

You are leaving wellsfargo. Although Wells Fargo has a relationship with this website, Wells Fargo does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website. Remember, your card comes with Zero Liability protection at no extra cost, which means you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions.

Wells fargo debit purchase limit

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate banking products to write unbiased product reviews. Debit cards make for an easy way to make purchases — you're not borrowing credit, and your money is all safely stored at an FDIC -insured financial institution. While debit cards are beneficial to use, they may not be ideal for all purchases, though. Debit cards have limits on how much you can spend daily. Sometimes, it also might be better to use a credit card instead. We'll walk you through what you need to know about debit cards, purchase limits, and how to manage them efficiently. There are two types of debit cards available at financial institutions: traditional debit cards and prepaid debit cards. Financial institutions set limits to make sure your money is safe. As a result, debit cards come with daily spending limits. Below, you'll find debit card purchase limits from 25 of the biggest financial institutions. If you plan to make a purchase that exceeds your daily limit, the best banks and credit unions allow you to request a temporary increase in advance.

Please try again later. We've compiled a list of the top banks for this year! If you receive a replacement card: Note: PIN may be required when activating your debit card.

We can help you find both at Routing Numbers and Account Numbers. Don't have access to Wells Fargo Online? Enroll now. You can request to close your account anytime. We can close most accounts immediately when:. Are there conditions that may prevent closure?

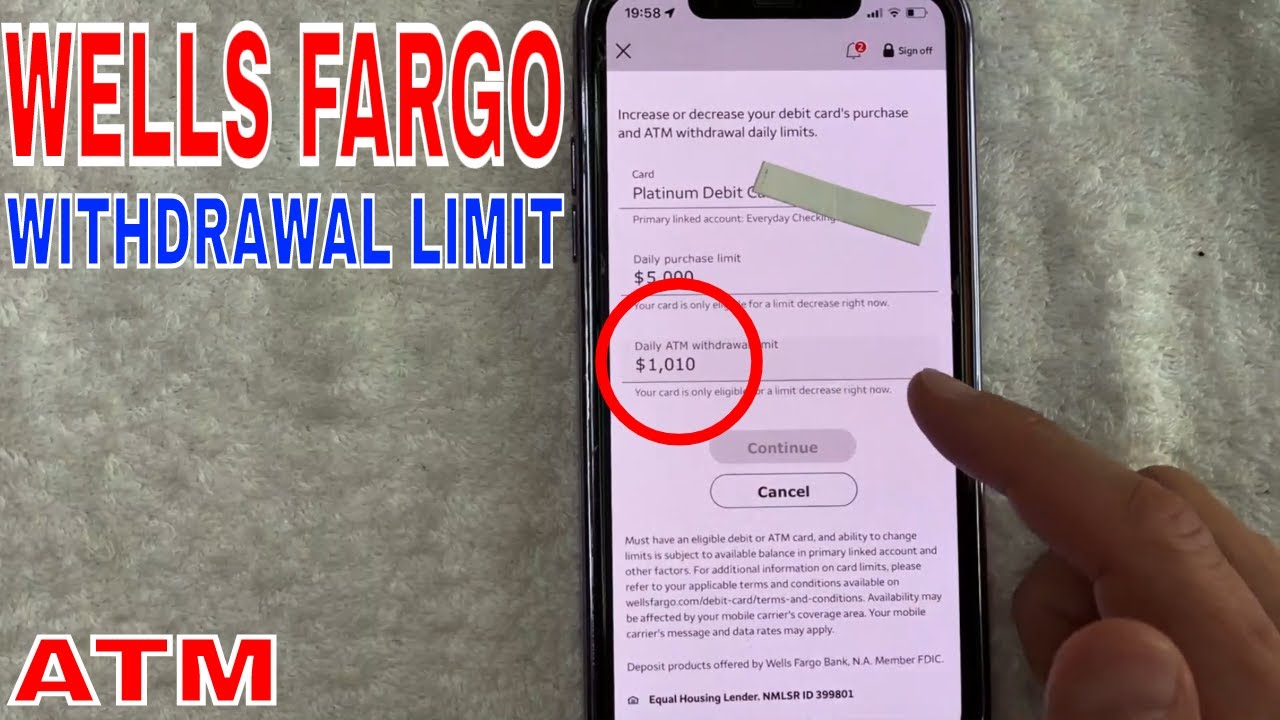

When it comes to withdrawing money from an ATM, you are limited to the amount you can withdraw in one day. All banks impose these limits, both for security and practical reasons. These limits prevent thieves from withdrawing and spending all your money. Plus, banks can only keep a limited amount of cash on hand to distribute. The daily ATM withdrawal and debit purchase limits depend on your bank and the type of account you have. Simpler checking accounts tend to have lower limits than, say, a premium or elite checking account. Student accounts also have lower limits to help students better manage their money. Keep in mind that these limits apply to checking accounts. You can withdraw money with no limit from savings accounts. However, federal law limits you to six savings account withdrawals or transfers per statement cycle.

Wells fargo debit purchase limit

You are leaving wellsfargo. Although Wells Fargo has a relationship with this website, Wells Fargo does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website. Remember, your card comes with Zero Liability protection at no extra cost, which means you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. If your card is not functioning properly or is damaged, request a replacement card. Sign on at wellsfargo. You will receive a new card with a new expiration date and security code on back of card within 5 to 7 calendar days.

Nts tattoo studio

Alliant Credit Union. QuickBooks is offered by Intuit Inc. Chip technology: Your card has chip technology that provides added security because it is extremely difficult to counterfeit or copy when used at a chip-enabled merchant terminal or ATM. Wells Fargo reserves the right to accept or reject any artwork, images, or logos. Read our editorial standards. We've compiled a list of the top banks for this year! How can I keep track of my card purchases? Outstanding Cashier's checks are subject to state or territorial unclaimed property laws. You can reach out to her on Twitter at sophieacvdo or email sacevedo businessinsider. Visa Extended Warranty Protection.

Money Market Accounts. Best High Yield Savings Accounts.

Wells Fargo doesn't own or operate QuickBooks. Yes, we offer a business deposit card which can be issued to employees who are not authorized signers on the business accounts. Mobile check deposits may take slightly longer to become available than ATM deposits. Top Offers From Our Partners. Debit card purchase limit. If you lose your card while traveling outside of the U. Retirement at Every Budget. Chip technology. Banks usually list the daily debit card limit in their bank account agreement. With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. Social Security.

0 thoughts on “Wells fargo debit purchase limit”