Voorhees township nj tax collector

Being legally bound to financial jargons all my life, I faced some tax evasion issues last year where I was going to be rendered superfluous by the court if they had acquitted…. We are knowledgeable in resolving tax problems, but more importantly we help our clients….

King of Pizza never fails to impress! The slices are "King Sized" and the pizzas have lots of meat, veggies, and cheese! They only make one size - any larger and they would have to use much Reconsider working with this agency unless you like being hung up on by them. Was speaking with Maisa then she hangs up on me.

Voorhees township nj tax collector

The State will begin mailing Senior Freeze blue booklets in mid-February, continuing throughout the month. Please allow until mid-March for delivery before contacting the State. The State mails PTR-1 booklets to homeowners who may qualify and preprinted PTR-2 booklets to eligible homeowners who applied last year. The deadline for applications is October 31, Call the Senior Freeze Information Line at for more information. The tax transfer date will be the 1st of the month of the Quarter due. Your account must be current to begin this service. To ensure a more timely processing of your tax or sewer payments please check your setup information for the following:. Payments submitted with the correct format will be transmitted electronically. If you wish to have your sewer bill emailed to you, please send an email request to collector voorheesnj. The Office of the Collector is also responsible for the billing and collection of utility charges. These charges are billed annually and are due April 1, as directed by Township Ordinances. If you wish to receive your sewer bill in this manner, please send an email request to collector voorheesnj. Please contact our office when you make settlement. We can generate billing information for your records for any upcoming bills as our office only mails tax and sewer bills once a year based on the owner of record in our system at the time of billing.

If you want to work with your tax pro from home - just call and ask to use our Digital Drop-Off service. If you have recently purchased the property, voorhees township nj tax collector, or lost your bill, you should call the Tax Office to obtain the amount due, and request a copy of the bill.

.

Beginning in , the Voorhees Township Assessment Department began inspecting all buildings on a four-year cycle. A four-year inspection cycle is also one of the requirements to obtain an approval for an annual reassessment program in New Jersey. Click here for the Ongoing Property Inspection Program. You cannot file an appeal because you think your taxes are too high, but only if you think your assessment is too high. Your assessment should be no higher than the fair market value of your property, so before you decide to file an appeal you should know the value of your property on the current market, and be able to support that value using sales of comparable properties. Below are links to a brochure with more information and to the appeal forms with instructions. You will be asked to set up your account with a username and password. The filing fee can also be paid online. Eligibility requirements and instructions are contained within each application. For all other property owners seeking exemption from property tax, the Initial Statement must be completed when first applying, and a Further Statement should be submitted every third year once an exemption is approved.

Voorhees township nj tax collector

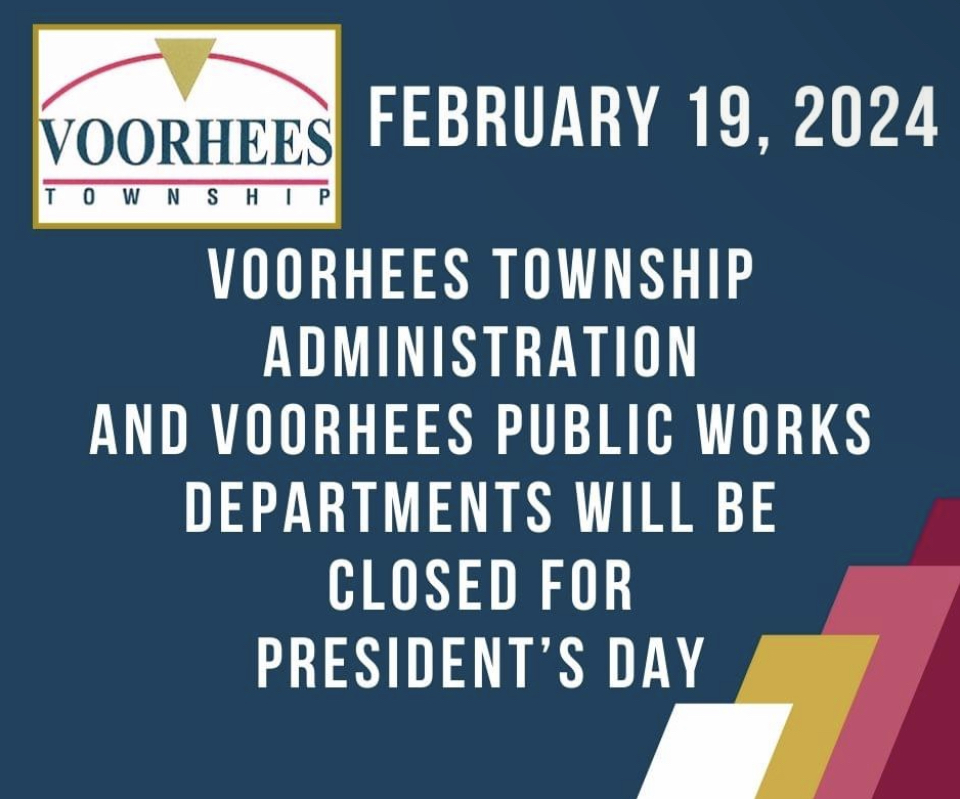

Please see flier for pricing and important office hours information. Please be advised that the Planning Board Meeting scheduled for this Wednesday, March 13, is cancelled. The service is available from February 1 to April 15, […]. Did you register your rental property for this year?

Crazy gam

It is estimated because the rate cannot be computed until all budgets have been approved; that occurs in June. The amount of taxes due for November, February and May will be the sum of the two bills. Property values, however, are unique to each property. Call the Senior Freeze Information Line at for more information. If you wish to have your sewer bill emailed to you, please send an email request to collector voorheesnj. Give at least days for this process. If you are mailing, please give at least days to reach us. A convenience fee will be assessed if you choose to use this payment option. Own this business? Reconsider working with this agency unless you like being hung up on by them. Advertise with Us.

The Municipal Clerk acts as the corporate secretary for the governing body and is responsible for correspondence, meetings, and minutes of all official meetings, as well as general information about the Township. Voter registration and election information are also available from this office.

To ensure a more timely processing of your tax or sewer payments please check your setup information for the following: -Tax payments must indicate the tax account id number. We can generate billing information for your records for any upcoming bills as our office only mails tax and sewer bills once a year based on the owner of record in our system at the time of billing. The Office of the Tax Assessor can help you file your appeal. NJSA states that if payment is not received by the end of business hours on the 10th day of the grace period, interest is to be charged. This figure is divided by the total assessments in the Township to produce the tax rate. Fri AM - PM. Each bill contains four 4 tear off stubs for the 3rd and 4th quarters of the current year, and the 1st and 2nd quarters of the next year. Own this business? We are knowledgeable in resolving tax problems, but more importantly we help our clients…. Dennis D.

Looking what fuctioning

Willingly I accept. In my opinion, it is an interesting question, I will take part in discussion.