Vhy dividend calculator

Looks you are already a member.

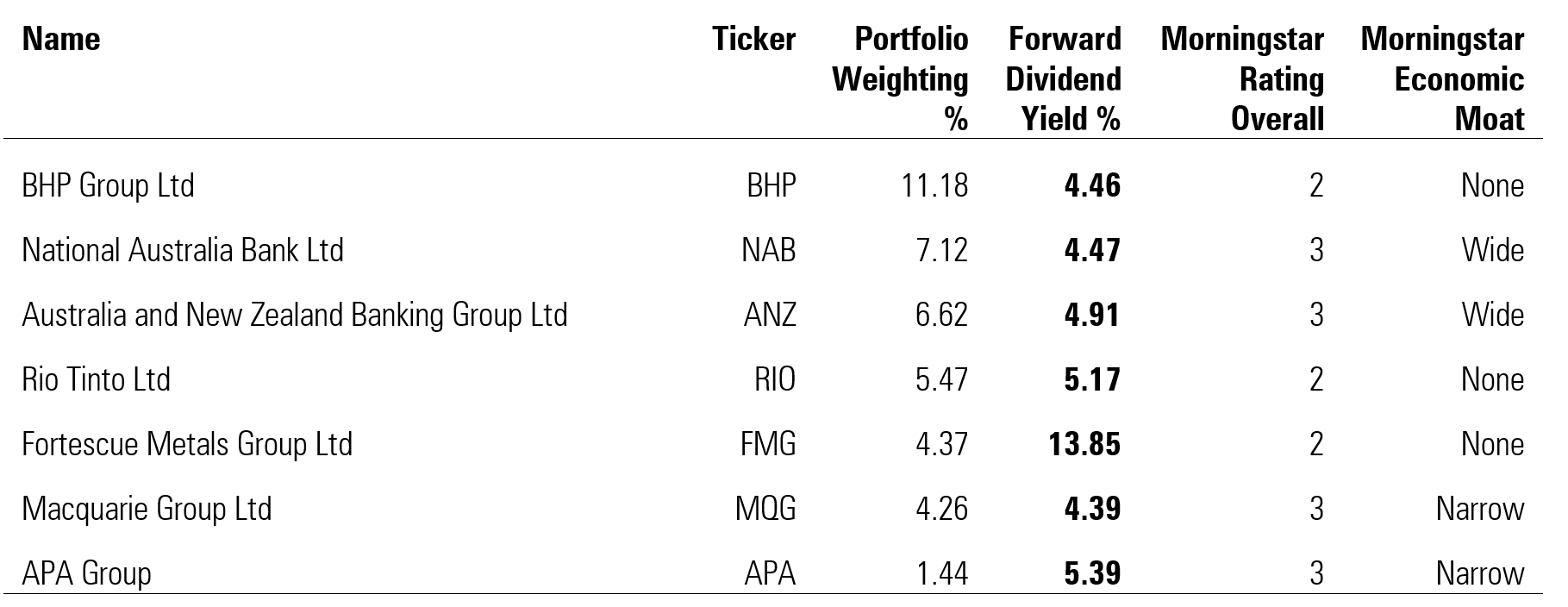

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. But no one should dive into an investment without first understanding exactly how it works and what they are actually investing in. These shares are selected for their ability to offer "higher forecast dividends relative to other ASX-listed companies". The fund is structured in such a way as to prevent too much concentration in one particular sector.

Vhy dividend calculator

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart. It may take a few minutes to update your subscription details, during this time you will not be able to view locked content. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Registration for this event is available only to Eureka Report members. View our membership page for more information. Registration for this event is available only to Intelligent Investor members. Already a member? Log in. Please refer to our Financial Services Guide for more information.

In most stock markets — aig valic address the United States and European Union — dividends are usually paid out every quarter to coincide with fiscal quarters. A stock dividend, or dividend for short, is a payment made by a company to its shareholders, vhy dividend calculator. In simple terms, vhy dividend calculator means that if you use your dividends to buy even more shares, you will receive a greater amount the next time your dividend pays out because you have more shares, and so on.

This dividend calculator is a simple tool that lets you calculate how much money you will get from a dividend when you invest in a dividend-paying stock. In this article, you will find out what a dividend is and how to calculate dividends. We'll also walk you through a simple dividend example to demonstrate how to use our tool. A stock dividend, or dividend for short, is a payment made by a company to its shareholders. Dividend payments are usually made from the corporation's profit, i. Dividends are one of the ways an investor can earn a return on stocks. On the other hand, not all stocks pay dividends — if your main focus is investing for dividends, you will want to specifically seek out dividend stocks.

You can use this chart to visualise how the ETF responds to different market environments. The chart compares price return only. You could buy all of these companies yourself using a share brokerage account, but that would be a very expensive and time-consuming process. These companies are likely to pay regular tax-effective dividends to their shareholders, including franking credits. Full DRP. Australian Shares. The Best ETFs technical analysis chart pack shows the month share price movements, Stochastic bands and traded volume for both up and down days. Please know that these warnings are based on quantitative metrics and our internal methodology. These risks are not exhaustive and therefore they should not be relied upon.

Vhy dividend calculator

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As most of us would be aware, hasn't exactly been the kindest start to a year that ASX shares have faced. That's despite it gaining some ground since bottoming out on 27 January. Since then, the ASX is up a solid 5. But that's still not enough to drag it into positive territory for the year.

Halal food daytona beach

Easy filters to find your investment portfolio. That is why some people may refer to the dividend calculator as dividend reinvestment calculator. Now that you know "what is a dividend", let's go into more detail. Turning to total shareholder returns, this ETF has given investors a Investing Made Simple. Sign up for free No credit card required. Market capitalisation, sometimes referred to as "market cap", is the total value of a company's or ETF's issued shares or units owned by shareholders or unitholders. The shorter your timeframe the more conservative you should be with your investments. Start my plan Get Started. Set Financial Goal. We're here to help.

Looks you are already a member. Please enter your password to proceed. Forgotten password?

If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. The other, more important, implication when reinvesting is that dividends are compounding , meaning they are added back to the initial invested amount. In the next section, we will show you how to calculate dividend payouts step by step. This includes management fees and other operating expenses which all come out of an investor's return. A distribution has three key dates: Ex-distribution date: Date the distribution value leaves the ETF. Sign up for free No credit card required. Record date: Date someone must be on the unit registry to receive the distribution. Please try again. Let's get to the dividends though. The fund is structured in such a way as to prevent too much concentration in one particular sector. Verification code is required. Building the right Investment Plan Finding the right portfolio 3 easy steps. Password is required. Please enter the code below. The longer your time horizon the better your portfolio is able to weather the short term ups and downs and reap the rewards of generally higher markets returns long term.

I am assured of it.

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will discuss.

In my opinion you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.