Vanguard life strategy

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, to poke a bit of fun, vanguard life strategy. Magazines count on something Steve Forbes one said.

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments.

Vanguard life strategy

Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Asset allocation—the mix of stocks, bonds, and cash held in your portfolio—can have a big impact on your long-term returns. So why not pick a fund with an asset allocation that fits your goals, time horizon, and risk tolerance? You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential. Not sure which asset allocation is right for you? Investment time horizon 3 to 5 years. Risk potential 2. Investment time horizon More than 5 years. Risk potential 3.

Contact us. Open or transfer accounts. Both include other expenses such as depositary, registrar, accountancy, auditor and legal fees.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund.

Contents move to sidebar hide. The Vanguard LifeStrategy funds are lifecycle offerings, providing investors with a variety of highly diversified all-in-one portfolios. The products are structured as funds-of-funds , charging only weighted averages of the expense ratios associated with the underlying index funds. LifeStrategy funds are cheap by any reasonable standard. In contrast to the Vanguard series of similar one fund diversified portfolios, target retirement funds , which utilize a gradual shifting strategic asset allocation over time, the LifeStrategy funds have a fixed target asset allocation. Vanguard considers the LifeStrategy funds to be target risk funds , in contrast to target date target retirement funds. While the funds are ostensibly designed for investors having a certain level of risk tolerance approximately , and are typically considered to be retirement accumulation or retirement decumulation vehicles, they may be used for other goals, depending on a particular shareholder's objectives.

Vanguard life strategy

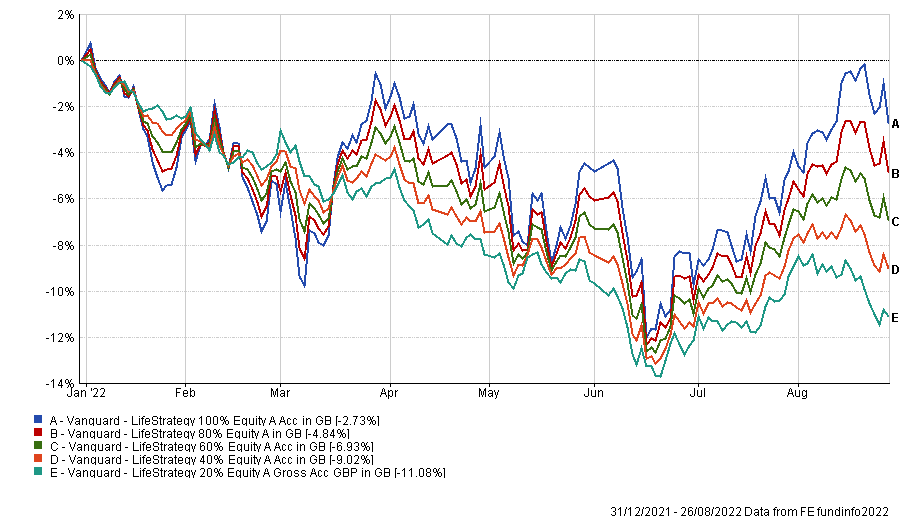

Five choices for low-cost, uncomplicated all-in-one access to global equity and bond markets. Through one singe fund or model portfolio, you can give your clients access to a balanced portfolio of equities and bonds from around the world. You just need to decide which format they would prefer, and which mixture of equities and bonds best suits their view to risk. With five different equity-to-bond mixes that are regularly rebalanced back to the target allocation, advisers and clients simply need to choose the most suitable mix. By keeping costs low, our investors keep more of their investment returns. Some will like the simplicity of a single fund. Others will appreciate the transparency of being able to see beneath the bonnet. Some investors will want to focus on their home market, while others will want global exposure. It does not include dealing costs or additional costs such as audit fees. All-in costs include Ongoing Charges Figures OCF and an annual portfolio management fee that covers the discretionary management of the managed portfolio service, ongoing oversight, and regular rebalancing of the portfolios.

Love letter lyrics seventeen

A structured asset-allocation framework implemented by The only material difference is that the OCF excludes any performance fees which would be shown separately on the fund's Key Investor Information Document , whereas the TER includes any performance fees paid over the past year. Learn about investing Choosing accounts Choosing funds Pension calculator Maximising allowances Get the low-down on investing with guides, views and market news. Top 5 Holdings. Past performance is no guarantee of future results. Role In Portfolio. After all, winners over one time period are often losers the next. Ad blocker detected. It's one of the things we count on in the magazine business -- along with the short memory of our readers. That would involve too much risk. Dual priced funds have two different prices a sell price and a buy price ; single priced funds have a single price at which the fund can be bought and sold. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Open an account Transfer an account to us. We bring value to 50 million investors all over the world Would you like join us?

Vanguard has become a towering figure in the world of exchange-traded funds ETFs. As investors increasingly turn to ETFs for their diversification, lower costs, and liquidity, understanding the offerings and strategies of major players like Vanguard is essential.

New to Vanguard or looking to consolidate your savings? Please note that even where a full saving is offered a dilution levy could be applied on the way in or out of the fund. More Vanguard funds ». Risk potential 2. But complaining about an extra 0. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. Top 5 Regions. See all search results for ' '. Fixed Income Effective Maturity You never know what asset classes stocks or bonds will perform best this year or next. The tax that could be payable on this loyalty bonus, and therefore the value of this saving to you, is shown below. Want to learn more about retirement? Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. Ready to take your first step?

I am assured, what is it � a lie.