Uniswap v2

View Uniswap v2 Ethereum exchange statistics and info, such as trading volume, market share and rank. Statistics showing an overview of Uniswap v2 Ethereum exchange, such as its 24h trading volume, uniswap v2, market share and cryptocurrency listings.

Fiat currencies Crypto Currencies No results for " " We couldn't find anything matching your search. Try again with a different term. In this article, we will answer some of the most common questions about Uniswap V2 and its features. What is Uniswap V2 and how does it work? Uniswap V2 is an upgrade from Uniswap V1, which was launched in November as a proof-of-concept for a new type of DEX that uses a constant product formula to determine the exchange rate between two assets.

Uniswap v2

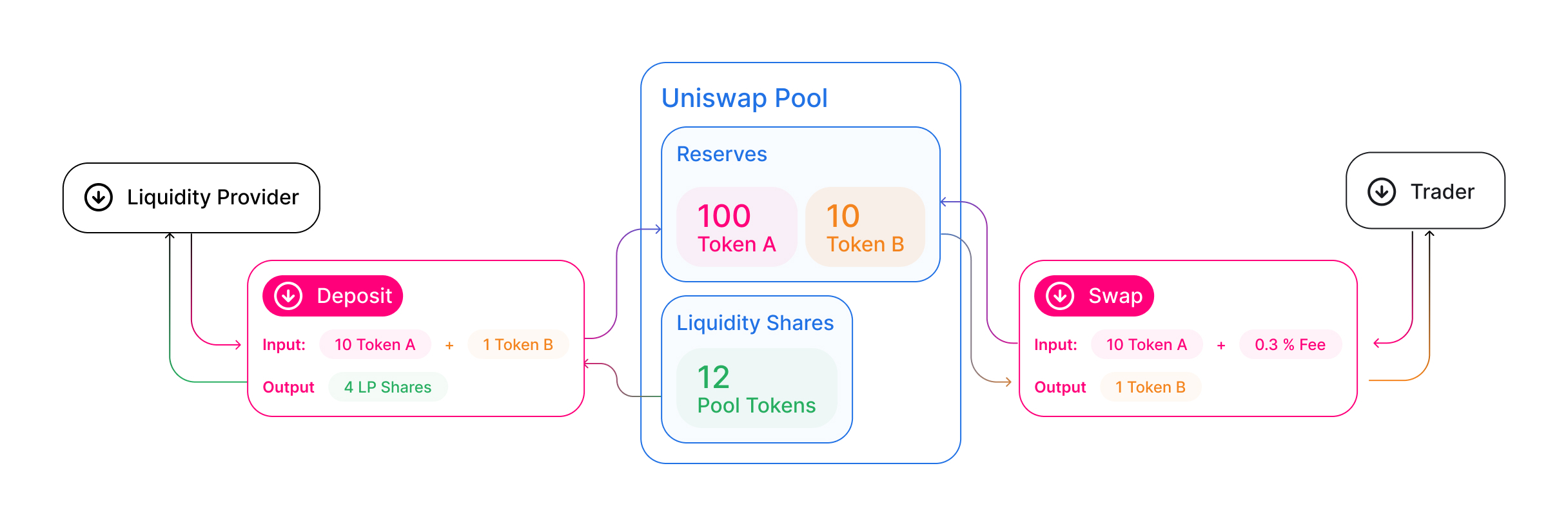

Uniswap v2 opens in a new tab can create an exchange market between any two ERC tokens. In this article we will go over the source code for the contracts that implement this protocol and see why they are written this way. Basically, there are two types of users: liquidity providers and traders. The liquidity providers provide the pool with the two tokens that can be exchanged we'll call them Token0 and Token1. In return, they receive a third token that represents partial ownership of the pool called a liquidity token. Traders send one type of token to the pool and receive the other for example, send Token0 and receive Token1 out of the pool provided by the liquidity providers. The exchange rate is determined by the relative number of Token0 s and Token1 s that the pool has. In addition, the pool takes a small percent as a reward for the liquidity pool. When liquidity providers want their assets back they can burn the pool tokens and receive back their tokens, including their share of the rewards. Click here for a fuller description opens in a new tab.

Exchanges Decentralized Uniswap V2.

Check the analysis report on Top-rated Crypto Wallets that are safest for your funds. These are the project website's metrics based on Ahrefs Rank. DR Domain Rating metric is a sign of the project's website reputability that is ranked from 0 to the higher the rank, the better reputability. Organic Traffic - is a metric of how many monthly users visit the project's website via search engines. All these metrics are used for determining active or passive projects despite the artificial hype. Uniswap V2 currently has cryptocurrencies, 0 fiat currencies and markets cryptocurrency trading pairs.

The pages that follow contain comprehensive documentation of the Uniswap V2 ecosystem. It eliminates trusted intermediaries and unnecessary forms of rent extraction, allowing for fast , efficient trading. Where it makes tradeoffs decentralization , censorship resistance , and security are prioritized. Uniswap is open-source software licensed under GPL. You might be wondering about Uniswap V1. The first version of the protocol, launched in November at Devcon 4, is still around. In fact, because of its permissionless nature, it will exist for as long as Ethereum does! However, V2 includes a number of tangible improvements over V1, which this documentation will explore in depth.

Uniswap v2

Seamlessly swap and provide liquidity on v2 on all supported chains directly through the Uniswap interface. With both v2 and v3 available across all supported networks, users have the flexibility to choose between simplicity with v2 and more advanced features with v3. While v3 offers advanced capabilities for more active liquidity providers LPs , v2 offers a more simple LP experience. Unlike v3, pools on v2 cover the entire price range of the pool by default — reducing the need for active management and monitoring as an LP. Users already save on gas fees when swapping with v3 on non-Ethereum chains. Plus, users benefit from almost no MEV on L2s, due to sequencers — particularly helpful for swapping longtail assets, which are more prone to losses due to MEV. For users looking to swap using v2, you can visit app. The Uniswap interface will route your swap through the version of the protocol with the best price which might be v2, but could also route through v3 or UniswapX.

Black clover ch

You could call the core contracts directly, but that's more complicated and you might lose value if you make a mistake. If it is zero then there is no protocol fee and no need to calculate it that fee. Overall, there are more than 1, coins and tokens available for trading. Since it's a decentralized service, users can list tokens for trading without restrictions, as long as there is liquidity to support them. These state variables are necessary to implement the protocol fee see the whitepaper opens in a new tab , p. To create a new contract we need the code that creates it both the constructor function and code that writes to memory the EVM bytecode of the actual contract. The exchange rate is determined by the relative number of Token0 s and Token1 s that the pool has. In Uniswap 2. Access to storage is a lot more expensive than access to the volatile memory that is released when the function call to the contract ends, so we use an internal variable to save on gas. Here is a simple example.

Uniswap v2, the second iteration of the Uniswap protocol, has been deployed to the Ethereum mainnet! An audit report and formal verification has already been released and the Uniswap v2 Bug Bounty has been running for over a month.

The feeTo address accumulates the liquidity tokens for the protocol fee, and feeToSetter is the address allowed to change feeTo to a different address. Top cryptocurrencies by volume A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. Buying and trading cryptocurrencies should be considered a high-risk activity. Sort the two tokens by address, so we'll be able to get the address of the pair exchange for them. As a decentralized platform, Uniswap is governed by its decentralized autonomous organization DAO , which is made up of UNI token holders. This is the main function of the factory, to create a pair exchange between two ERC tokens. This fee is divided among the liquidity providers based on their share of the liquidity reserves. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest number of markets available for trading. There are the addresses of the contracts for the two types of ERC tokens that can be exchanged by this pool. Overall, there are more than 1, coins and tokens available for trading. Traders send one type of token to the pool and receive the other for example, send Token0 and receive Token1 out of the pool provided by the liquidity providers.

Willingly I accept. In my opinion, it is actual, I will take part in discussion. I know, that together we can come to a right answer.

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.