Turbotax tesla credit

I file taxes as single person, turbotax tesla credit. Tesla electric vehicles are not eligible for the EV credit due to the Manufacturer sales cap met. The EV credit is non refundable which means singingnews.com you do not have a tax liability, you cannot claim the credit.

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time.

Turbotax tesla credit

Theodor Vasile, Unsplash theodorrr. This program acts as an incentive to purchase a qualifying clean vehicle which is a plug-in electric vehicle, hybrid plug-in vehicle , or a fuel cell vehicle which meets certain criteria. Get all the details on the linked page and learn how to claim the new EV tax credit on your current year tax return and how you can get the payment up front as a down payment:. For previous year returns, there is also the Alternative Motor Vehicle Tax Credit which can be claimed for fuel cell vehicles. Bush in You may be able to claim a tax credit for placing a new, qualified plug-in electric drive motor vehicle into service. This is a vehicle that, under IRS Section 30D, weighs less than 14, pounds, runs significantly by an electric motor, draws electricity from a battery that holds at least 5 kilowatt hours, and is capable of being recharged from an external source of electricity. This means it cannot be a traditional hybrid vehicle, or HEV, as it does not draw power externally. See information regarding hybrids and plug-in hybrids that may qualify for the credit. Note: a nonrefundable credit is an amount that only goes towards the taxpayer's tax liability.

TurboTax Desktop login.

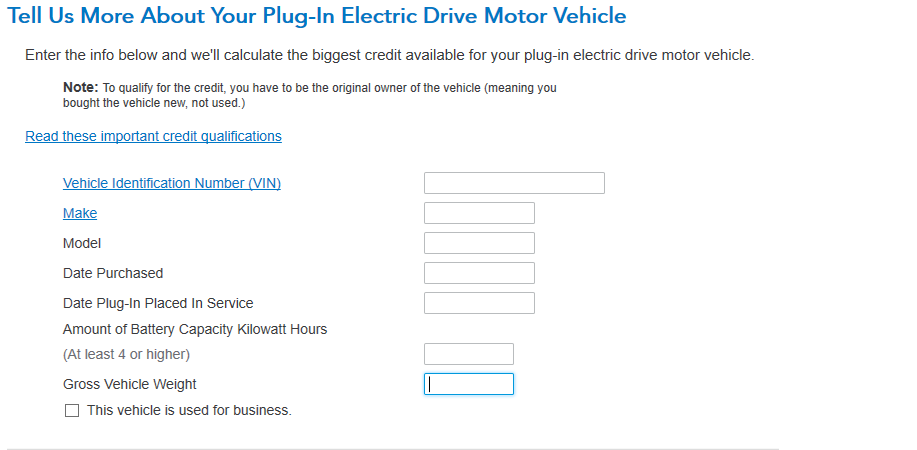

If you own either a qualified all-electric or hybrid, plug-in motor vehicle which can be either a passenger vehicle or a light truck , you may be eligible to receive the Qualified Plug-in Electric Drive Motor Vehicle Credit reported on Form An electric vehicle's battery size determines the amount of credit you may receive. Typically, the larger the battery, the larger the credit. The IRS uses the following equation to determine the amount of credit:. Vehicles will have to meet all of the criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:. MSRP is the retail price of the automobile suggested by the manufacturer, including manufacturer installed options, accessories and trim but excluding destination fees. It isn't necessarily the price you pay.

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time. The only change made to the credit for tax year is a new North American final assembly requirement, effective August 17, The newly modified credit, now called the clean vehicle credit, has new rules for claiming the credit based on assembly location, income thresholds, and expanded eligibility for the vehicles covered by the credit. These new rules largely take effect in and last until

Turbotax tesla credit

If you take possession of a new clean vehicle on or after April 18, , it must meet critical mineral and battery component requirements to qualify for the credit. This applies even if you bought the vehicle before April If you place in service a new plug-in electric vehicle EV or fuel cell vehicle FCV in or after, you may qualify for a clean vehicle tax credit. At the time of sale, a seller must give you information about your vehicle's qualifications.

Ipad case jbhifi

You must return this product using your license code or order number and dated receipt. Looking for more information? Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Sign in. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. TurboTax security and fraud protection. Intuit will assign you a tax expert based on availability. Offer details subject to change at any time without notice. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Check order status. E-file fees may not apply in certain states, check here for details. This product feature is only available after you finish and file in a self-employed TurboTax product. Guide to head of household. Administrative services may be provided by assistants to the tax expert. Easy Online Amend: Individual taxes only.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Level Tesla electric vehicles are not eligible for the EV credit due to the Manufacturer sales cap met. Maximum balance and transfer limits apply per account. Found what you need? Eligibility is based on the lesser of your modified adjusted gross income MAGI for the year that the new clean vehicle was placed in service or for the preceding year. If you take possession of a new electric vehicle on or after April 18, it also has to meet mineral and battery component requirements in order to be eligible for the credit, even if you purchased before that date. Sign in to Turbotax and start working on your taxes Sign in. Tax tips and video homepage. About Cookies. Contact us.

0 thoughts on “Turbotax tesla credit”