Tsla stock forecast 2024

Even as it may appear the dust has settled, one can make a convincing argument on either side about where TSLA is headed from here, tsla stock forecast 2024. On one hand, plenty of strong long-term catalysts remain in motion. In time, they could help assuage key concerns at present. On the other hand, momentum could stay on the side of the skeptics.

In the unfolding narrative of , Tesla Inc. NASDAQ: TSLA continues to ride the waves of market dynamics, showcasing resilience, innovation, and the inherent challenges of maintaining a pioneering stance in the ever-evolving electric vehicle EV sector. The embers of optimism for a robust are fueled further by the much-anticipated unveilings of the Cybertruck and Tesla Semi, aligning with a balanced price-to-earnings narrative, a tableau echoed across market analysts. As Tesla's innovative pulse continues to disrupt the automotive status quo, the federal incentives rolled out for new clean vehicles in or beyond add a favorable wind to Tesla's sails, potentially enticing a broader consumer base to embrace the electric drive. With the stock market's heartbeat resonating positively with Tesla's operational and financial maneuvers so far in , the narrative of Tesla continues to be a riveting blend of innovation, trading realities, and the undying quest for electric mobility supremacy.

Tsla stock forecast 2024

.

How high is Tesla stock expected to go? Skeptics who dismissed Tesla's targets as fantastical were proven wrong as the company nearly achieved the 'impossible' goal ofvehicles.

.

Every car company is now mass producing electric vehicles. Tesla must maintain its margins in the face of that global competition to maintain its market cap. It can dance, and in a year, it will thread a needle, he insists. Tesla has launched a drive to build a second factory in China. Its Mexico factory is on track and will make 1 million cars per year. The bear case for Tesla is tied to growing EV supplies from the rest of the world and slumping demand. BYD also makes its own batteries and is beating Tesla in its home market. The other Chinese EV companies are also growing. By adding a small gas-powered motor, Li can deliver a family SUV that runs miles between fill-ups, with luxury electronics that include self-driving.

Tsla stock forecast 2024

Tesla closed out with a bang, reporting record deliveries for a calendar year and eclipsing the 1. Now, is here, and analysts are putting into scope what could come from Tesla this year. Tesla will also look to ramp up production of the Cybertruck this year. Tesla Model 3 Highland delivery from Fremont expected by the end of Q1 Analysts are split on what they expect from Tesla in , while the bulls are being bulls and the bears are being bears. What else should we expect, right? Inversely, we will also look at the more pessimistic analysts, and why they feel could be the most challenging year for Tesla yet. Instead, the focus is in the United States and Europe:. These could indicate an easier battery production ramp, or, perhaps, a better-than-expected Cybertruck ramp-up as the early months of the project continue on.

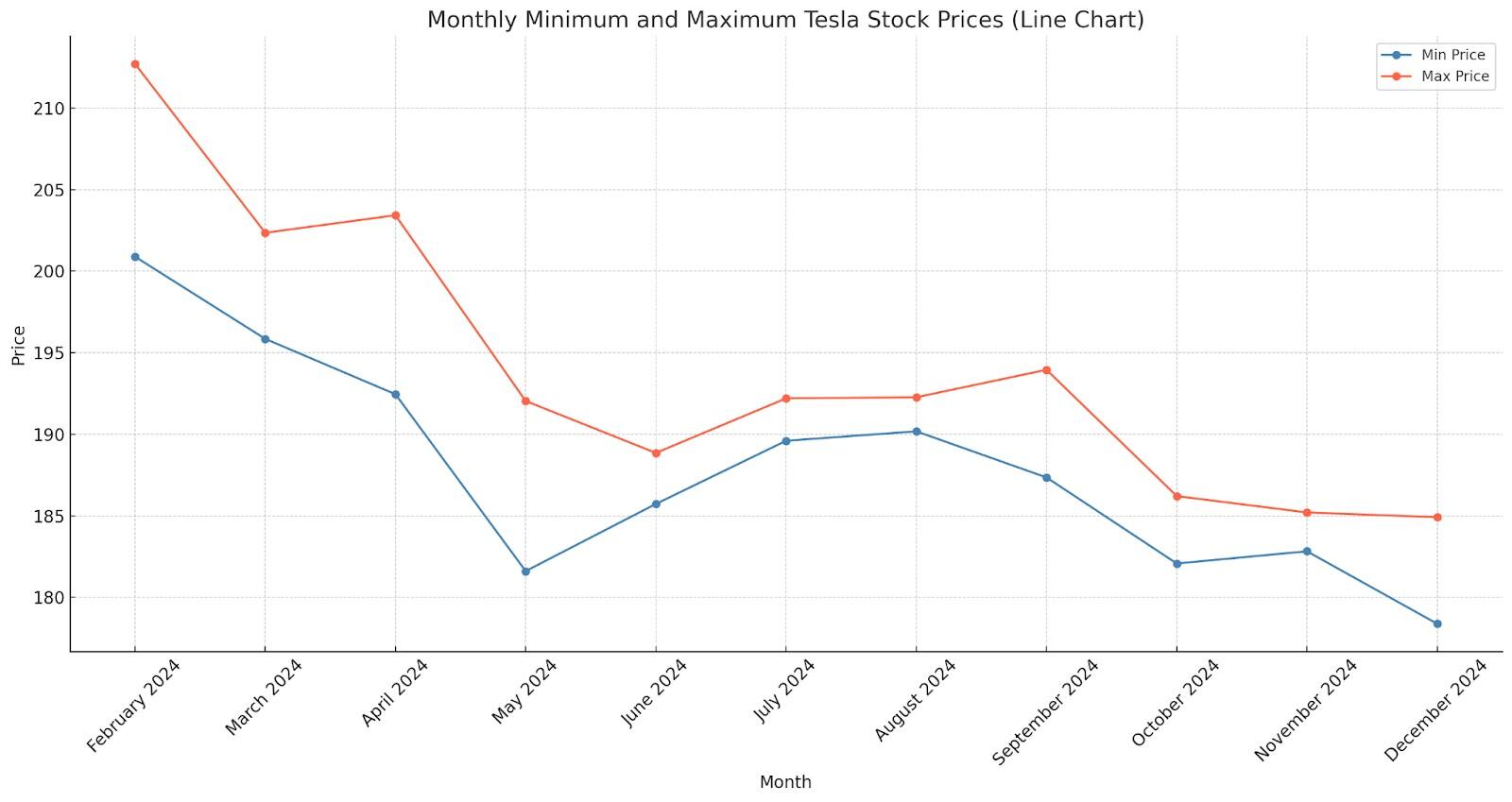

Ito surry hills

The possibility of further high growth has yet to disappear with Tesla. Please, use the Comments section below. By fortifying its balance sheet and dialing in operations, Tesla aims to accelerate past competitors and deliver full self-driving capabilities. They see an upside driven by growth, margins and new innovations. Investing involves risks and is no guarantee. Written by. The actual monthly prices could deviate significantly depending on how the competitive environment and financial dynamics evolve. Follow us in social networks! How can I follow the stock ratings of top Wall Street analysts? The table displays the subsequent expected lows and highs of the TSLA price in Our monthly price forecast analysis provides an insightful perspective on where Tesla's stock price could be headed. As the electric vehicle maker continues ramping production and expanding into new regions, forecasts for where the stock heads next vary widely. Monthly price prediction chart provides an insightful range of potential scenarios for Tesla in With a premium valuation, fickle sentiment, and hype feeding the beast, TSLA lives on the edge. Log out.

With the New Year less than two weeks away, at the time of publication, Finbold decided to see what Wall Street analysts are forecasting for the EV giant, as well as who some of its biggest bulls and bears are. Bernstein analysts also back their prognosis by pointing toward market saturation and the ever-increasing competition in the EV industry. They conclude that much like Tesla had to implement price cuts in to keep up, it will have to reduce the cost of its vehicles even more in

But talking heads will turn against TSLA at the first sign of trouble. Written by. After several attempts to overcome local highs, a strong downward trend began with upward corrective movements, which continues to this day. Buying a single share of Tesla could be a long-term investment given the optimistic projections, but it's crucial to consider the inherent risks and market volatility. In time, they could help assuage key concerns at present. A single patent, property, or partnership can increase Tesla's price. Tesla's meteoric rise has sparked heated debate about how high the company's shares can climb in the coming years. Yet, there are substantial risks, including execution challenges, production delays, fierce competition from traditional automakers transitioning to EV production, and concerns regarding high valuation. This dynamic innovator dominates attention, for better or worse. Consumer Discretionary , Automotive , Electric Vehicles. On the other hand, momentum could stay on the side of the skeptics. As the company contends with its growth and margin issues, investors could continue to be hesitant to pay top dollar for shares. Start Trading Cannot read us every day?

0 thoughts on “Tsla stock forecast 2024”