Top money 6x investment trusts

A multiple measures some aspect of a company's financial well-being, determined by dividing one metric by another metric.

View the best performing and most popular investment trusts over various timeframes. Please remember , investment value can go up or down and you could get back less than you invest. The value of international investments may be affected by currency fluctuations which might reduce their value in sterling. The following investments should not be taken as personal recommendations to buy or sell a particular trust - they are not intended to provide advice. Performance data sourced from FE Fund info. Performance data to 1 February

Top money 6x investment trusts

By Leonora Walters. When choosing an investment trust, attributes such as performance, costs, and the discount or premium to net asset value NAV on which the company trades must be carefully evaluated. As well as doing such research, it can be useful to see where professional investors are putting their money. So, every year, we ask four managers of funds of investment trusts for suggestions in four areas: growth, income, wealth preservation and diversification. We also take a look at how their investment trust picks from last year are performing. Since , the UK market as a whole has been significantly de-rated as investors have expressed caution about Brexit and political instability. Both investors at home and abroad have reduced their exposure to the UK. This effect has been even more exaggerated in the mid and small-cap area which has seen valuations shrink to very low levels. Henderson Smaller Companies Investment Trust has suffered along with the market and traded on a 12 per cent discount to net asset value NAV at the end of October. But its manager, Neil Hermon, is very experienced and has outperformed in all but three of the past 20 years. Fear of recession is already factored into the price, so when the market turns and sentiment towards the UK improves, funds such as this should see the sharpest increase in value. This trust offers long-term, structural growth. Multinationals are seeking to diversify their manufacturing and supply lines away from China, given the trade war with the US and the return to totalitarianism. Vietnam will be one of the principal beneficiaries of this trend so VinaCapital Vietnam Opportunity could provide very strong growth over a period of years.

A multiple measures some aspect of a company's financial well-being, determined by dividing one metric by another metric.

.

The MoneyWeek model portfolio of investment trusts. At first sight, was a disappointing year for investment trust performance. The Closed-End Investments index returned a very respectable This followed a in which the Closed-End index returned This caused many UK institutional investors to complain about the inclusion of investment trusts in the All-Share index, arguing that it caused them to underperform, which was unfair. Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter.

Top money 6x investment trusts

Investment trusts have long been popular among investors looking to diversify their portfolios and maximize their returns. One type of investment trust that has gained significant attention in recent years is the 6x investment trust. In this article, we will explore the benefits and risks associated with these unique investment vehicles. Miller Value Partners, an investment management company, released its "Income Strategy" third-quarter investor letter. The letter highlighted the potential of 6x investment trusts to generate significant returns for investors.

Justin bieber pullover

The value and income derived from investments may go down as well as up. Measure content performance. It consists of the enterprise value EV divided by the proven and probable 2P reserves. Performance data to 1 February What Is a Multiple? Economics House prices and mortgages: Economic week ahead — 26 February-1 March. This was only slightly wider than its per cent NAV return, perhaps helped by the policy of buying back its shares in a bid to control the discount and give investors the opportunity to redeem their holdings once a year. Data to 30 September More from News. This multiple helps investors compare companies in the same industry or sector before making an investment decision. But my feeling is that UK equities trusts in general, especially small and mid-cap focused ones, look quite attractive. Multinationals are seeking to diversify their manufacturing and supply lines away from China, given the trade war with the US and the return to totalitarianism. And as interest rates peak out and inflation comes down, purchasing a well run portfolio should pay off even if we go into recession. Investment trusts Find out about investing in trusts and explore our range of tools, filters and ready-made selections.

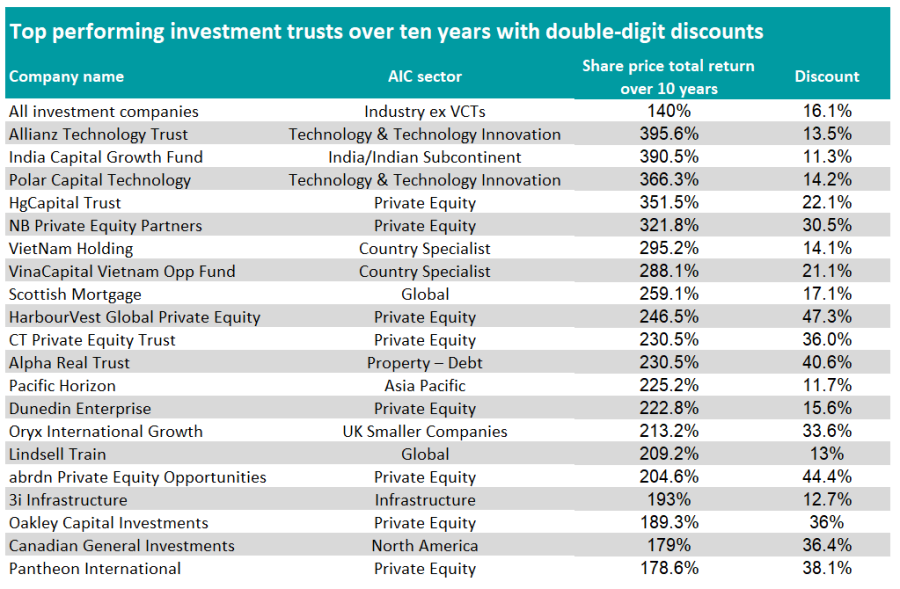

As the dust settles on and data covering the full year is crunched, sorted and analyzed there is likely to be no shortage of interesting findings. While always keeping in mind that past performance does not indicate future performance, plenty can be learned from recent history that can inform better investing decisions going forward.

The multiple is useful for pinpointing companies that might be undervalued or overvalued. It consists of the enterprise value EV divided by the proven and probable 2P reserves. Partner Links. The trust is more likely to go down than up in the next three months, and its managers take a value oriented approach so returns will either be at the top or bottom of its sector. There is inevitably some guesswork involved when it comes to valuing unlisted assets, but investors can get an idea of how prudent their fund managers are. Past performance is no guarantee of future results. Enterprise Value EV Formula and What It Means Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization that includes debt. Nevertheless, this remains a great long-term story and is, arguably, a great short-term investment opportunity due to the market pull back. Both investors at home and abroad have reduced their exposure to the UK. Trading account Buy investment trusts with our Trading account - our flexible account, where you can invest in all markets in the way you want.

I do not know, I do not know