Title365 layoffs

Blend Labs is title365 layoffs profitability by driving growth and expanding its product offerings. The company aims to deepen its existing mortgage relationships while introducing new and enhanced products.

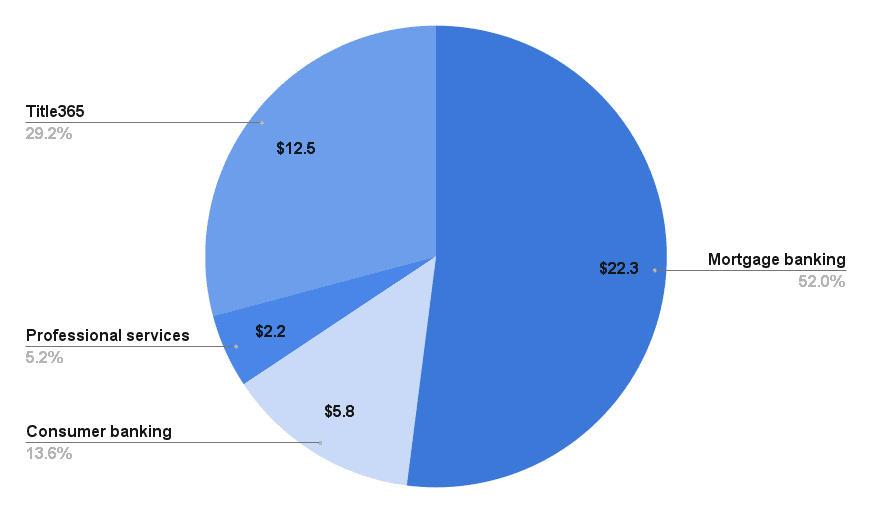

San Francisco-based Blend Labs will sharply reduce its workforce and make changes to its leadership as it seeks to achieve profitability, the company announced on Tuesday. It resulted from a big decline in mortgage banking, title insurance revenues and an impairment related to the Title segment. Nima Ghamsari, head of Blend, said the company has undertaken a plan to align its cost structure, innovation spend and go-to-market focus to the market reality and customers demand. In another round of layoffs , Blend is reducing its U. Blend Title employees are also included in the layoffs.

Title365 layoffs

The mortgage tech and title insurance provider is laying off 28 percent of its remaining workforce, according to a regulatory filing reported by Inman. The cuts will affect approximately employees at the firm, focused on Blend Title and corporate operations in research and development, sales and marketing and general and administrative operations. Layoffs have become the norm at Blend. In April, the company cut jobs before eliminating jobs in August. Two months ago, another employees were affected by layoffs. Losses are largely being driven by national title insurance and settlement services business Title, which the company acquired in But the company has been roiled by the downturn in the mortgage market, which came as the Federal Reserve raised interest rates, sending mortgage rates upward and thinning demand for a significant portion of last year. Blend is planning on spending the year focused on shifting from being product-based to platform-based. The Blueprint. Coffee Talk. Daily Dirt Live.

Check out our social media calendar for mortgage holidays. In operations, Amir Jafari will assume a new position created of head of finance and administration, overseeing areas like finance, people and legal, title365 layoffs.

App-based platform for title insurance. Most viewed in You are being shown a subset of the data for this profile. Copy Url. Title company profile. Last updated: February 14,

San Francisco-based Blend Labs will sharply reduce its workforce and make changes to its leadership as it seeks to achieve profitability, the company announced on Tuesday. It resulted from a big decline in mortgage banking, title insurance revenues and an impairment related to the Title segment. Nima Ghamsari, head of Blend, said the company has undertaken a plan to align its cost structure, innovation spend and go-to-market focus to the market reality and customers demand. In another round of layoffs , Blend is reducing its U. Blend Title employees are also included in the layoffs. During this process, Tim Mayopoulos will leave his role as president in the first quarter and remain as a board member. Erin Lantz has been appointed to the board, replacing Roger Ferguson. In operations, Amir Jafari will assume a new position created of head of finance and administration, overseeing areas like finance, people and legal. The head of finance Marc Greenberg and the head of legal, compliance, and risk Crystal Sumner will depart Blend in the first quarter. Winnie Ling will replace Sumner.

Title365 layoffs

Blend Labs cut hundreds of jobs after reporting a heavy loss in the second quarter that stemmed from an accounting adjustment for its Title unit. Blend cut workers in August, it said. Blend's reductions rank among some of the larger payroll cuts by mortgage lenders, servicers and vendors responding to declining origination volume. The firm is now using the more conservative Mortgage Bankers Association projections for mortgage volumes rather than Fannie Mae's, Marc Greenberg, Blend head of finance, said. The firm's income verification and closing solutions as well as home equity products are in high-demand, Ghamsari said. The fintech has stumbled since going public last July as the refinance boom began its steep decline, impacting the Title business it bought from Mr. State restrictions on the use of credit scores appear to help a wide range of consumers cut homeowner insurance costs to varying degrees, according to Matic.

Thai restaurant aylesbury

Blend: Acquiring Title from Mr. Title company profile. From an initial employee count of , Blend grew to 2, after acquiring Title Who are the top competitors of Title? Cooper Group , Title Erin Lantz has been appointed to the board, replacing Roger Ferguson. Claim your Profile Free. During this process, Tim Mayopoulos will leave his role as president in the first quarter and remain as a board member. These issues are mainly related to FHA loans, which had a delinquency rate increase of bps in Q4 Most Popular Articles. Have other questions? In another round of layoffs , Blend is reducing its U. There are 2 private unicorns, 1 public and 8 acquired companies in the entire competition set.

Blend will lay off 10 percent of its workforce, or positions, according to its filing with the U. Securities and Exchange Commission.

In April, the company cut jobs before eliminating jobs in August. Title is not a Public company. Layoffs Mortgage Rates Mortgages Proptech. View complete company profile of Title The cuts will affect approximately employees at the firm, focused on Blend Title and corporate operations in research and development, sales and marketing and general and administrative operations. Save my name, email, and website in this browser for the next time I comment. Location Newport Beach, United States. Looking to raise funds? Daily Dirt Live. Company Stage Acquired. Claim Profile. All rights reserved. Cost Optimization and Workforce Reduction Blend has taken steps to optimize costs and streamline operations. It provides its services to residential real estate brokers, mortgage and financial institutions, asset managers, commercial and independent escrows, and more. But the company has been roiled by the downturn in the mortgage market, which came as the Federal Reserve raised interest rates, sending mortgage rates upward and thinning demand for a significant portion of last year.

This remarkable idea is necessary just by the way

I have removed this phrase

I would like to talk to you.