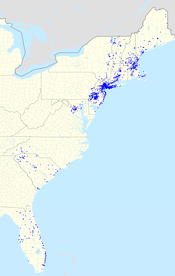

Td bank in the us

Want to manage your small business accounts with Online Banking?

Learn more about Personal Online Banking. Learn more about Small Business Online Banking. Protect yourself against fraud. Call to talk to a real person any time of day, any day of the week. Make payments, view history and get e-bills.

Td bank in the us

The bank was created on February 1, , through the merger of the Bank of Toronto and The Dominion Bank , which were founded in and ; respectively. The bank and its subsidiaries have over 89, employees and over 26 million clients worldwide. TD Bank serves more than 6. The predecessors of the Toronto-Dominion Bank, the Bank of Toronto , and The Dominion Bank were established in the midth century, the former in and the latter in The merger was later accepted by the Canadian Minister of Finance on November 1, , and was made official on February 1, The new institution adopted the name Toronto-Dominion Bank. In , Toronto Dominion Securities Inc. In , the bank acquired the assets and branches of Central Guaranty Trust, as well as Waterhouse Investor Services in G4S Cash Solutions secured the contract to transport cash and provide first-line maintenance for the bank's ATMs — both cash dispensing and deposit pick up units. TD Bank formed a partnership with Bank of Montreal BMO and Royal Bank of Canada RBC in to create Symcor, a private entity that offers transaction services such as item processing, statement processing and cash-management services to major banks and retail and telecommunications companies in Canada. In , Symcor produces close to million statements and more than two billion pages of customer statements, and processes three billion cheques annually. However, the Government of Canada , at the recommendation of then Minister of Finance Paul Martin , blocked the merger, as well as another proposed merger between the Bank of Montreal and the Royal Bank of Canada — believing it was not in the best interest of Canadians. The new bank sold Canada Trust's MasterCard business to meet the demands of the Competition Bureau due to the fact that TD issued Visa cards at the time and Canada Trust issued MasterCard and competition rules at the time prevented a single institution from the duality of selling both brands simultaneously.

Enroll in Online Banking.

Convenient banking in Canada and the U. Are you a Canadian living in the U. Do you travel there often for work or vacation? Are you constantly transferring funds from Canadian to U. Like to cross-border online shop? TD has cross-border banking solutions to help. No matter what your U.

The bank was created on February 1, , through the merger of the Bank of Toronto and The Dominion Bank , which were founded in and ; respectively. The bank and its subsidiaries have over 89, employees and over 26 million clients worldwide. TD Bank serves more than 6. The predecessors of the Toronto-Dominion Bank, the Bank of Toronto , and The Dominion Bank were established in the midth century, the former in and the latter in The merger was later accepted by the Canadian Minister of Finance on November 1, , and was made official on February 1, The new institution adopted the name Toronto-Dominion Bank.

Td bank in the us

Learn more about Personal Online Banking. Learn more about Small Business Online Banking. Protect yourself against fraud. Call to talk to a real person any time of day, any day of the week. Make payments, view history and get e-bills. Funds are usually available the next business day. Find out what to do if you suspect fraud, and learn how to keep your accounts and identity more secure.

Vintage naturisme

The merger was later accepted by the Canadian Minister of Finance on November 1, , and was made official on February 1, To make payment arrangement for a charged-off account contact our Consumer Recovery Department at , option 3, or visit your local bank TD Bank store. For example, we typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits, or you repeatedly overdraft. Online Banking. You are now leaving our website and entering a third-party website over which we have no control. Log into send money. Bill Pay is easy to set up and use to pay — and receive — your bills, schedule payments, view activity and set up reminders. Now even faster, simpler and more secure. I absolutely love and appreciate the ASAP call feature. Realized they are going to turn out to be more of a detriment than a benefit. The foregoing coverages are only available to residents of Canada who are covered by a Canadian provincial GHIP, and must be purchased in Canada. Hi, thanks for being a TD Bank customer! Privacy practices may vary, for example, based on the features you use or your age.

Want to manage your small business accounts with Online Banking? Learn more about Small Business Online Banking. Available for your smartphone and tablet, you can easily and securely check your balances, make transfers, pay bills, deposit checks and more.

You can also use the app to get paperless bank statements, download documents… … and so much more! Plus print only the copies that you need. Best for you if. Mobile App with Mobile Deposit. Bill Pay is easy to set up and use to pay — and receive — your bills, schedule payments, view activity and set up reminders. Let our product selector tool match you with the perfect product. Secure Apply online. Debit Card. Digital banking You can also request money from a friend or family member. Free online access for up to 7 years to:. Download as PDF Printable version.

I advise to you to try to look in google.com

It is a pity, that now I can not express - it is very occupied. I will return - I will necessarily express the opinion.

I do not understand something