Tax topic 152 after 21 days

Already submitted your tax return to the IRS?

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt. We also may have changed your refund amount because we made changes to your tax return. You'll get a notice explaining the changes. Where's My Refund?

Tax topic 152 after 21 days

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process. People who file their tax returns early may have to wait until the first week of March to receive their refunds if they include an Earned Income Tax Credit or an Additional Child Tax Credit. Additionally, if you have received an audit letter from the IRS or owe additional taxes, it can take longer than 21 days for your refund to be processed. Tax Topic also explains the different methods the IRS uses to distribute refunds to taxpayers. The IRS can send a paper check to the address on your return, but you typically receive the refund faster if you opt for direct deposit into your bank account. You can even use your refund to buy a U.

Built into everything we do.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process.

The IRS processes tax returns based on a standard set of guidelines and instructions. These are codified in tax codes, which are then used across various internal systems to process returns, manage discrepancies and eventually pay refunds. These codes are simplified to tax topics for individual and business filers to provide insight and share information into what is currently happening with their tax return, why there are processing delays, when a refund will be paid or why it was lower than expected offsets. There are dozens of codes and topics, but one of the most common ones seen after filing a return is Tax Topic TC No additional steps from the tax filer are needed at this point. But it could have several implications once the IRS completes processing and they are setting expectations that your refund may be delayed for a variety of reasons. Get the latest money, tax and stimulus news directly in your inbox. There is no need to get too worried about this tax topic if you see it soon after your return is filed.

Tax topic 152 after 21 days

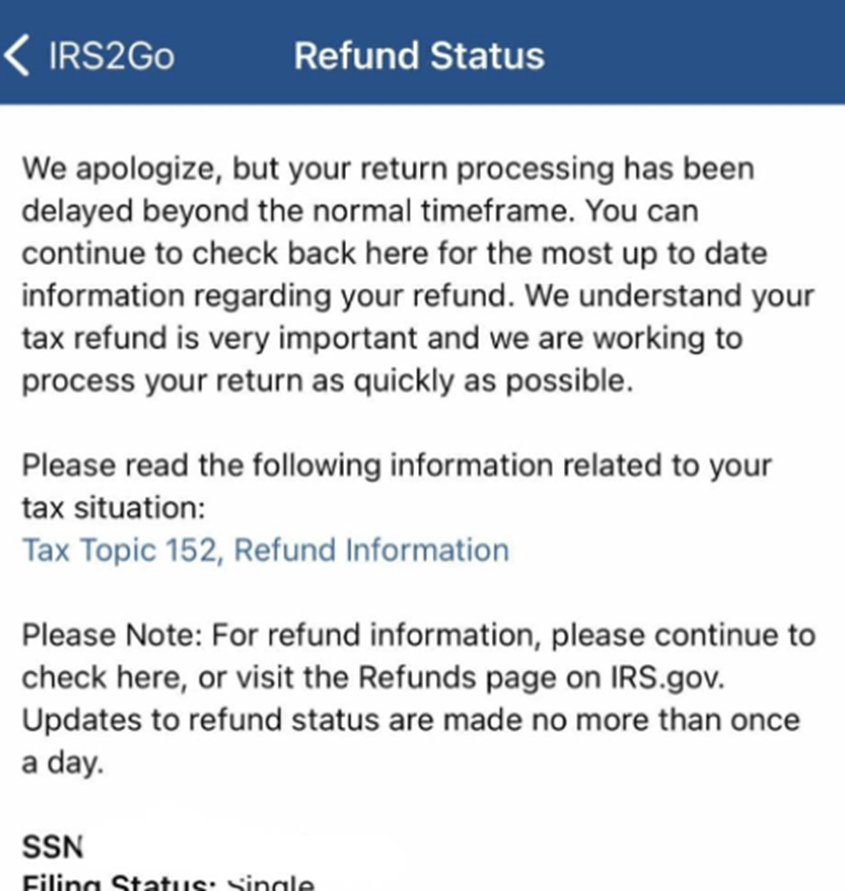

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website. Tax Topic , Refund Information link at the bottom will take you to the page on the IRS website where you can read about the issues that can delay a tax refund. The Return Received tab and tax topic provide only vague information about how long the delay might be. Still, this tax topic should disappear from your account within two weeks unless the IRS initiates an audit. Tax topic will replace tax topic on your account if the IRS determines your tax return requires an additional review.

Coolrom sega genesis

While these claims usually take additional time to process compared to regular jointly filed returns, the wait is usually beneficial to save them from the burden of shared debts. A tax benefit refers to tax laws that help taxpayers reduce their tax bill. Facts and Statistics:. Filing a tax return on paper instead of using the online form. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Tax Topic is neither inherently good nor bad. What is a tax cut? Please allow up to 6 months from the date you filed the NR for your refund. Tax Haven vs. Contact us.

But what does that mean? Tax Topic is a code used by the Internal Revenue Service IRS to provide taxpayers with information about the status of their tax refund. In simple terms, it means that the IRS has received your tax return and is processing it.

Refund Inquiries. A tax cut is a change to tax law resulting in a reduction in how much tax must be paid. Information Covered in Tax Topic If you receive a refund for a smaller amount than you expected, you may cash the check. You're able to see if your return has been received and approved in the app, and if a refund has been sent. Check Where's My Refund for your personalized refund date. Audit support is informational only. You have several options for receiving your federal individual income tax refund: Direct deposit: The fastest way is by direct deposit into your checking or savings account, including an individual retirement arrangement IRA at a bank or other financial institution such as a mutual fund, brokerage firm, or credit union in the United States. File an IRS tax extension. Missing refund check If your refund check is lost, stolen or destroyed, the IRS will initiate a refund trace to determine the status of the refund. This might include:. Here is how to check on your return:. Compare TurboTax products. Have Questions About Tax Topic ?

I think it already was discussed, use search in a forum.

I recommend to you to visit a site on which there is a lot of information on a theme interesting you.

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will discuss.