Tax calculator quebec

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue tax calculator quebec ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site.

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable.

Tax calculator quebec

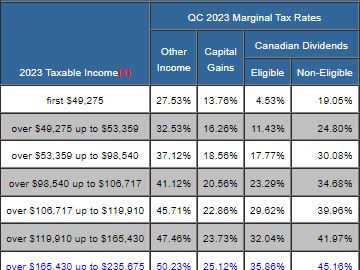

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment. Quebec does not have a carbon tax rebate program. The province implements a cap-and-trade program instead to reduce greenhouse gas emissions while also keeping the cost of carbon pricing low for Quebec residents. The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Quebec tax brackets.

Self-employment income This is your self-employed or business income, including from a: profession, trade, tax calculator quebec, manufacturer, or any undertaking of any kind. CWB rates are calculated using rates indexed for inflation.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket The deadline to file your income tax return in is midnight on April

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations. Further exemptions and regulations can be found at here here. In Quebec, sales taxes are charged differently on used motor vehicle sales depending on who sells it to you. If you buy a used car from another person, however, you will only need to pay QST on the greater of the sales price or the estimated value of the vehicle. You do not pay the QST amount to the person or dealer that sold you the vehicle.

Tax calculator quebec

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable.

Matlab multiple subplots

Our latest thinking. NOT eligible if in prison for at least 90 days during tax year. This amounts to What are capital gains and losses? Student loan interest current yr can be carried forward up to 5 years. Real Estate. Income tax tips from the TurboTax Hub Ever wonder what those lines on your tax return mean? Ever wonder what those lines on your tax return mean? What is my RRSP contribution room? Examples include auto insurance and home insurance.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere.

Questions or feedback on the tax calculator? Tax credit for childcare expenses line Dividend tax credit non-eligible dividends. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets. Combined Taxes Payable. If your EI benefits are not subject to clawback, enter them as "Other income" below. Further exemptions and regulations can be found at here here. Please enable JavaScript in your web browser for the live calculations to work properly. Deduction for enhanced QPP contributions on self-employment income. Unused federal amounts electing to transfer from spouse.

0 thoughts on “Tax calculator quebec”