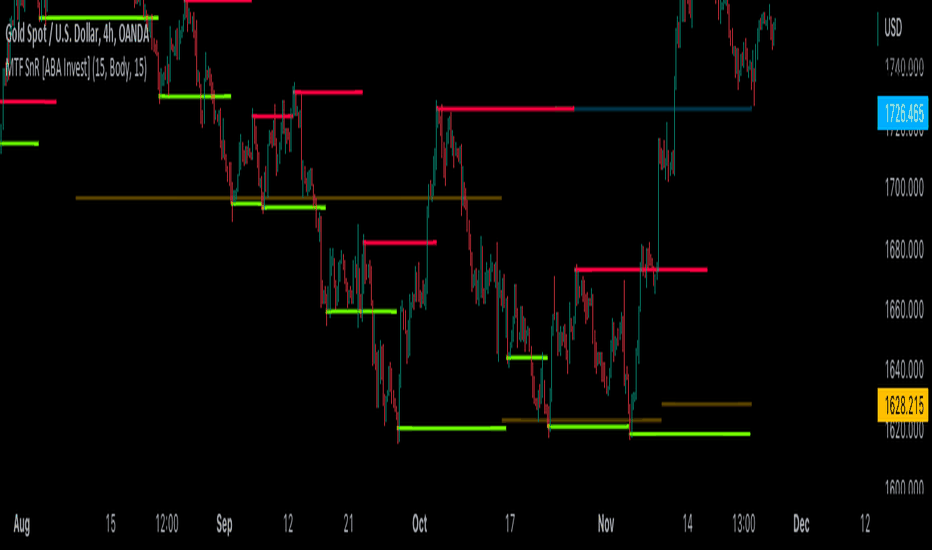

Support and resistance indicator tradingview

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Support and resistance indicator tradingview

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. This innovative tool operates across three distinct timeframes, offering a comprehensive view of market dynamics to help you make informed trading decisions. By combining data from three different timeframes, this indicator provides a holistic perspective on market trends and key levels. The adaptive nature of this tool ensures a dynamic assessment of support and resistance zones, empowering traders to adapt to changing market conditions efficiently.

These include selecting the scoring method for pivots and adjusting the number of pivots to consider, along with many visual aids. We have also provided some smoothing for this line to make it easer to use, support and resistance indicator tradingview. Now you will be able to easily see the older zones extend across the chart.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. This would now be looked upon for potential support or resistance. Mitigation occurs when the The All Time High ATH Levels indicator displays a user-set amount of historical all-time high levels made on the user's chart, highlighting potential key price levels. Displayed levels can be filtered out based on their duration, as well as their relative distance from each other. The script also evaluates the role a level might have as a support or resistance

Support and resistance indicator tradingview

I am going to reveal a powerful fibonacci trading strategy that I learned many years ago. It combines structure analysis, fibonacci retracement and extension levels and candlestick analysis. Step 1 Find a trending market - the market that is trading in a bullish or in a bearish trend on a daily time frame. There are several ways to trade gaps but first, there should be a solid understanding of what Gaps are and how they show up. Markets aren't that hard to read if we have some simple ways to see them that adhere to the principles of movement. All markets move in contraction and expansion. What are the best key levels to trade? In the today's article, I prepared for you a list of 5 elements of a perfect support and resistance for trading. As always, remember that the best key levels are always on a daily time frame.

Gaytuve

Trend Lines, Supports and Resistances. Normally without this feature, when a new SR zone is found, the older zones do not extend all the way right despite the fact that those older SR zones can still be very powerful and reliable to trade off of. Mitigation occurs when the They exist due to an influx of buyers or sellers at key junctures. Want to use this script on a chart? You can use it to identify market direction and potential key points. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Open-source script. You can also specify whether you want to use pivot high, pivot low, or both in your analysis. This new indicator can render order blocks with their volumetric information. This indicator is tailored for traders looking to capitalize on intraday price movements, particularly focusing on breakout strategies. First picture below shows an example with this option unchecked, and with label location also changed to "Left". Fewer pivots are shown in Low Color, suggesting weaker levels.

Identifying key support and resistance levels is critical for determining optimal entry and exit points. Tradingview offers several robust indicators to pinpoint support and resistance zones on any chart. Support and resistance represent key price levels where demand and supply reach equilibrium.

Users can also see the score using the distribution mode to more accurately determine the strength of these areas. The script also evaluates the role a level might have as a support or resistance This would now be looked upon for potential support or resistance. ChartPrime Premium. Fewer pivots are shown in Low Color, suggesting weaker levels. Release Notes: Minor update to address bug with labels. Alerts are included for the occurrence of a new target as well as for reached targets. The script highlights pivot points and draws support and resistance lines based on user-defined parameters. This gives a central pivot level, allowing you to see the average pivot position. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. It identifies price levels where historically the price reacted either by reversing or at least by slowing down and prior price behavior at these levels can leave clues for future price behavior. Alternatives Renko overlay charts Want to use this script on a chart?

I am sorry, that I interfere, but, in my opinion, there is other way of the decision of a question.

I think, that you are not right. I am assured. I suggest it to discuss.

Thanks for an explanation.