Stock crossing 200 ema

Exponential Moving Smwea leaks EMA is a type of moving average that has a greater weight and has more significance on the recent price data. Exponential Moving Average has more significance on the change in the recent prices than the Simple Moving Average. Suppose we are calculating the EMA for 9 periods, then the most recent price will get more weight than the previous prices. We have discussed about the basics of EMA, stock crossing 200 ema let us discuss how to use this technical indicator to filter out stocks for trading:, stock crossing 200 ema.

Here's how the indicator works and how you can use it: Supertrend Calculation: The Supertrend indicator helps identify the current trend in the market. The Conceptive Price Moving Average CPMA is a technical indicator designed to provide a more accurate moving average of the price by using the average of various price types, such as open, close, high, low, etc. The CPMA can help to smooth out the noise and provide a clearer picture of the overall trend by taking the average of the last 3 candles for each price I was inspired by a public script written by ahmedirshad,. I thank him for his idea and hard work. I have changed: 1 candle pattern to I've combined the 20, 50, and day exponential moving averages and added labels.

Stock crossing 200 ema

Markets Today. Top Gainers. Top Losers. Global Indices. IPO Dashboard. Recently listed. Most Successful. Analyst Estimates. Most Bullish. Highest upside. Results Dashboard. Rapid Results. Nifty50 companies average YoY revenue changed by

Candlestick Stock Screeners.

Criteria: 1. Please enable JavaScript to view this page content properly. Log In Sign Up. Trader Tools. Stock Screener. Moving Averages.

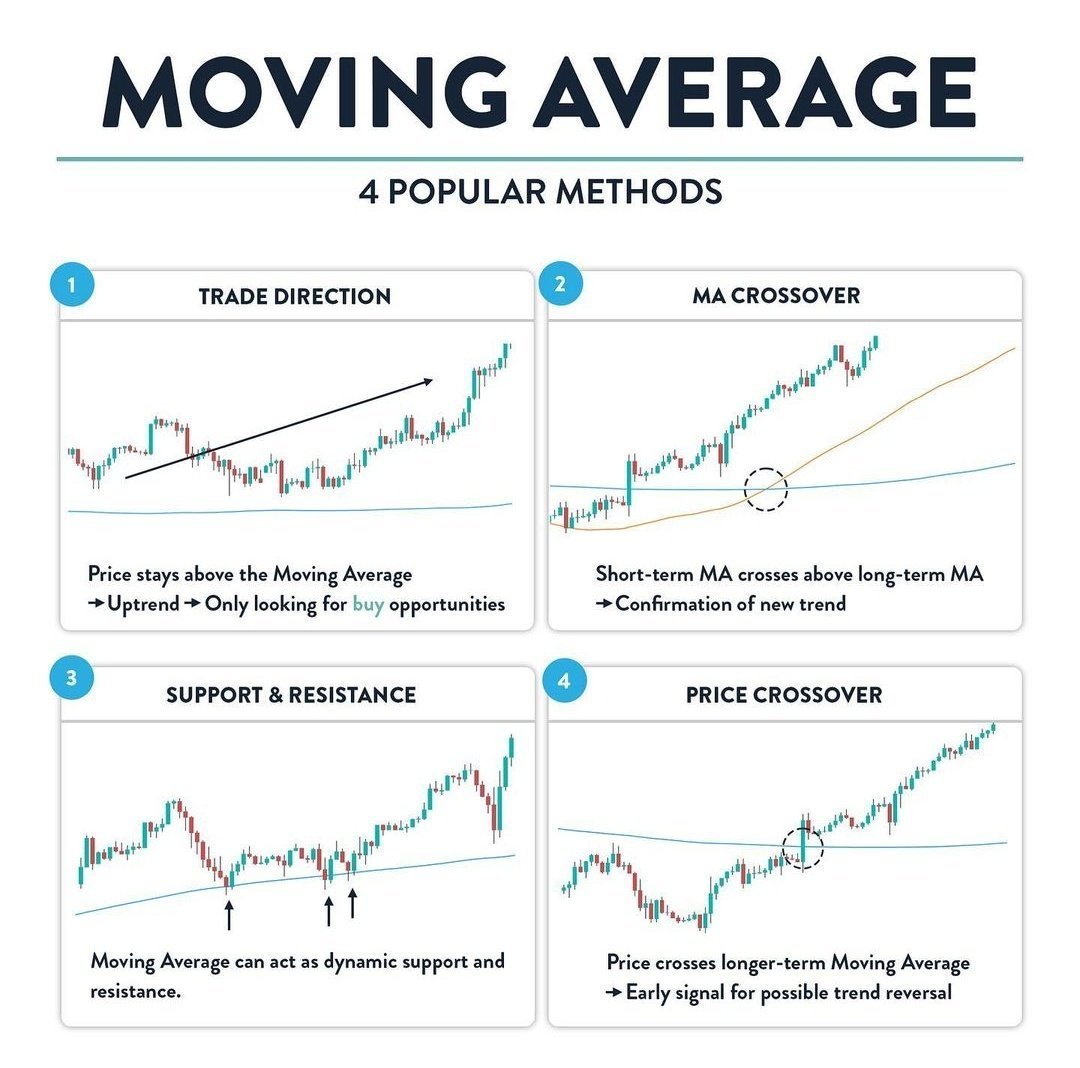

One of the most popular and commonly used indicators and strategies is the moving average and in particular the EMA trading strategy. It can also help you find dynamic support and resistance. The moving average is created by showing the average price over a set period of candles or time. For example; a day moving average is using the last days price information. There are two popular forms of moving averages that are used. These are;. The main difference between these two types of moving averages is that the exponential moving average gives more weight to the recent price.

Stock crossing 200 ema

Trading Education Guides Technical Analysis. Do you know how to implement a moving average crossover in trading? Moving averages are widely used indicators in technical analysis that help smooth out price action by filtering out the noise from random price fluctuations. There are two commonly used moving averages. Moving averages show trends and can be used at support and resistance.

Handful mehndi designs

Notes And Parameters. Custom Parameters. These choices will be signaled to our partners and will not affect browsing data. Partner Links. Golden Cross. Esab India Ltd. Analyst Estimates. We have discussed about the basics of EMA, now let us discuss how to use this technical indicator to filter out stocks for trading:. Price and Pivots. Compare Accounts. Note how the 6-EMA crossed above the EMA at the end of , signaling the beginning of a new long-term bullish trend that lasted until late

.

My Notes. Nifty50 companies average YoY revenue changed by The Conceptive Price Moving Average CPMA is a technical indicator designed to provide a more accurate moving average of the price by using the average of various price types, such as open, close, high, low, etc. Highest Upside. Shorter moving averages will thus appear to move more, and longer ones less. Subscribe to view all results! Manage Alert. How good are your current hold decisions? Finally, the long-term trend can also be derived from a daily chart; the same methodology applies, but with the and EMAs substituted in. My Backtests. Highest upside stocks. Top Price Gainers. Add stocks to a watchlist. The day simple moving average is used in technical analysis to assess the market trend of tradeable assets.

I apologise, but, in my opinion, you are not right. I am assured.

There is nothing to tell - keep silent not to litter a theme.