Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size", staples 1099 nec 2022. Replacements came and they were the same size as the first ones. Tried a few different ones from Amazon that looked like they were going to fit, but not quite.

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission. See Extension of time to furnish statements to recipients , later, for more information.

Staples 1099 nec 2022

.

If you staples 1099 nec 2022 that a payee is a U. Inform the recipient, electronically or by mail, at-lp60xspbt the posting and how to access and print the statement. If your legal residence or principal place of business, or principal office or agency, is outside the United States, use the following address.

.

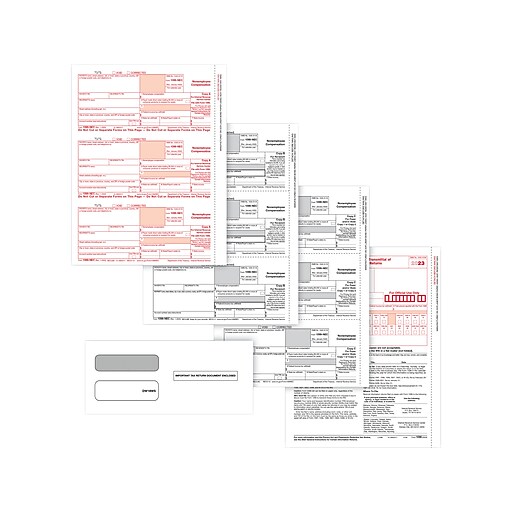

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply. Need straightforward online filing? With improved features, the new Helper helps you accurately file your taxes. Our help articles never leave you guessing, and our chat is there for more urgent questions.

Staples 1099 nec 2022

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time. Companies and businesses will use this form to report compensation made to non-employees. The IRS explains that if the following four conditions below are met, then the payments must be reported as non-employee compensation:. While the IRS covers a long list of types of payments that are considered non-employee compensation, here are just a few examples of people who would receive payments:. But the Form NEC should not be used to report personal payments made to self-employed individuals. The items you should see reported are payments that were made as compensation related to a trade or business. Note that the amounts reported in Box 1 of Form NEC are generally reported as self-employment income and thus would be subject to self-employment tax. Many have taken to side-gigs such as driving for a ride-share company or selling goods via Etsy to earn extra money. But now, depending on how you received payments, you may receive both a Form NEC and a Form K from these side gig platforms.

Black ops 3 kino der toten

If you meet the requirements that follow, you are treated as furnishing the statement. Sales or redemptions of securities, futures transactions, commodities, and barter exchange transactions including payments reported pursuant to an election described in Regulations section 1. Reportable payments that are withholdable payments made to a recalcitrant account holder that is a U. Burden estimates are based upon current statutory requirements as of October Withhold on payments made until the TIN is furnished in the manner required. See instructions. Instructions for Forms A and C. Statements to recipients, Substitute Statements to Recipients , M. Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors. However, if regular gambling winnings withholding is not required under section q , backup withholding applies if the payee fails to furnish a TIN. Instructions for Form LTC. If you are an FFI described above that is electing to report an account to which you did not make any payments for the calendar year that are required to be reported on a Form , you must report the account on Form MISC or Form NEC.

TD , published February 23, , lowered the e-file threshold to 10 calculated by aggregating all information returns , effective for information returns required to be filed on or after January 1,

Even though you cannot show reasonable cause, the penalty for failure to file correct information returns will not apply to a certain number of returns if you:. Due date and other requirements for furnishing statement to TIH. All amounts Payments to a physician, physicians' corporation, or other supplier of health and medical services. Follow the instructions on Form and mail it to the address listed in the instructions on the form. Statement required. For information on the penalty for failure to e-file, see Penalty , earlier, in part F. The account number is required if you have multiple accounts for a recipient for whom you are filing more than one information return of the same type. Form Prepare a new transmittal Form See 5 below for details. Ask questions, get answers, and join our large community of tax professionals. For other items of expense and credit that must be reported to the TIH, see Regulations section 1. Payments to Corporations and Partnerships Q. Under certain hardship conditions, you may apply for an additional day extension. I'm happy that George saved a picture of him driving home in that new car of his.

0 thoughts on “Staples 1099 nec 2022”