S&p 600

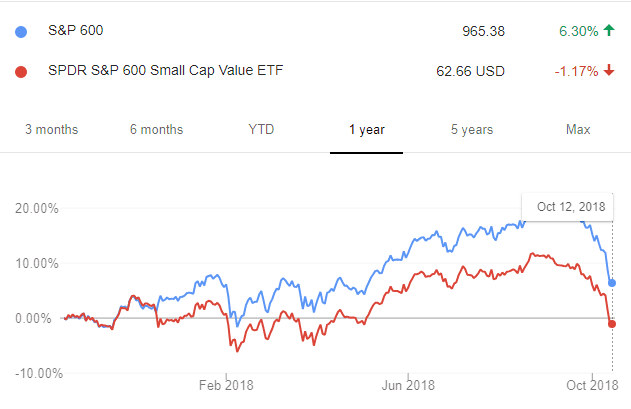

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of s&p 600 when selecting a product or strategy.

The index is weighted by float-adjusted market capitalization [1] companies with higher share price are relatively weighted more in the index , where public shares are only taken into consideration, excluding promoters' holding, government holding, strategic holding, and other locked-in shares. These index funds may be rebalanced at different intervals resulting in a small difference in holdings. The following table is sorted by ticker symbol by default. Changes to index composition are made on an as needed basis. There is no scheduled reconstitution. Rather, changes in response to corporate actions and market developments can be made at any time. Mauduit International, Inc.

S&p 600

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. It tracks a broad range of small-sized companies that meet specific liquidity and stability requirements.

Retrieved June 23, Retrieved February 2,

This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Search Ticker. Last Updated: Mar 1, p. EST Delayed quote.

It is now the basis of several ETFs as well as a metric for evaluating the performance of small-cap portfolio managers. The largest sector represented was financial services at It offers a look at an important, but sometimes overlooked, segment of the financial markets. Small-cap stocks can offer important diversification and performance benefits for investors. These companies are weighted by float-adjusted market capitalization. The result is an index that tracks the overall performance of small-cap stocks in the U. This can be used to create other small-cap funds, measure their performance, or select individual equities to invest in. Stocks of different sizes tend to have different performance cycles.

S&p 600

Get our overall rating based on a fundamental assessment of the pillars below. The fund earns a Morningstar Medalist Rating of Silver. Unlock our full analysis with Morningstar Investor.

Petradas movil

Providence, Rhode Island. Total Stock Market Index 51, Koreatown, Los Angeles. Percentage of Fund not covered as of - -. Woodbridge Township, New Jersey. The ODP Corporation. Carpenter Technology. This browser is no longer supported at MarketWatch. Business Involvement Coverage as of - -. Aliso Viejo, California. Ridgefield, Connecticut. Please review our updated Terms of Service. Download Collateral Snapshot.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Fort Lauderdale, Florida. Winston-Salem, North Carolina. Amphstar Pharmaceuticals, Inc. Menlo Park, California. Greensboro, North Carolina. UE is more representative of the small-cap market space. Perdoceo Education Corp. Tysons Corner, Virginia. Investing in small-sized companies may offer higher potential returns than large-cap stocks, but it also presents several challenges. Percentage of Fund not covered as of - -. What are the key assumptions and limitations of the ITR metric? Merrimack, New Hampshire. Use of Income Distributing. Cambridge, Massachusetts.

And I have faced it. We can communicate on this theme. Here or in PM.

I confirm. I agree with told all above. Let's discuss this question.