Silver price prognosis

Global silver demand is silver price prognosis to reach 1. Silver is used primarily for industrial purposes and commonly incorporated in the manufacturing of automobiles, silver price prognosis, solar panels, jewelry and electronics. A projected recovery in consumer electronics is also poised to give the silver market an additional boost, the report stated. That said, the institute noted that in the short term, a slowing Chinese economy and decreased odds of U.

Silver will move higher in because the top in Yields is confirmed. Silver and Yields are inversely correlated. Our silver price forecast is supported by 4 leading indicators: Yields coming down, US Dollar flat, inflation expectations on the rise, silver CoT data very bullish. Nowadays, the web is full of fake silver price forecasts. Many sites publish large tables, generated by AI, with price calculations for the next years, positioning those endless series of numbers as silver price forecasts. We have a very different view on how to predict the price of silver.

Silver price prognosis

Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Also this comes with a weaker dollar," Teves said. In January, the Federal Reserve held short-term interest rates at a year high of 5. While research has found that gold doesn't directly correlate with inflation in any meaningful way, people are likely buying more gold in an attempt to own some sense of stability in an economy that is rife with inflation, a tough real-estate market and a growing distrust for banks and other financial institutions, Jonathan Rose, co-founder of Genesis Gold Group, told CNBC. According to the investing website Investopedia, the price of gold is influenced by a number of market factors including supply and demand, interest rates, market volatility and potential risk to investors. It tends to outperform a move in gold," Teves said. So there is a lot of catching up to do and I think the move could be quite dramatic. The UBS report came after a report from the Silver Institute projected that global silver demand would increase to 1. The wholesaler has the 1-ounce bars listed for sale online but they are available only to members with a limit of two bars per member. Price of gold, silver expected to rise with interest rate cuts, UBS analyst projects. Facebook Twitter Email. Share your feedback to help improve our site!

As a by-product metal, investors can also gain exposure to silver through some gold companies. At what price did Warren Buffet buy silver? What is silver and what affects its price?

Price predictions help market participants manage price risks, create hedging strategies, and make informed decisions about buying or selling assets in financial markets. That said, price predictions are speculative, particularly when it comes to long-term price forecasts. Therefore, investors should use them as a complementary tool, and not as their primary source of advice to make investment or trading decisions. Together with gold, silver is one of the most popular precious metals. It has been used for many centuries to create coins and jewellery. It has also established itself as a popular investment for investors trying to protect their assets against inflation.

Neumeyer has voiced this opinion often in recent years. He has reiterated his triple-digit silver price forecast in multiple interviews with Kitcoover the years, as recently as March Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism.

Silver price prognosis

The latest silver price forecasts, predictions and analysis of trends in the silver market. Silver expert David Morgan provides his outlook for silver in , including the main catalysts he sees driving demand. David also discusses platinum, palladium, copper, and other commodities he thinks will outperform as we move into the New Year. Silver has just witnessed a rare false breakout.

Alekssecret leaks

We firmly believe that our silver price forecasts of and will materialize in Source PricePrediction. It has applications in technology and batteries — both growing sectors that will drive demand higher. They note that demand for silver will grow as highly populated emerging economies are creating new markets for consumer electronics. Source Silver price forecasts and beyond Major banks and leading market analysts generally provide only short to medium-term price predictions. Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article. Thus, it is more attractive to investors to just hold cash instead. As things are now, it seems unlikely silver will reach those highs. Chart commentary : this chart was updated on March 15th, , to ensure an up-to-date quarterly silver price chart. In that vein, silver is more sensitive to economic changes and more volatile than gold. The wholesaler has the 1-ounce bars listed for sale online but they are available only to members with a limit of two bars per member. Learn everything you need to know about oil trading and how it works in this guide. Swiss bank Pictet sees global economic conditions improving in , thus lifting industrial demand for silver. The consolidation is taking some 3 years now.

The latest silver price forecasts, predictions and analysis of trends in the silver market.

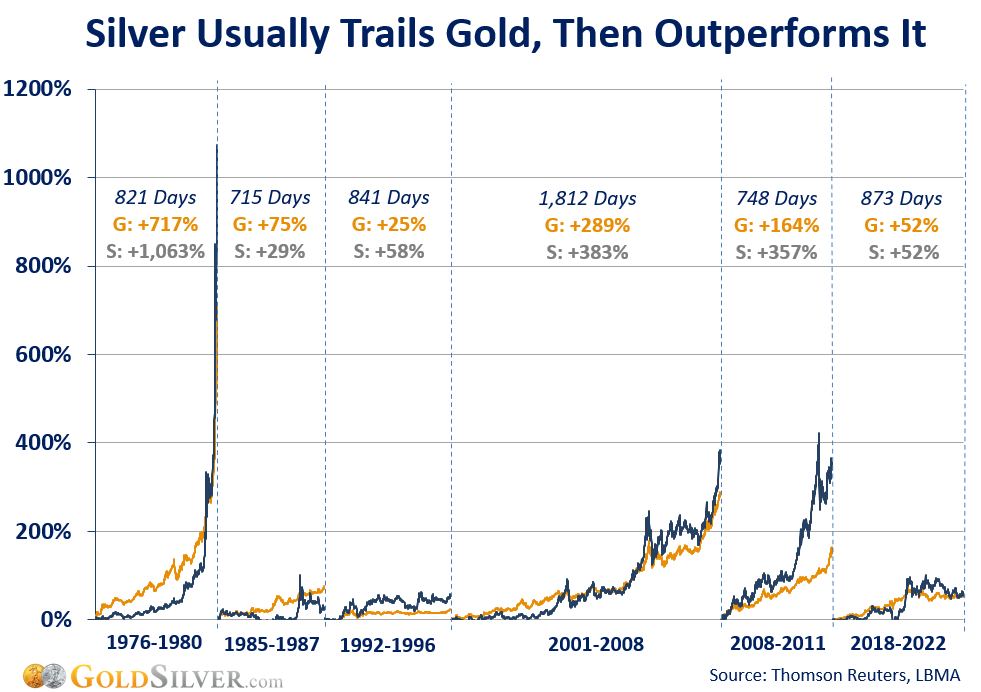

Top Stocks. Most of them are absolutely worthless. Hydrogen Stocks: 9 Biggest Companies. In , the precious metal saw a parabolic price increase that was driven by the attempt of the Hunt brothers to influence the market. Silver has a track record of running very hard and fast, in both directions. Our public blog posts typically share high level insights that are not actionable. Show More Replies. The historical evidence suggests that the gold-to-silver ratio entering the 80 to x range may act as a signal for a significant rally in the price of silver. Milan Cutkovic has over eight years of experience in trading and market analysis across forex, indices, commodities, and stocks. Log In. Silver carries the ignominious title of being gold's poorer cousin, but the two share a positive correlation when it comes to prices, albeit with a lag. Due to silver's extensive industrial applications, its performance is tied closely to the health of the overall economy or business cycle. Educational Content Specialist. After prices started to cool down, the Hunt brothers could not meet their margin requirements, which caused panic in the market. As seen on the longest timeframe, the silver price chart over 50 years, there is a giant cup and handle in the making.

I congratulate, it seems magnificent idea to me is

I suggest you to try to look in google.com, and you will find there all answers.