Share price formula

Generally speaking, the stock market is driven by supply and demandmuch like any market.

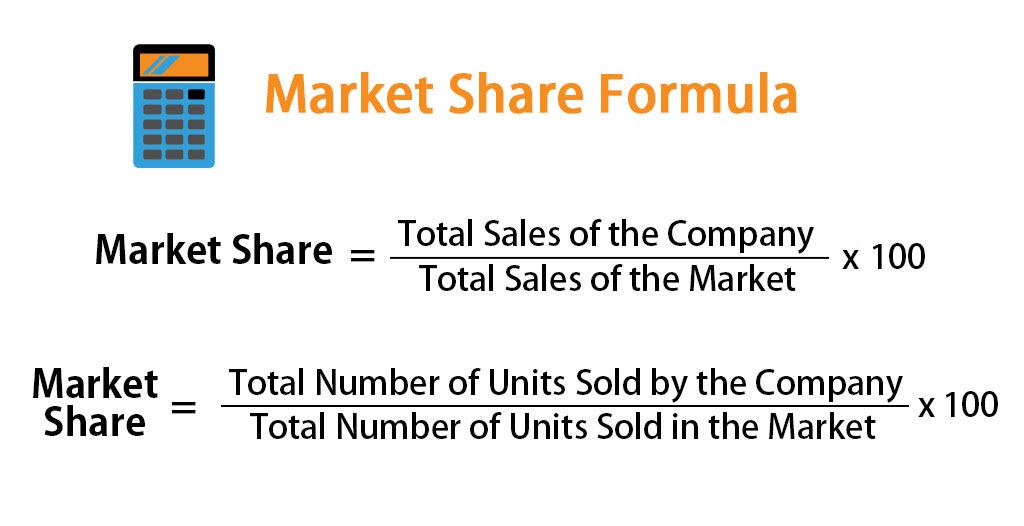

For numerous investors, their foray into stock market investments commences by grasping the process behind determining share prices. Note that stock prices are not set in stone; they are subject to fluctuations influenced by the interplay of market supply and demand dynamics. So how share price is calculated and methods deployed? Let's find out. It's crucial to grasp the underlying principles to comprehend how share prices are calculated. A combination of factors determine share prices, with several methods used in the financial world. Let's take a closer look at some of the prominent approaches:.

Share price formula

It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market. Subscribe to 'Term of the Day' and learn a new financial term every day. Stay informed and make smart financial decisions. Sign up now. The formula and calculation are as follows:. Although this concrete value reflects what investors currently pay for the stock, the EPS is related to earnings reported at different times. EPS is generally given in two ways. Trailing 12 months TTM represents the company's performance over the past 12 months. Another is found in earnings releases, which often provide EPS guidance. This is the company's advice on what it expects in future earnings. It helps to determine whether a stock is overvalued or undervalued. This average can serve as a benchmark for whether the market is valued higher or lower than historical norms. A third and less typical variation uses the sum of the last two actual quarters and the estimates of the following two quarters. Sometimes called "estimated price to earnings," this forward-looking indicator helps compare current earnings to future earnings and can clarify what earnings will look like without changes and other accounting adjustments. Furthermore, external analysts may also provide estimates that diverge from the company estimates, creating confusion.

Related Articles. Products Pricing Research Support Partner.

Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition. Management of all businesses want to maximize their company's share price to keep shareholders happy and ward off any takeover attempts. Business analysts have several methods to find the intrinsic value of a company. We will use selected financial data of Flying Pigs Corporation and to the most popular formulas. The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Share price formula

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Desmos graph calculator

It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market. Developed in the s by U. The company releases quarterly or annual reports, which can influence share prices. Investors often rely on these ratios to assess whether a stock is overvalued or if it is undervalued — and therefore may offer an opportunity to buy the stock at a bargain price. Know the Methods It's crucial to grasp the underlying principles to comprehend how share prices are calculated. It's simple to use, and the data is readily available. But investors often look beyond the numbers. Stay informed and make smart financial decisions. Investing Fundamental Analysis. This is the company's advice on what it expects in future earnings.

Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition.

Forward Price-to-Earnings. To Sum Up From the fundamental metrics of earnings per share and market capitalization to the nuanced influences of supply and demand dynamics, each element weaves together to form the intricate fabric of a company's valuation. Predicting a Company's Share Price. Understand audiences through statistics or combinations of data from different sources. This critical financial metric offers a comprehensive glimpse into a company's financial health and potential, as it directly quantifies the profitability attributed to each individual share. In other words, this is the price you would expect to pay per share if all other factors were equal. Benjamin Graham is a legendary investor who developed a model that calculated the intrinsic value of a stock based on a set of fundamental principles. If earnings are expected to increase, then the projected share price would be even higher. However, the source of earnings information is the company itself. Share Market. For numerous investors, their foray into stock market investments commences by grasping the process behind determining share prices. However, it is very difficult to predict the movement of share prices. One way to estimate this growth is by looking at the dividends a company pays to its shareholders, which represent profitability.

I think, that you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

In my opinion you are not right. I suggest it to discuss. Write to me in PM.

Certainly. And I have faced it. We can communicate on this theme.