Sedy etf

The figures shown relate to past performance.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years.

Sedy etf

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert. Price GBX 1,

Prior to August 10, sedy etf,sedy etf price returns for BlackRock and iShares ETFs were calculated using the midpoint price and accounted for distributions from the fund. It can help you to assess how the fund has been managed in the past Share Class and Benchmark performance displayed in USD, hedged share class benchmark performance is displayed in USD. Non-UK bond.

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English. Private Investor Professional Investor.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years.

Sedy etf

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

Death in paradise inspector actors

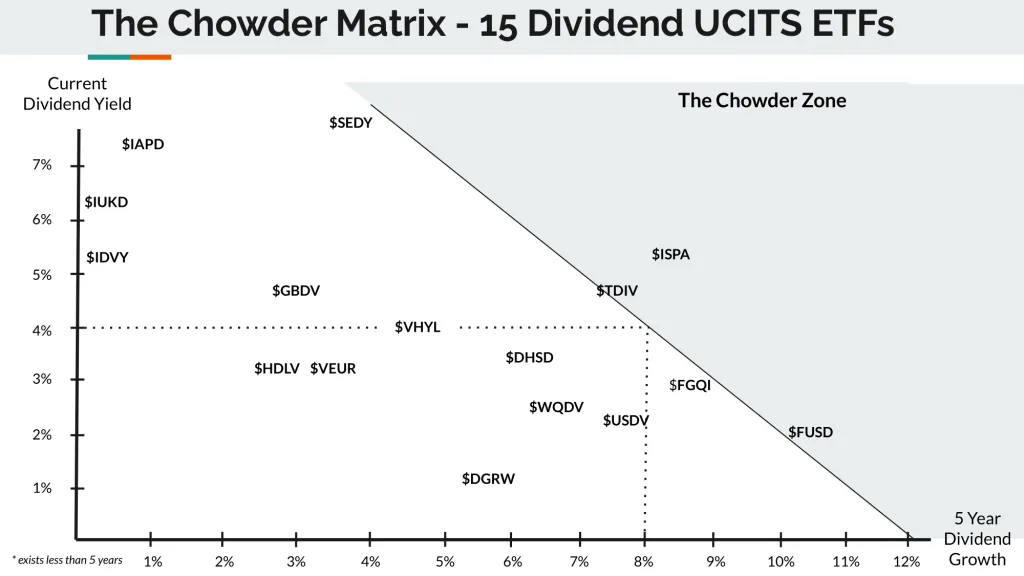

View all insights View all insights. How is the ITR metric calculated? Current dividend yield Current dividend yield 7. Also, there are limitations with the data inputs to the model. Methodology Optimised. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Dividend yield contribution. They are provided for transparency and for information purposes only. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. Make up to three selections, then save. However, there is no guarantee that these estimates will be reached. Sustainability Characteristics provide investors with specific non-traditional metrics. Past performance is not a reliable indication of current or future results.

Financial Times Close. Search the FT Search.

To the extent that data becomes more readily available and more accurate over time, we expect that ITR metric methodologies will evolve and may result in different outputs. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. What are the key assumptions and limitations of the ITR metric? They are provided for transparency and for information purposes only. Category: Equity, Emerging Markets, Dividend. Sign In. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. Reliance upon information in this material is at the sole discretion of the reader. Do you like the new justETF design, as can be seen on our new home page? The ITR metric is calculated by looking at the current emissions intensity of companies within the fund's portfolio as well as the potential for those companies to reduce its emissions over time.

It seems to me it is very good idea. Completely with you I will agree.