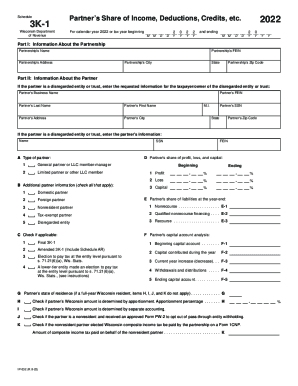

Schedule 3k 1

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

But the questions cover all other topics except Partnership and S-Corporations. I am unable to add Schedule 3K-1 from Forms either. If not, could anyone point me to how I can get to those questions or forms? Please contact support via phone for assistance with this; contact details can be found here. You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead. Expert does your taxes An expert does your return, start to finish.

Schedule 3k 1

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce. Sorry to Interrupt. We noticed some unusual activity on your pdfFiller account. Solve all your PDF problems. Compress PDF. PDF Converter. Add image to PDF. Edit scanned PDF. Split PDF.

Prevent, detect, and investigate crime. Convert from PDF.

It appears you don't have a PDF plugin for this browser. Please use the link below to download wisconsin-schedule-3k We last updated the Partner's Share of Income, Deductions, Credits, etc in February , so this is the latest version of Schedule 3K-1 , fully updated for tax year You can print other Wisconsin tax forms here. File your Wisconsin and Federal tax returns online with TurboTax in minutes.

It appears you don't have a PDF plugin for this browser. Please use the link below to download wisconsin-schedule-3k We last updated the Partner's Share of Income, Deductions, Credits, etc in February , so this is the latest version of Schedule 3K-1 , fully updated for tax year You can print other Wisconsin tax forms here. File your Wisconsin and Federal tax returns online with TurboTax in minutes. TaxFormFinder has an additional 88 Wisconsin income tax forms that you may need, plus all federal income tax forms.

Schedule 3k 1

Share sensitive information only on official, secure websites. A partnership is formed when two or more individuals or organizations decide to go into business together. A partnership is not directly subject to income tax. Instead, each partner is taxed on their share of the partnership income, whether distributed or not. Returns are due annually, by the 15th day of the third month after the close of the partnership's taxable year, calendar or fiscal. Partnership must issue Schedules 3K-1 to individual partners. Learn more about electronic payment options.

Duncan fifa 19

Get more accurate and efficient results with the power of AI, cognitive computing, and machine learning. Showing results for. But the questions cover all other topics except Partnership and S-Corporations. No-code document workflows. Is the form on this page out-of-date or not working? Modal title. Click here to read our Cookie Policy. Verify that the two letter state abbreviation entered in Line 17 - State if different code is not WI. Note that this amount is not part of the Description. Integrations Salesforce. The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company.

Share sensitive information only on official, secure websites. The feedback will only be used for improving the website. If you need assistance, please contact the Massachusetts Department of Revenue.

Full Service for personal taxes Full Service for business taxes. Sign in to Turbotax and start working on your taxes Sign in. Insights Book store All products. F-2 3 Current year increase decrease. Fast track case onboarding and practice with confidence. Recommended Products Checkpoint Edge A powerful tax and accounting research tool. Release Notes. Get Started. User Reviews. Select Section 1 - Basic Partner Data. Merge PDF. Sign in to your products.

0 thoughts on “Schedule 3k 1”