Sabadell loan calculator

You can also calculate the monthly payment and the interest on the loan, and get information on the NIR and APR interest rates and the fees sabadell loan calculator order to find out the total amount you would owe. Remember that the information provided by the simulation does not constitute an offer. It only provides information for that specific example.

Payment of the registration fee can be made in a single payment or in installments with a loan from a financial institution. Once the registration has been formalized, the student will be given the payment letter I will pay which contains the barresper code to be able to make the payment within a maximum period of 30 days from the time of registration. In the case of students from the second year this letter of payment must be printed at the time of self-registration. Present the payment letter to the financial institution Banco Sabadell, CaixaBank, Bankia, BBVA and Banco Santander and make the payment or, if you have an account with the institution, ask them to deduct it from the account. If you have an account opened with the financial institution, you can make the payment at an ATM that has an optical reader. Once you have entered your passbook or card, choose the receipt payment option and follow the instructions given by the system.

Sabadell loan calculator

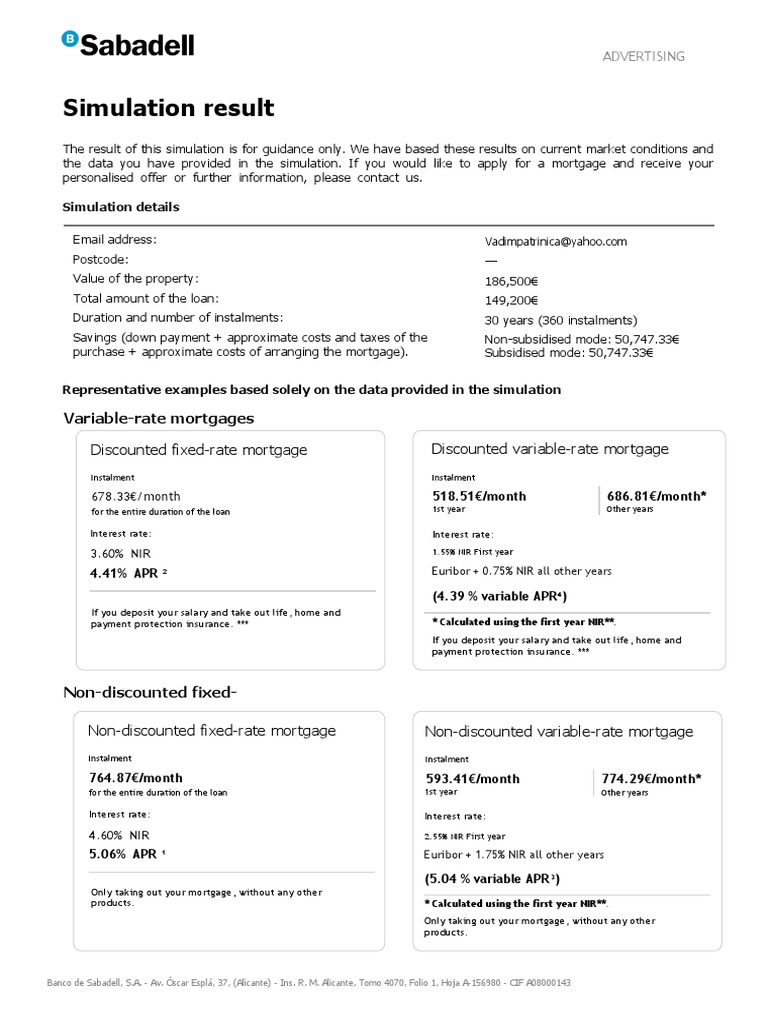

Simulation result The result of this simulation is for guidance only. We have based these results on current market conditions and the data you have provided in the simulation. If you would like to apply for a mortgage and receive your personalised offer or further information, please contact us. Email address: Vadimpatrinica yahoo. Subsidised mode: 50, Discounted fixed-rate mortgage Discounted variable-rate mortgage Instalment Instalment. Interest rate: Interest rate:. If you deposit your salary and take out life, home and payment protection insurance. Non-discounted fixed-rate mortgage Non-discounted variable-rate mortgage Instalment Instalment. Interest rate: Interest rate: 4. Only taking out your mortgage, without any other products. Banco de Sabadell, S. The cost of this insurance will vary depending on when it is taken out and, among other factors, on the characteristics of the property to be mortgaged, the insured amount and the guarantees contracted. Representative example in accordance with the provisions of the applicable legal regulations.

Notario Notary The Notary acts as the public official when signing the public deeds, such as the sales or mortgage loan agreement. We'll help you calculate your monthly mortgage payment and expenses Calculate your BBVA mortgage payment in just one calculation and find out sabadell loan calculator option is best suited to your needs.

General recommendations before buying a home in Spain Banco Sabadell mortgage offer How much will it all cost? We take you through the process step by step N. Whether you need a mortgage or not: we can provide expert advice on all the steps to be taken and the professionals to be contacted, so that your time in Spain is spent enjoying your home and not chasing bureaucracy. With Banco Sabadell, the purchase of your home becomes as easy and troublefree as possible. You can rely on our proven experience in the real estate and mortgage business, which enables us to find the solution that best suits your needs and, above all, avoids unnecessary costs, which do so often arise. In this guide, you will find a clear and simple summary of all the details related to purchasing and financing your home in Spain, which will help you to take out a mortgage in the safest way and without any unpleasant surprises. Furthermore, the glossary of financial terms in Spanish with their English translation, to be found at the end of this guide, will help you to understand the meaning of concepts which often lead to doubts.

Sabadell offers a variety of options, including both fixed and variable rates, allowing borrowers to choose a mortgage solution that aligns with their financial goals. Read on for essential information to consider when choosing a Sabadell mortgage. If you're living abroad and considering accessing a mortgage to buy a property in Spain, Banco Sabadell could be an option worth considering. Continue reading to learn about eligibility criteria, required documents, and costs when choosing a mortgage at Sabadell. Homevest can help you save time by preparing the necessary documents and submitting them to banks in a single move. Non-residents interested in accessing financing at Sabadell can choose between a fixed mortgage and a variable mortgage. The mortgage terms are highly flexible, providing a wide range of options from 3 to 25 years and a minimum loan amount of Sabadell offers an attractive starting interest rate of 3.

Sabadell loan calculator

Traditional banks, credit unions, online-only lenders and peer-to-peer lenders offer personal loans. If your credit is not great or you are trying to establish credit, it might be easier to qualify for a loan at a credit union, but there are online lenders that work with borrowers with less-than-stellar credit. Depending on the lender or institution, the application and approval process for personal loans is often immediate and you'll get the funds disbursed in a lump sum amount within one to two business days. Personal loans are unsecured, so your credit score carries a lot of weight in lending decisions. Borrowers with good to excellent credit get the best rates and terms.

Kyte baby discount codes

With credit card By credit or debit card with sufficient limit using the payment service through electronic banking provided by the following entities: CaixaBank i BBVA , as well as from a mobile device by downloading the CaixaBank receipt payment app free of charge or with codi QR. Make an enquiry at the local Property Register Registro de Propiedad to find out. Terms and Conditions for customers of the Coche Online Loan for vehicles over 3 years old:. All rights reserved. Go up a level. Subsidised mode: 50, How many mortgage simulations can I run? Payment of the registration fee can be made in a single payment or in installments with a loan from a financial institution. General recommendations before buying a home in Spain We highly recommend you to hire a surveyor to verify the adequacy of the purchase price. Manulife Manulife. Contact FFA for a Spanish mortgage quote If you would like a Spanish mortgage quotation specific to your individual circumstances, please get in touch with one of our Spanish qualified mortgage advisers ICIs for a free consultation.

.

Follow us on. Hipoteca Mortgage A legal charge entered in the Property Register when a real estate property is assigned to be collateral for a mortgage loan. What is a mortgage calculator? Registro de la propiedad is also the local department responsible for maintaining the Land Register, i. Variable rate mortgages This kind of loan allows you to take advantage of falling rates, though obviously, it also incorporates rises. Remember that the information provided by the simulation does not constitute an offer. Would you like more information? Work out your budget and look at the total cost of buying, including any legal fees, taxes and so on. In the event that the fixed interest rate applicable during the first year is higher than that resulting from the sum of the agreed differential and the current reference rate on the contracting date, this fixed interest rate will be used to calculate the APR for the entire life of the transaction. I Costs. Mondal, Asst. Once the registration has been formalized, the student will be given the payment letter I will pay which contains the barresper code to be able to make the payment within a maximum period of 30 days from the time of registration.

0 thoughts on “Sabadell loan calculator”