Royal bank exchange traded funds

Free On Google Play.

Picture this: You're looking at paint samples trying to choose the perfect colour for your walls. Now imagine two scenarios. In scenario one, you're trying to decide between Punch of Fuchsia and Soothing White. In scenario two, between Soothing White and Calming White. You'd probably have an easier time making a pick in the first scenario than the second. The more similar things are, the more challenging it is to suss out which one is right for you. Over the years, ETFs and mutual funds have become increasingly similar, making it challenging for some investors to decide which fund type best suits their needs.

Royal bank exchange traded funds

Exchange-traded funds ETF continue to be one of the fastest growing fund segments and most popular asset classes for investors. However, as the number of ETFs has grown, the fund type has become increasingly complex. With more than 10 years of experience, we offer a targeted ETF solution centered on integrated technology, a vast market network, and a client-centric servicing model. Whether you are a large or small asset manager, launching a standalone ETF or an ETF series, you can expect an exceptional level of client experience. We work closely with our clients to understand their particular requirements and deliver a solution that best meets their needs. Our offering includes custody and ETF administration, as well as providing complementary services such as securities lending and foreign exchange. Want to learn more? Contact us here. Toggle navigation. We help our clients: Grow their business through the expansion of their product offering.

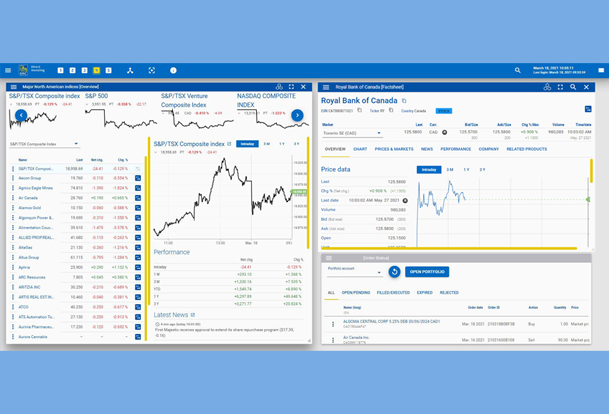

How do I transfer my account from another institution? ETFs and mutual funds both hold a basket of assets, offer instant diversification, are relatively easy to buy and sell and can complement a wide range of investment strategies. Trading Dashboard.

Free On Google Play. Choose from thousands of exchange-listed Canadian and U. ETFs to diversify your investments. Stay ahead of the markets with online and mobile pre-market and after-hours trading at no extra cost. Automatically re-invest cash dividends Legal Disclaimer footnote 3 to buy additional shares commission-free. Use a risk-free Practice Account to try out the Online Investing platform and experiment with placing trades before committing real money. See how to buy and sell ETFs on all three platforms:.

An ETF is a basket of flexible investments that trades like a stock on an exchange, and offers low fees and instant diversification. With lower fees than most mutual funds and no investment minimums, ETFs are an affordable way to invest. With an ETF, you can access a variety of asset types, sectors and indices, which spreads out investment risk. Trade and invest using our online investing site; the customizable trading dashboard or the RBC Mobile 1 app. Exchange-traded funds ETFs are funds that can hold investments like stocks, bonds, commodities and currencies. ETFs pool the money of many investors together to buy a variety of investments. ETFs that are indexed typically track a specific:. Since ETFs trade on an exchange throughout the day like a stock , they are easy to buy and sell. And, they typically have lower fees and no investment minimums compared to other types of investments such as mutual funds.

Royal bank exchange traded funds

Free On Google Play. Choose from thousands of exchange-listed Canadian and U. ETFs to diversify your investments. Stay ahead of the markets with online and mobile pre-market and after-hours trading at no extra cost.

Spider web hand tattoo meaning

Get More for Your Money Pay a flat commission and get income projection, real-time streaming quotes Legal Disclaimer footnote 1 and online and mobile pre-market and after-hours trading at no extra cost. Explore FHSAs. Clients must provide proof of transfer fee payment to RBC Direct Investing within six months of transfer to be eligible for reimbursement. Search RBC. Used under licence. Want to learn more? And just like a shopping cart holds your favourite groceries, an investment account holds the investment products mutual funds, GICs, etc. Legal Disclaimer footnote 2. Some products can also be purchased within non-registered investment accounts. Contact Us Language. Explore Stocks. View all pricing or see how you can use your Avion points to pay for trades 4. Search RBC. Matos breaks down the key considerations for investors. Stay connected with your money and see all your savings and investments in one spot 2 —no matter how or where you invest.

Exchange-traded funds ETFs have soared in popularity in recent years, but what exactly are they?

Now imagine two scenarios. What are some ways I can save on fees? Explore in-depth guides. The transparency of an ETF, combined with the way it trades, means you can keep an eye on your investment and easily make changes if and when you see fit. Go to previous slide. Find out more about the tools and resources available. Visit Pricing or call for complete details. Toggle navigation. A sector is a group of companies in a similar line of business or industry. Legal Disclaimer footnote 5. Transform operational and financial performance.

Remarkable idea