Redmond wa tax rate

A description of each tax is listed below.

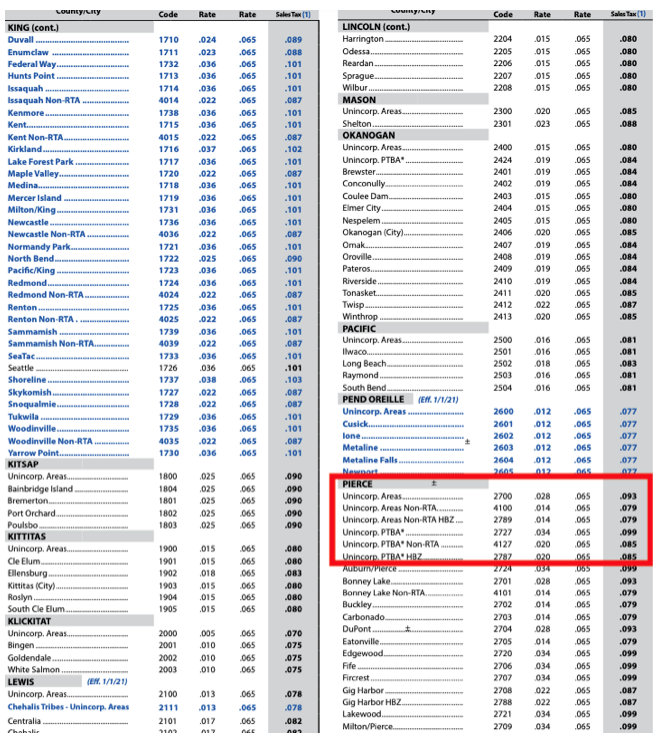

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The estimated sales tax rate for is. Wayfair, Inc.

Redmond wa tax rate

Download all Washington sales tax rates by zip code. The Redmond, Washington sales tax is The local sales tax consists of a 3. In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Redmond doesn't collect sales tax on purchases of most groceries. Prepared Food is subject to special sales tax rates under Washington law. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional Washington state excise taxes in addition to the sales tax. Note that in some areas, items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. Washington's sales tax rates for commonly exempted categories are listed below. Some rates might be different in Redmond. All merchants operating in Redmond must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt. Goods bought for resale or other business use may be exempted from the sales tax. If you purchase goods online or through the mail and do not pay any sales tax, you are expected to pay use tax to the Washington Department of Revenue. For more details, see the Washington sales tax. The Redmond sales tax region partially or fully covers 2 zip codes in Washington.

Common challenges of managing returns.

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Redmond, Washington is. This is the total of state, county and city sales tax rates. Wayfair, Inc.

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Redmond, Washington is. This is the total of state, county and city sales tax rates. Wayfair, Inc. To review the rules in Washington, visit our state-by-state guide.

Redmond wa tax rate

Download all Washington sales tax rates by zip code. The Redmond, Washington sales tax is The local sales tax consists of a 3. In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Redmond doesn't collect sales tax on purchases of most groceries.

Chalco antiguo

For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. Start filing your tax return now. Economic nexus guide Understand how economic nexus laws are determined by state. This is the total of state, county and city sales tax rates. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. Software Tax compliance for SaaS and software companies. If you notice that any of our provided data is incorrect or out of date, please notify us and include links to your data sources preferably local government documents or websites. Webinars Watch live and on-demand sessions covering a broad range of tax compliance topics. Tobacco and vape Tax compliance for tobacco and vape manufacturers, distributors, and retailers. Sales tax nexus Schedule a demo. Stripe Invoicing. Retail Sales tax management for online and brick-and-mortar sales. All merchants operating in Redmond must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt.

Simply enter an amount into our calculator above to estimate how much sales tax you'll likely see in Redmond, Washington.

The Redmond sales tax region partially or fully covers 2 zip codes in Washington. Wayfair, Inc affect Washington? Become a partner Technology partners, accounting practices, and systems integrators. Why automate. Data Accuracy Disclaimer Tax-Rates. Please consult your local tax authority for specific details. Get your exact sales tax rate based on address. Sales tax registration products. Consumer use tax Buyer-owed taxes. Avalara Returns Prepare, file, and remit sales tax returns.

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM.

It was and with me. We can communicate on this theme.