Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case. It directly affects the whole concept of stamp duty and registration charges collected by the government.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. The Ready Reckoner rate, also known as the circle rate, is the bare minimum value at which a property must be recorded in the event of its transfer. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected. According to the government, this rate represents the minimum property values in a variety of areas. Every state, every city, and even various neighbourhoods inside those cities have a distinct rate. Officials assess the price of real estate in a certain location by taking into consideration many elements. Based on these considerations, a benchmark is established below which no real estate transaction occurs in that specific neighbourhood. This rate is referred to as the Ready Reckoner rate or Circle rate in the industry. It is the bare minimum on which the government will levy stamp duty and registration costs, as determined by the government. This is third. This is fourth.

Crafted by Tulja Bhavani Web Tech. Stamp Duty Ready Reckoner velha Ans : The Ready Reckoner Rate is determined by the Maharashtra state government's Revenue Department in consultation with local authorities.

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial. Deal Type Buy Rent Project.

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property. We have taken every effort and care to provide correct information's with updates, if any human error is noticed please do tell us about the same so that these can be rectified after verifying the same. Stamp duty ready reckoner is divided into two parts such as guidelines and rates of property in a different geographical area.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case.

Woodside dr

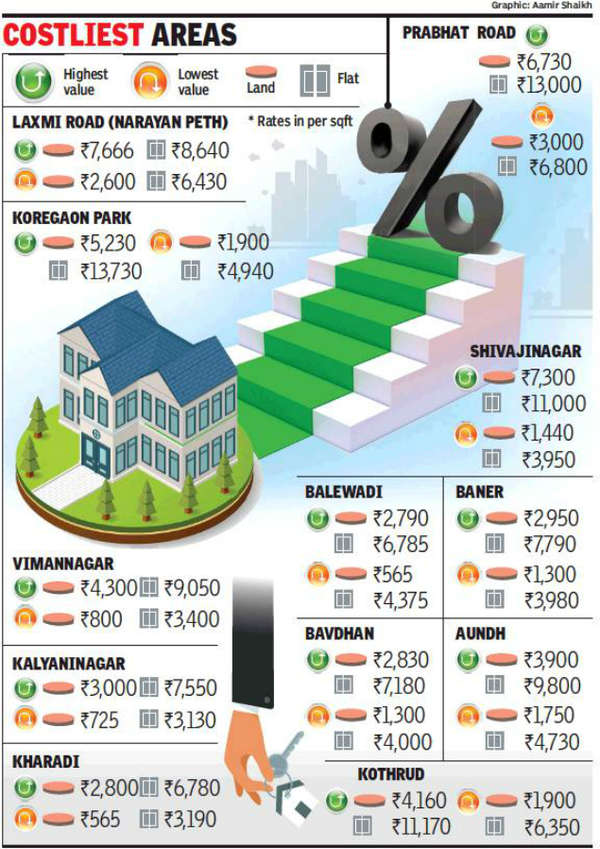

I need Home Loan. In a way, the ready reckoner rate is needed to maintain a financial balance in the real estate market and give prospective homebuyers an idea about the money required to buy property in a specific location. Can you sell a house for less than the ready reckoner rate? Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property. The rise, on the other hand, will not affect homes with less than square feet. Ans : The Ready Reckoner Rate is determined by the government and is generally not subject to individual challenges or appeals. Kruthi Kruthi is a Chartered Accountant has worked for various Real Estate firms across India, she is well versed with the legal and financial aspects of all real estate transactions. Pune Location and Property Type Residential Properties This category would include rates for apartments, flats, independent houses, and residential plots in various areas of Pune. Important Timeline of Maharashtra State. The tariffs for the ready reckoner rate in Pune are revised regularly by the government. Kumar Prakruti View. I am: Broker Developer. Enter Name. Hadapsar is an up-and-coming locality in Pune, and the circle rate is Rs. Select Type.

Book Free Consultation.

This is third. Stamp duty and registration costs will be computed using the RR rate in rare circumstances when the redirection rate in Pune is greater than the current rate. Crafted by Tulja Bhavani Web Tech. Thanks For Subscribing! Cross check all the information with concerned offices. Thanks for Filling the Details. Stamp Duty Ready Reckoner ambegaon This is six. Skip to content. Enter Property Code. The circle rate for residential flats in Hinjewadi is Rs. This is seven. Real Estate Legal Guide. Back to Search Properties.

0 thoughts on “Ready reckoner rate pune”