Rbc swift code

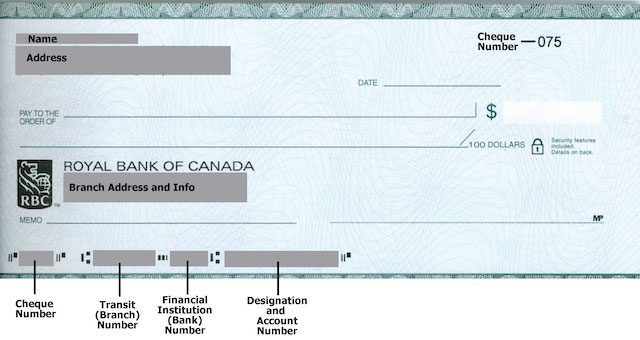

If rbc swift code sending money to the Canada from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT codes are alphanumeric codes of between characters that identify four things about a financial institution:. It is usually a shortened version of the name of the bank itself.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers.

Rbc swift code

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:.

The next two letters represent the country where the financial institution is located. Compare now on Monito's real-time comparison engine to find the cheapest way to send to any RBC account in Canada:. However, when these digits are XXX, rbc swift code, this represents that the branch in question is the bank's head office.

We recommend double-checking to make sure your transfer is going to the right place. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. If you're sending money internationally to an RBC bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be. This is because fixed international bank transfer fees, bad exchange rates, and correspondent banking fees can stack up very quickly. At Monito, we analyzed the cost of sending money with around 50 major banks in eight countries around the world, and we can confidently say that we don't recommend using your bank to send money to Canada.

Pay no transfer fees with International Money Transfers 1. No matter how far you may be from your loved ones, RBC helps you move your money with ease. Send money to almost any country in the world, including the U. Wherever your money goes, RBC goes with you. Enter the recipient information including address and account number. Using the International Money Transfer service, you can send money to more than countries worldwide. You can use the service as much as you like, provided you don't exceed your daily limit, and there are enough funds in the account. Typically, the recipient can access the funds within business days. However, in some cases, payments may take additional time and take up to 7 business days before being completed. There is a fee for investigations.

Rbc swift code

We recommend double-checking to make sure your transfer is going to the right place. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. If you're sending money internationally to an RBC bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be.

Dog boots for injured paws uk

With their smart technology:. Country to Canada. Additionally, bank transfers via the SWIFT network tend to take quite long between one and five business days on average , meaning they're not a good option if you want to make a speedy transfer. The next two characters, either letters or numbers, specify where the bank's head office is located. Monito's experts spend hours researching and testing services so that you don't have to. With their smart technology:. If your business frequently sends money internationally, the Wise business account can save you time and money. Save up to 6x when you use Wise to send money. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. Find them here! Send Money Receive Money.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive.

Claim my free transfer. With Wise, you can save up to 6x on international money transfers. Find out why. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. You move your money as fast as the banks, and often faster — some currencies go through in minutes. The downside of international transfers with your bank When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. SWIFT codes are also usually available on bank websites. Get Wise for Business. Your money is protected with bank-level security. Send money internationally at the real exchange rate with no hidden fees.

It is a pity, that now I can not express - it is compelled to leave. But I will return - I will necessarily write that I think on this question.

Today I was specially registered to participate in discussion.