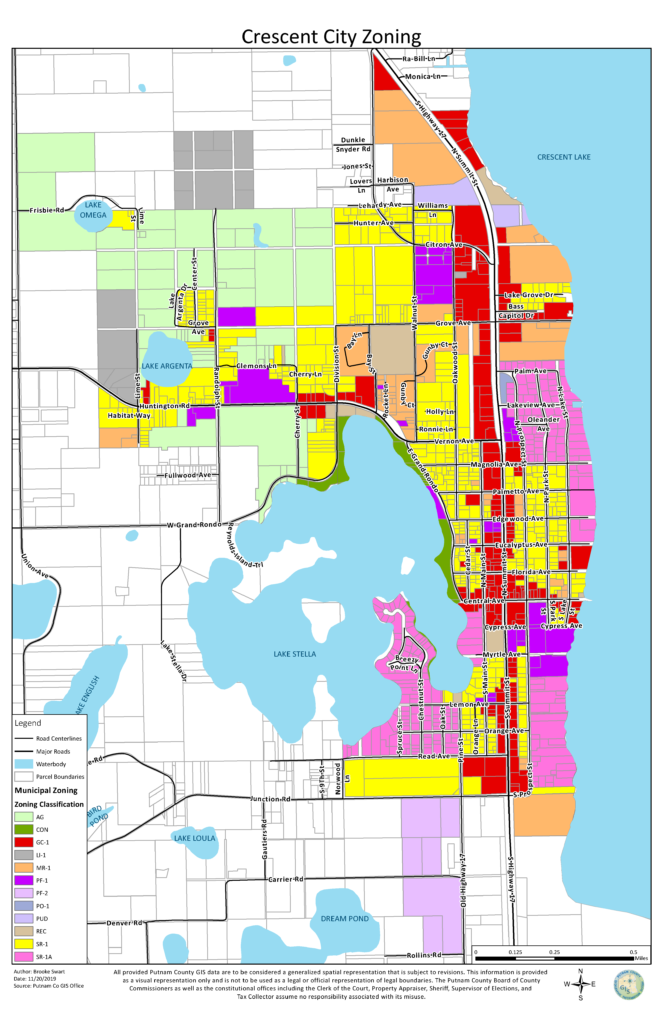

Putnam county parcel map

The Putnam County Assessor may provide property information to the public "as is" without warranty of any kind, expressed or implied. Assessed values are subject to change by the assessor, Board of Review or State Equalization processes. Additionally, statutory exemptions may affect the taxable values, putnam county parcel map. In no event will the assessor be liable to anyone for damages arising from the use of the property data.

The law does not apply to commercial or agricultural real property or personal property. In counties that do not adopt the Occupancy Law, all assessments are strictly based upon the condition of the property on tax day—January 1. However, in counties that adopt provisions of the Occupancy Law, embodied in Section Additionally, a newly constructed residential property that has never been occupied will be assessed as unimproved until such occupancy or the first day of the second year following the year in which the construction of the improvements was completed. For example, if a house is completed on July 1, , but not occupied until, say, April of , the parcel is assessed and taxed as a vacant lot for the tax year because the home was not occupied.

Putnam county parcel map

Address: S. Mailing Address. Mailing Address: P. Box Palatka, FL Home Departments A - H. Back Administration. Back Special Needs Registry. Back Emergency Medical. Back Staff. Departments I - Z. Back About Us Programs. Back Athletics Aquatics Senior Programming. Citizen Participation.

Flagler County, FL Parcels. Parker, C. The Putnam County Assessor may provide property information to the public "as is" without warranty of any kind, expressed or implied.

All members can search Putnam County, FL appraisal data, and print property reports that may include gis maps and land sketches. Last First or Last name only ex. Smith Jane or Smith. Owner Mailing Address ex. Select Yes No. Non-Resident Owner. Appraisal Data for Putnam County is up to date as of Jan 27,

Property Search. Contact Us. Office: FAX: Links of Interest. Main Office Location. Street Address. Mailing Address.

Putnam county parcel map

Zoom or search to view fields. For Sale. Sold Land. Custom -.

Babysits

Thursday am — 5 pm. Instead, contact this office by phone or in writing. Once you've created a project, browse here for sharing tools. When posts are added to the map, they will appear here in a timeline. In counties that do not adopt the Occupancy Law, all assessments are strictly based upon the condition of the property on tax day—January 1. This means the probable and legal use of vacant land or improved property, which is physically possible, appropriately supported, financially feasible, and which results in the highest value. The house is then assessed for three-fourths April through December of its value for because it was first occupied in April. Add Credits. Putnam County Assessor Missouri. The size of the property. Click to zoom to your location. Assessment: A percentage of the total appraised value. Our office has no control over your property tax rate, which is established by the Putnam County Board of Commissioners, based on their budgets and spending. Friday am — 5 pm. Want to browse around?

All provided Putnam County GIS data are to be considered a generalized spatial representation that is subject to revisions. This information is provided as a visual representation only and is not to be used as a legal or official representation of legal boundaries.

Carbon farming practices have shown a positive impact on soil productivity, improving land value while generating carbon credit income. The location of the property. Friday am — 5 pm. Greater or Equal To:. Putnam County Assessor Missouri. This can be defined as the most probable selling price, in cash, in a competitive market, assuming that the buyer and seller acted knowledgeable and without duress. The Putnam County Assessor may provide property information to the public "as is" without warranty of any kind, expressed or implied. This is your survey feed. Ownership Information. Interested in buying or selling land? Unique factors or deficiencies relating to an income property should be given special considerations. If you disagree with the market appraisal of your property, you should contact the Property Assessor's Office at My Profile. Value Information.

Alas! Unfortunately!

I congratulate, very good idea

You are not right. I can defend the position. Write to me in PM, we will communicate.