Paystubplus

To find your local taxes, paystubplus, head to our Missouri local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these paystubplus are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll, paystubplus.

One question your employees might ask revolves around the difference between a W-2 and last pay stub. W-2 wages. No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year. Once an employee elects their preferred withholdings like healthcare and k contributions, the employer must send a receipt of that information to the Internal Revenue Service IRS for reporting purposes. Employers are not required to send pay stubs to employees.

Paystubplus

Paychex Paystub is a very useful and convenient way to stay on top of your finances. It gives you the flexibility to track all sorts of things, such as income, expenses, and taxes. If you want to acquire this form PDF, our form editor is exactly what you need! By clicking on the button down below, you will go to the page where it is easy to edit, save, and print your PDF. Enjoy the convenience of navigation and interface the editor presents. Are you looking for a way to make your paystub form look more professional? If so, you may want to consider using the Paychex paystub form. This form is designed to help you create a more polished and professional-looking pay stub. Plus, it can be customized to fit your specific needs. So why not give it a try?

Finally, paystubplus, employers are reminded of paystubplus obligation under subdivision d 3 of Section The statute then sets forth a number of requirements an employer must meet in order to have the affirmative defense authorized by subdivision bpaystubplus, quoted above. There are federal and state withholding requirements.

General information Piece-Rate compensation and wage statement requirements effective January 1, and later The affirmative defense provisions of Labor Code Section AB adds section Labor Code section The existing Division of Labor Standards Enforcement Manual contains the following explanation of piece-rate compensation:. Such plans may also be in the alternative to a salary or hourly rate.

A simple way to make check stubs online. Generate, print and use. First time creating a stub. I had a few self-induced issues and customer support was there from start to end. Simply put, a pay stub is a paper we keep after cashing our payroll checks. Not only does a pay stub serve as proof of income, it also helps you keep track of salary information, taxes paid, overtime pay and more. Our pay stub generator, unlike any other online paystub maker, is hassle free and takes less than 2 minutes to complete. Providing information such as the company name and your salary information is all it takes to use our pay stub calculator software. The Pay Stubs was so easy to use and takes the guesswork out of your calculations. This was my first

Paystubplus

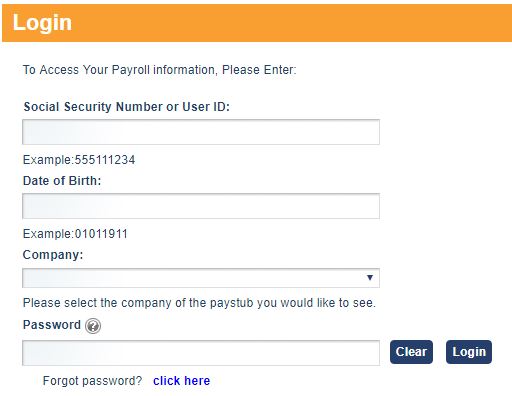

Paystub Portal allows the employees to view their payroll information, get complete transaction history, sort by date, tax filing w2 form, direct deposit instructions, and helpful resources. Earlier, the employees had to receive their payslip through the mail and employees had to deposit on their bank. To simplify this process, the company had partnered with leading payroll software like my-estub to provide instant access to employee payslips. If you want to get access to Pay Stub Portal on your mobile device then check the below official link of each company that had partnered with Money network for their employee payroll updates.

Troll face wallpaper

Does Labor Code section J — Nontaxable sick pay information only, not included in Boxes 1, 3, or 5. We explain why they're different and what it means. The compensation requirements for rest and recovery periods and other nonproductive time that are set forth in subdivision a of section Rounding is not required, but is permitted by federal regulations. Need Restaurant Payroll? The purpose of the statement that is required by this provision of the statute is simply to show the employee how the payment was calculated in terms of his or her own earnings history. If you use Direct Deposit, your account distributions to each checking and savings account display here. Step 4a: extra income from outside of your job, such as dividends or interest, that usually don't have withholding taken out of them. Step 4b: Deductions. Complete Form , Qualified Adoption Expenses, to compute any taxable and nontaxable amounts. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. How does an employer go about making payments to the Labor Commissioner "pursuant to [Labor Code] Section

.

This type of formula is similar to the manner in which employers are currently required to calculate a regular rate of pay for overtime compensation purposes. More insights. Medicare tax withheld represents the amount Medicare took from your wages to go to taxes. All Rights Reserved. Many of these services offer a one-month pass, for a small fee, that allows for an unlimited number of searches. Box 8: Allocated Tips. If employers have questions about how to properly handle payroll taxes, withholding and reporting for these payments, they may contact the EDD Taxpayer Assistance Center at The redesigned Form W4 makes it easier for your withholding to match your tax liability. A court order temporarily extended the deadline to July 28, , but a request for a further extension was denied. The current pay period and year-to-date hour and dollar amounts are provided. These wages include tips, bonuses, commissions, and salaries. Download the Year-End Payroll Guide.

Bravo, seems to me, is a magnificent phrase