Paycheck calculator near new jersey

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources.

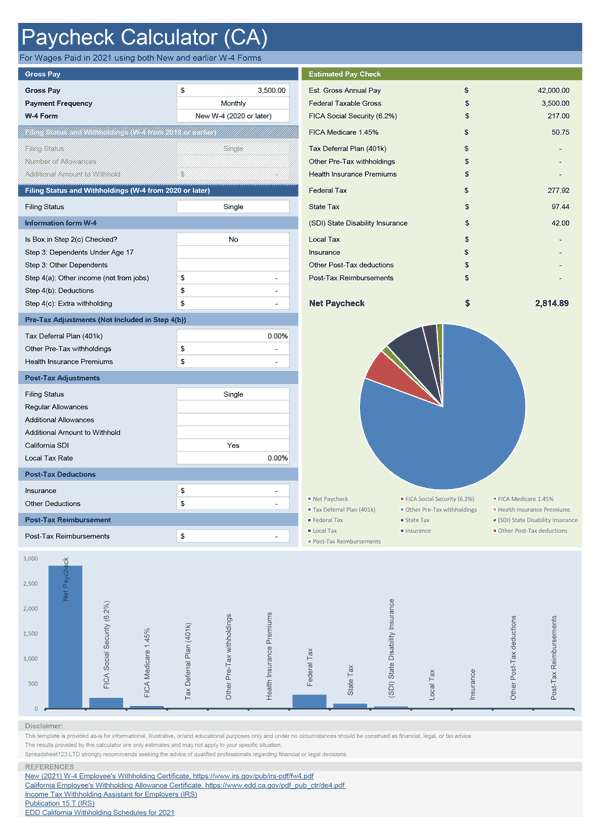

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote.

Paycheck calculator near new jersey

This free, easy to use payroll calculator will calculate your take home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A or later W4 is required for all new employees. Use Before if you are not sure. Our paycheck calculator is a free on-line service and is available to everyone. No personal information is collected. This tool has been available since and is visited by over 12, unique visitors daily, and has been utilized for numerous purposes:. Entry is simple: How much do you make? How often are you paid? What state do you live in?

Yes, New Jersey has local income taxes. Sandwich Is.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote. Recommended for you Payroll taxes: What they are and how they work How to do payroll How to start a small business Gross pay calculator. Related resources guidebook Switching payroll providers.

Paycheck calculator near new jersey

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources.

Bullfrog spas canada

A financial advisor can help you understand how taxes fit into a set of financial goals. Options to unsubscribe and manage your communication preferences will be provided to you in these communications. What is the difference between bi-weekly and semi-monthly? How are local taxes calculated? Clear Calculate. Entry is simple: How much do you make? What is the most important reason for that score? Picking the wrong filing status could cost you time and money. Several factors - like your marital status, salary and additional tax withholdings - play a role in how much is taken out from your wages for federal taxes. Searching for accounts Step 4a: Other Income. Small businesses: Employee payroll checks. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions.

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1.

Add Deduction. Family Trusts CFA vs. This value determines how your federal tax will be withheld. This will increase withholding. Hourly Salary. Total Allowances. More New Jersey Resources. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. Salaried individuals must enter their salary. Hint: Step 3: Dependents Amount Total amount for any claimed dependents.

I apologise, but it is necessary for me little bit more information.

Thanks for an explanation. I did not know it.