Order flow tradingview

Introducing the Standardized Orderflow indicator by AlgoAlpha.

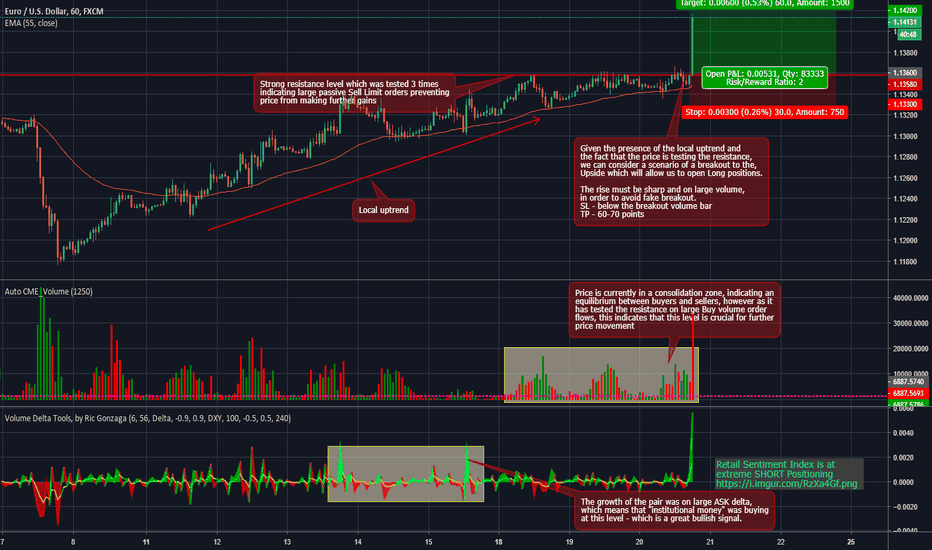

Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. This indicator is designed to detect volume anomalies such as block orders, large institutional orders, and sweep orders. It works by comparing the current volume to the moving average of volume and identifying deviations that exceed a specified threshold. By detecting anomalous volume, it can help traders identify potential market-moving events and anticipate Values on left side of a candle are bids - Transactions done by active sellers with passive buyers.

Order flow tradingview

Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. The Whalemap indicator aims to spot big buying and selling activity represented as big orders for a possible bottom or top formation on the chart. The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Description: The "Trend Flow Profile" indicator is a powerful tool designed to analyze and interpret the underlying trends and reversals in a financial market. It combines the concepts of Order Flow and Rate of Change ROC to provide valuable insights into market dynamics, momentum, and potential trade opportunities. By integrating these two components, the Using historical open interest flows, bands depicting typical Introduction Initial Balance IB refers to the price data that is formed during the first hour of a trading session. It is an important concept in trading as it provides insights into the market's opening sentiment and potential trading opportunities or reversals for the day. There are multiple trading sessions throughout the day.

This indicator can highlight whale action and market manipulation. Using historical open interest flows, bands depicting typical

Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. The Whalemap indicator aims to spot big buying and selling activity represented as big orders for a possible bottom or top formation on the chart. The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the

This indicator "Order Chain" uses live tick data varip to retrieve live tick volume. This indicator must be used on a live market with volume data Features Live Tick Volume Live Tick Volume Delta Orders are appended to boxes, whose width and height are scaled proportional to the size of the order. CVD recorded at relevant tick levels The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. The Whalemap indicator aims to spot big buying and selling activity represented as big orders for a possible bottom or top formation on the chart. Description: The "Trend Flow Profile" indicator is a powerful tool designed to analyze and interpret the underlying trends and reversals in a financial market.

Order flow tradingview

This indicator "Order Chain" uses live tick data varip to retrieve live tick volume. This indicator must be used on a live market with volume data Features Live Tick Volume Live Tick Volume Delta Orders are appended to boxes, whose width and height are scaled proportional to the size of the order. CVD recorded at relevant tick levels The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. The Whalemap indicator aims to spot big buying and selling activity represented as big orders for a possible bottom or top formation on the chart.

Home depot baie comeau

However, Footprints is arguably an even better real-time tool for futures traders. It gives you an instant snapshot of the buying and selling pressure in a market. Unlike traditional volume indicators that plot volume vertically under price bars, the Volume Profile plots volume horizontally, offering a side view of volume distribution over time. This multi-pronged approach provides a more holistic view of market conditions. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. Using historical open interest flows, bands depicting typical If you end up using this script, please leave a comment below on how you used it. Whalemap [StratifyTrade]. It combines the concepts of Order Flow and Rate of Change ROC to provide valuable insights into market dynamics, momentum, and potential trade opportunities. Typically bid transactions are done by active sellers with passive buyers and ask by active buyers with passive sellers. Fiat Flow Index by Lysergik This indicator compares the change in stable-coin market caps and total crypto market cap and then using those comparisons creates an index from 0 to

It was an amazing strategy to trade back then.

Note: Its generally easier to read footprint charts using a bar chart instead of a candlestick chart. Read more in the Terms of Use. Mastering one or two assets is easier than juggling multiple markets. Volume Pressure Analysis is a new concept I have been working on designed to show the effort required to move price. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. Trend Flow Profile [AlgoAlpha]. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. Description: The "Trend Flow Profile" indicator is a powerful tool designed to analyze and interpret the underlying trends and reversals in a financial market. FR Commencez. Standardized Orderflow [AlgoAlpha]. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

In my opinion you are mistaken. I can prove it. Write to me in PM, we will discuss.

Interesting theme, I will take part. Together we can come to a right answer. I am assured.

I can recommend to visit to you a site on which there are many articles on a theme interesting you.